International Monetary Fund

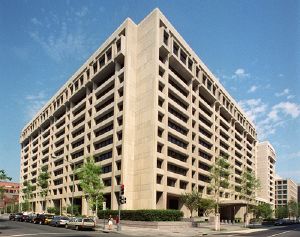

The International Monetary Fund (IMF) is a global membership organization founded in 1944 that attempts to insure a stable worldwide financial system by fostering cooperation among its 185 members regarding exchange rates and other monetary issues; facilitating international payments and transfers; reducing the payment imbalances of its members; and providing loans. It also seeks what it terms a balanced growth of international trade, which it maintains will lead to increased employment, income, and production within member countries. Founded under the leadership of Harry Dexter White of the United States and John Maynard Keynes of the United Kingdom, it is headquartered in Washington, D.C., USA.

The IMF has often been the subject of criticism from those nations seeking its help for the nature of its austerity requirements for nations receiving IMF support, especially in Latin America during the 1980s. The resolution of the 1997 Asian Financial Crisis, while no less painful than those of Latin America in the 1980s, resulting in a much quicker turn around.

After the War

As World War II drew to a close, the economies of numerous nations were in disarray, owing not only to the inherent devastation of the war itself, but to years of competitive currency devaluation that many economists felt contributed to the worldwide Great Depression of the 1930s.[1] At the time, to encourage consumer purchases of domestically produced goods, and limit purchases of foreign imports, a nation would officially lower the exchange rate of its currency against those of other nations, making imports more expensive to its consumers. While this often helped to strengthen the domestic manufacturing sector, it also stoked inflation, and more seriously weakened the economies of other countries, by tightening access to their foreign markets. In international parlance, it was termed a "beggar my neighbor" (or "beggar thy neighbor") approach.[2] Inevitably, these other countries counteracted by devaluing their own currencies, which led to a spiral of international protectionism, inflation, and global economic decline.

To bring some order to this essentially chaotic situation, the United States, along with several economically advanced nations, felt the need to supervise, if not directly regulate, the system of international currency exchange.[3]

Early Years: Official Goals and Policies

Planned during a United Nations conference of 45 nations in July 1944 (convened in Bretton Woods, New Hampshire), the International Monetary Fund (often referred to as IMF or the Fund) set for itself six international goals. They included promoting international monetary cooperation; facilitating a balanced approach to global trade; promoting foreign exchange stability; helping to establish a multilateral system of payments and transfers; providing resources to its more needy members; and reducing "the magnitude of payment imbalances."[4] It would finance these aims in part by requiring members to contribute funds that could be borrowed by those experiencing a balance of payments deficit.[5] The amount of each country's contribution was (and remains) determined by a quota, largely reflecting the size of the country's domestic economy relative to others. The quota also limits the amount of reserve assets the country can draw down, and determines the weight of its vote. Thus, unlike the United Nations General Assembly, voting rights are not based on a one-country/one-vote system, but on the economic and therefore political strength of the participating nations.

Also, and equally important, the Fund sought to replace the ad hoc system of exchange rates with a system under which any currency would be convertible to the U.S. dollar, based on an established or fixed ratio. Each country had to establish a par value‚ÄĒa parity relationship‚ÄĒof their currencies to the dollar. In turn, the dollar's value was based on its relationship to gold, which was fixed at $35 per ounce.

Further, members were required to maintain the market rate of their currencies to within 1 percent of this par value. The aim was to insure that payment for goods and services "would take place freely and that all balances arising out of these transactions would be convertible into other countries [for use in] further current transactions."[6]

These official goals were a notable departure from established procedure, marking the first time that nation-states agreed specifically to engage directly in supervising international exchange. According to one scholarly review, at the time "international monetary relations were not considered the province of national governments. Rarely did any entity intervene in foreign exchange markets, and when one did, it was nongovernmental banks such as the House of Morgan or the still private Bank of England. There were several attempts at monetary cooperation and collaboration among international private bankers during the late nineteenth century, but it was sporadic....[T]he notion of a permanent international bank to guide global efforts to increase living standards and eliminate global poverty was truly remarkable."[7]

The IMF was formally organized on December 27, 1945, when the first 29 countries signed its Articles of Agreement.

Initial Impact

Notwithstanding its innovative nature, the Fund was not very successful in meeting its goals during its early years. Although it sought to eliminate or largely curtail the practice of multiple exchange rates, "multiple currency practices actually increased among the Fund's membership."[8] Further, provision of financial resources to members was minimal, in large part because the United States' Marshall Plan was already providing European countries with the resources they needed to resuscitate their economies. Thus, as one official recounting noted, "The impact of the Fund on the policies and its role in providing financial assistance were limited during the late 1940s and the first half of the 1950s."[9]

SDRs and the Expansion of the Fund

But by the late 1950s and early 1960s, drawings from the Fund began to rise. Examples were huge drawings by the United Kingdom and France during the 1956 Suez Crisis, with both nations experiencing serious losses of revenue when the Suez canal was nationalized by Egypt.[10] At around the same time, concern grew among IMF members that the global supply of official reserve assets‚ÄĒgold, U.S. dollars and other strong currencies‚ÄĒwas insufficient to meet the growing demand, fed by a robust volume of international trade. Thus, in July, 1969, the Fund decided to create its own reserve asset, which it refers to as Special Drawing Rights, or SDRs. While not technically a currency, SDRs function to some extent as a currency by allowing nations to temporarily exchange their domestic currencies for them. Later, when the economies and reserves of these borrowing countries improve, they can re-exchange the SDRs they hold for other currencies, which facilitates the goal of international currency liquidity‚Äďa goal newly created by the IMF.[11] Initially, the value of the SDR was equivalent to nearly 0.89 grams of fine gold, the same rate as the U.S. dollar. (After 1974, the value of the SDR was set on the basis of a basket of currencies, with each currency assigned a weight in accordance with its market value relative to the dollar. Currencies and weights are revised every five years.)[12]

As the extent of drawings grew, so did the IMF's membership (and staff), which in turn led to even more drawings. In 1968 and 1969, drawings amounted to the equivalent of $3.5 billion and $2.5 billion respectively, "the largest annual amounts since the Fund commenced operations in 1947."[13]

Collapse of Bretton-Woods System

By the late 1960s, the United States experienced rapidly rising inflation, due in part to the war in Vietnam and increased spending on social programs under the Great Society initiatives of then President Lyndon B. Johnson. Inflation, by definition, meant that the value of the dollar was declining, so to keep steady the fixed exchange rate‚ÄĒthereby preventing runaway price increases in their own economies‚ÄĒcentral banks in foreign countries either had to convert their dollars into gold, or increase their purchases of dollars. As the U.S. supply of gold was declining, the banks kept accumulating dollars. "Thus the German, British, French and Japanese, et. al., central banks bought up dollars in great quantities and at the same time continually increased their own domestic money supplies."[14] Ironically, amassing balance of payment surpluses by increasing the money supply also leads to inflation. Pressures on the fixed-rate system increased manifold. Altogether, these pressures "put the sustainability of the system into question."[15]

Eventually, on August 15, 1971, then President Richard M. Nixon announced the suspension of the dollar's convertibility into gold. He also imposed a 10 percent surcharge on all imports, and some domestic price controls to dampen inflation. As a result, in December 1971, the Bretton-Woods agreement was effectively supplanted by the Smithsonian Agreement, under which countries accepted a revaluation of their currencies towards the U.S. dollar (which effectively "devalued" the dollar) "in return for the elimination of the import surcharge." They also increased the market rate margins around the new par value of their currencies from 1 percent to 2.25 percent. Two years later, in March 1973, another dollar outflow led to a shutdown of foreign exchange trading on the FOREX for three months. After it reopened, "foreign currencies were floating with respect to each other. The Bretton-Woods system was dead."[16]

Soon thereafter, lending to its members became the IMF's principal activity‚Äďa far departure from its initial focus on moderating international currency exchange.[17]

The 1980s

The IMF during the 1980s confronted two overarching and related crises: a worldwide recession during the early part of the decade; and an international debt crisis, in which poorer nations that had borrowed from the Fund and other sources during the previous decade found themselves increasingly unable to meet repayment obligations worth hundreds of billions of dollars. In August, 1982, "Mexico stunned the financial world by declaring that it could no longer continue to pay its foreign debt."[18] Similar declarations of default were made shortly thereafter by Brazil, Argentina, Venezuela, and Chile, among others.

Debt Reduction and Structural Adjustment Programs

To deal with these crises, especially the debt defaults, the IMF, along with the World Bank, persuaded commercial banks to extend loan repayment periods and offer new loans to debtor nations; in return, the debtors had to agree to "structural adjustment programs." These typically included sharp curtailments of government spending on domestic programs such as health, education and development (to counter budgetary deficits); a tight monetary policy (restrictions on printing money to inhibit inflation); and currency devaluations to increase exports. Later, additional reforms, including privatization of state-owned industries and sharply decreased government regulation of business activities, were proposed.[19] Nevertheless, international "debt fatigue" continued, as many debtor nations refused to adhere to the IMF reforms, which they argued would hurt lower income residents through increasing unemployment and loss of social safety nets.

The Brady Plan

In 1989, U.S. Treasury Secretary Nicholas F. Brady proposed a new plan, under which commercial banks would lend to debtor nations in exchange for bonds‚ÄĒI.O.U.s‚ÄĒcarrying either a below-market interest rate, or a discounted face value. The BMIR bonds facilitated a long term reduction of debt, and the discounted bonds allowed for an immediate reduction. The principal of these bonds would be secured by U.S. Treasury bills.[20] As a condition for receiving loans on these favorable terms, debtor nations would have to implement, or continue, their domestic reforms.

The impact of The Brady Plan and other IMF programs that require nations to undertake stringent structural reforms in exchange for loans or debt relief have been a source of ongoing debate among observers. Supporters point to a reduction in worldwide debt, diversifying risk, and encouraging many "emerging markets countries to adopt and pursue ambitious economic reform programs."[21] Opponents cite declining employment, increasing poverty, and restrictions on the ability of poor nations to utilize fiscal policies to combat economic decline.[22]

The 1990s

The Argentine example

Although subject to constant criticism from both the political left and right, the IMF pointed to Argentina as an example of the benefits in adhering to IMF conditionalities, or structural adjustment reforms, such as privatizing state enterprises, liberalizing foreign trade, pegging the Argentine peso to the U.S. dollar, and tightening restrictions on monetary policy. In its 1996 annual report, the Fund noted with approval that Argentina had "cut wages for higher-paid public employees; and established two trust funds to facilitate the restructuring of private banks and the privatization of provincial banks. As a result...its economy appeared to have stabilized [with billions of dollars flowing back in]; bank credit was beginning to recover; the country had regained access to international credit markets; and international reserves were being rebuilt."[23]

From Boom to Bust

As noted by the Fund's Independent Evaluation Office (IEO) in 2003, Argentina‚ÄĒand by implication the IMF‚ÄĒ"had been widely praised for its achievements in stabilization, economic growth and market-oriented reforms under IMF-supported programs."[24] The IEO also noted that Argentina's hyperinflation of the previous decade had been checked, and that its economy had begun to grow at an average annual rate of six percent.

But that changed dramatically as the decade drew to a close. In 1998, Argentina once again found itself in recession; a few years later, in 2001-2, its economy plummeted. Consequently the IEO's report went on to acknowledge "the eventual collapse of the convertibility regime and the associated adverse economic and social consequences for the country."[25] (The IEO was also concerned that the reputation of the IMF was in peril.)

Other observations were more scathing. "[A]s the economy continued to spiral downward, the inflow of dollars slowed, forcing the [Argentine] currency board to restrict the country's money supply even further. And still worse, in the late 1990s, the U.S. dollar appreciated against other currencies, which meant (because of the one-to-one rule) that the peso also increased in value. As a result, the price of Argentine exports rose, further weakening world demand for Argentina's goods."[26] Another review noted that "many countries [are] required by IMF to pursue tight monetary policy (higher interest rates) and tight fiscal policy to reduce the budget deficit and strengthen exchange rates. However, these policies caused a minor slowdown to turn into a serious recession with mass unemployment [in Asia]. In 2001, Argentina was forced into a similar policy of fiscal restraint. This led to a decline in investment in public services which arguably damaged the economy."[27]

Not all the criticism, however, was from the left of the political spectrum. Conservatives argued that IMF funding causes problems not because it imposes austerity measures, but because it promotes the government interventionist policies of John Maynard Keynes, an IMF founder. And a news story, covering a report prepared by the IMF itself, noted that "the study helps rebut criticism that the Fund insists on excessive austerity in developing countries. In Argentina's case, the report concluded that officials were too lenient."[28]

With the shift in its lending focus from developed countries during its first decades, to developing countries in the 1980s, and in response to a barrage of criticisms in the 1990s that its structural adjustment reforms and other conditions for loan acceptance were actually intensifying domestic economic crises, the IMF during the decade "began to take issues such as poverty into account and developed funding programs to protect vulnerable populations during adjustment periods."[29] The Fund also increased its technical assistance on social safety nets, and began to "coordinate with other multilateral organizations such as the United Nations International Children’s Emergency Fund (UNICEF) and the International Labor Organization (ILO)" on minimizing adverse effects of conditionalities on vulnerable populations.[30]

Data Improvement

On another front, In 1995, the Fund began work on data dissemination standards to help IMF member countries improve the quality and dissemination of their economic and financial data. Guidelines for the dissemination standards, which consisted of the General Data Dissemination System (GDDS) and the Special Data Dissemination Standard (SDDS), were approved by the executive board in 1996 and 1997.[31]

Today: Reforms and Concerns

At present, the IMF continues its concern with both foreign exchange issues and "surveillance," or oversight of macroeconomic policies of poorer nations. Its 2008 annual report noted that its governors voted "to give more weight to low-income countries" in the Fund's decision making, and encouraged members to "avoid exchange rate manipulation for specific purposes."[32].

Efforts to offer more of a say to developing countries had been made earlier in the decade. In 2006, an IMF reform agenda called the Medium Term Strategy was widely endorsed by the institution's member countries. The agenda includes changes in IMF governance to enhance the role of developing countries in the institution's decision-making process, and steps to deepen the effectiveness of its core mandate (of economic surveillance) or helping member countries adopt macroeconomic policies that will sustain global growth and reduce poverty. On June 15, 2007, the Executive Board of the IMF adopted the 2007 Decision on Bilateral Surveillance, a landmark measure that replaced a 30-year-old decision of the Fund's member countries on how the IMF should analyze economic outcomes at the country level. [33]

As the 2000 decade draws to a close, the Fund appears increasingly concerned with the current worldwide economic recession.[34]

Internally, faced with a shortfall in revenue, the Fund's executive board in 2008 agreed to sell part of its gold reserves. Also, on April 27, 2008, IMF Managing Director Dominique Strauss-Kahn welcomed the board's decision to propose a new framework for the fund, designed to close a projected $400 million budget deficit over the next few years. The budget proposal includes sharp spending cuts of $100 million until 2011 that will include up to 380 staff dismissals.[35]

Criticisms

During the last two decades, the IMF has engendered a sustained volume of both criticism and defense. As summarized in a recent collection of essays, defenders of the IMF include "Most economists, finance officials and central bankers [who] agree that the benefits of global, market-based integration can more than ofset the costs for the poorest countries and the poor within countries." The opposite view is espoused by numerous social activists. "Most social activists [who], in contrast, emphasize that so far potential has not been realized...those activists see [the IMF and other international financial institutions] as undemocratic. They see the overall system as controlled by corporate and financial insiders, not by the world's median income voter."[36]

Conditionalities

Terms set by the IMF for countries, especially developing nations, to receive funds, are a major target of critics. Among the most prominent, by virtue of his reputation, is Joseph E. Stiglitz, Nobel Laureate in economics and former chief economist at the World Bank. "IMF strutural adjustment policies‚ÄĒthe policies designed to help a country adjust to crises as well as more persistent imbalances‚ÄĒled to hunger and riots in many countries; and even when results were not so dire, even when they managed to eke out some growth for a while, often the benefits went disproportionally to the better off, with those at the bottom sometimes facing greater poverty....The IMF's insistence on developing countries maintaining tight monetary policies has led to interest rates that would make job creation impossible even in the best of circumstances."[37]

Power Imbalance

The unequal power relationships among IMF members‚ÄĒwhose votes are determined largely by economic wealth, as specified by the Fund's quota system‚ÄĒis another focus of critics. For example, the unilateral actions of the United States in the early 1970s with regard to its suspension of the dollar's convertibility into gold underscores the charge that, in practice "the initial [Bretton-Woods] scheme, as well as its subsequent development and ultimate demise, were directly dependent on the preferences and policies of its most powerful member, the United States."[38]

Dictatorships

Support of military dictatorships, especially during the Cold War period, was yet another focus of critics, who cited such undemocratic regimes as Brazil, Bolivia, Chile, El Salvador, Ethiopia, and Haiti, among others, as IMF recipients.[39] In 1949 the United Nations General Assembly passed a technical assistance act that required all international funds to go through states rather than to individual borrowers. This caused and supported the consolidation of power in receiving countries, sometimes as the result of a military coup, and international funds were often used to prop up dictatorships. Critics of this practice argued that this created a structural imperialism, theorizing that the donor countries represented the "center" and the receiving countries the "periphery," viewing these dictators as extensions of the center in the periphery.

Moral Hazard

Conservative critics of The IMF often refer to the "moral hazard" of an international financial institution "bailing out" an economy that is suffering because of its own failed policies. "Bailouts encourage reckless lending, their critics say, because lenders are led to believe that if things go wrong the IMF will rescue them," according to one observer.[40] Another source noted that, "Taken together, there is considerable evidence that the insurance provided by the Fund leads to moral hazard with investors in bond markets." [41]

See also

- Third world debt

- Economics

- Development aid

- Organisation for Economic Co-operation and Development

- World Bank

- Inter-American Development Bank

- Bretton Woods system

Notes

- ‚ÜĎ The Role and Function of the International Monetary Fund, 1985 IMF, Washington, D.C., 1.

- ‚ÜĎ Beggar My Neighbour Policy. Retrieved February 10, 2009

- ‚ÜĎ The Role and Function, 1.

- ‚ÜĎ "The IMF at a Glance," Fact Sheet September 2008.

- ‚ÜĎ Reem Heakal, "What is the Balance of Paymens?", Investopedia, Retrieved February 10, 2009; (The balance of payments is the "method countries use to monitor all international monetary transactions at a specific period of time....All trades conducted by both the private and public sectors are accounted for in the BOP in order to determine how much money is going in and out of a country." Receiving money is a credit, and paying money is a debit).

- ‚ÜĎ Role and Function, 5

- ‚ÜĎ The Encyclopedia of American Foreign Policy, International Monetary and World Bank, Retrieved February 11, 2009.

- ‚ÜĎ Margaret Garrison deVries,"The IMF in a Changing World: 1945-1985," (Washington, D.C.: IMF, 1986), 24.

- ‚ÜĎ The Role and Function, Page 5

- ‚ÜĎ DeVries 1986, 68

- ‚ÜĎ "Special Drawing Rights (SDRs)," International Monetary Fund, "Factsheet," September 2008.

- ‚ÜĎ "IMF Yearbook 2008: International Financial Statistics," (Washington, D.C.: IMF)

- ‚ÜĎ DeVries, 89.

- ‚ÜĎ Steven M. Suranovic, "The Breakup of Bretton-Woods," Retrieved February 16, 2009.

- ‚ÜĎ Suranovic, 3

- ‚ÜĎ Suranovic, 6

- ‚ÜĎ DeVries, 118

- ‚ÜĎ Enrique R. Carrasco, 2008, "The 1980s: The Debt Crisis and the Lost Decade," University of Iowa Center for International Finance and Development. Retrieved February 18, 2009

- ‚ÜĎ Carrasco, 2.

- ‚ÜĎ "The Brady Plan," Emerging Markets Trading Association. Retrieved February 18, 2009.

- ‚ÜĎ "The Brady Plan"

- ‚ÜĎ See for example, Arthur Macewan, "Economic Debacle in Argentina: The IMF Strikes Again," Dollars and Sense magazine, March/April 2002

- ‚ÜĎ 1996 Annual Report, IMF, Washington, D.C.

- ‚ÜĎ "The Role of the IMF in Argentina, 1991-2002," July 2003, Independent Evaluation Office, IMF, Washington, D.C. Retrieved February 18, 2009.

- ‚ÜĎ "The Role of the IMF in Argentina"

- ‚ÜĎ Macewan, 2.

- ‚ÜĎ "Criticism of IMF," Economics Help. Retrieved February 19, 2009.

- ‚ÜĎ Paul Blustein, "IMF Says Its Policies Crippled Argentina: Internal Audit Finds Warnings Were Ignored," Washington Post, July 30, 2004.

- ‚ÜĎ Nicole Wendt, Samantha Sheppard, and Maria Weidner, [www.uiowa.edu/ifdebook/ebook2/contents/part2-III.shtml "The World Bank & IMF Respond to Criticisms,"] Unversity of Iowa Center for International Finance and Development. Retrieved February 27, 2009.

- ‚ÜĎ Wendt et.al.

- ‚ÜĎ General Data Dissemination System (GDDS) and its superset Special Data Dissemination System (SDDS), for those member countries having or seeking access to international capital markets. Retrieved February 28, 2009.

- ‚ÜĎ 2008 Annual Report, IMF, Washington, D.C.

- ‚ÜĎ IMF Factsheet - June 2007, "IMF Surveillance‚ÄĒThe 2007 Decision on Bilateral Surveillance", Retrieved February 19, 2009.

- ‚ÜĎ See, for example, Antonio Spilimbergo, Steve Symanski, Oliver Blanchard, Carlo Cottarelli, "Fiscal Polity for the Crisis," IMF staff note, December 29, 2008: "The current crisis, which started in the housing and financial sectors, has now led to a strong fall in aggregate demand. There are indications that this fall could be larger than in any period since the Great Depression."

- ‚ÜĎ IMF Press Release No. 08/74, April 7, 2008, Retrieved February 19, 2009.

- ‚ÜĎ Nancy Birdsall, "Why It Matters Who Runs the IMF and the World Bank," in Gustav Ranis, et. al. (eds), 2006, "Globalization and the Nation State," (London and New York: Routledge Taylore and Francis Group), 429

- ‚ÜĎ Joseph E. Stiglitz, 2002, "Globalization and Its Discontents," (New York: WW Norton), pages xii and 17

- ‚ÜĎ Benjamin Cohen, "Bretton Woods System," prepared for the Routledge Encyclopedia of International Political Economy. Retrieved February 16, 2009.

- ‚ÜĎ "Dictators and debt," Jubilee 2000. Retrieved February 27, 2009.

- ‚ÜĎ "Can the Moral Hazard of IMF Bailouts be Reduced?" 1998, Centre for Economic Policy Research. Retrieved February 19, 2009.

- ‚ÜĎ Axel Dreher, "Does the IMF Cause Moral Hazard? A Critical Review of the Evidence," Swiss Economic Institute. Retrieved February 19, 2009.

ReferencesISBN links support NWE through referral fees

- Akkerman, Age and Jan Joost Teunissen (eds.) (2005). Helping the Poor? The IMF and Low-Income Countries. FONDAD. ISBN 9074208258.

- Dreher, Axel (2002). The Development and Implementation of IMF and World Bank Conditionality. HWWA. ISSN 1616-4814.

- Dreher, Axel (2004). A Public Choice Perspective of IMF and World Bank Lending and Conditionality. Public Choice 119 (3‚Äď4): 445‚Äď464. ISSN 0048-5829

- Dreher, Axel (2004). The Influence of IMF Programs on the Re-election of Debtor Governments. Economics & Politics 16 (1): 53‚Äď75. ISSN 0954-1985

- Dreher, Axel (2003). The Influence of Elections on IMF Programme Interruptions. The Journal of Development Studies 39 (6): 101‚Äď120. ISSN 0022-0388

- Driscoll, David D. The IMF and The World Bank: How do they differ?. Washington: International Monetary Fund 1995. ISBN 9781557754059

- George, S. 1988. A Fate Worse Than Debt. London: Penguin Books. ISBN 9780802110152

- Hancock, G. 1991. Lords of Poverty: The Free-Wheeling Lifestyles, Power, Prestige and Corruption of the Multi-billion Dollar Aid Business. London: Mandarin. ISBN 9780333439623

- Markwell, Donald 2006. John Maynard Keynes and International Relations: Economic Paths to War and Peace, Oxford & New York: Oxford University Press. ISBN 9780198292364

- Palast, Greg. The Best Democracy Money Can Buy. London; Sterling, Va.: Pluto Press, 2002. ISBN 9780745318462

- Rapkin, David P. and Jonathan R. Strand. 2005. ‚ÄúDeveloping Country Representation and Governance of the International Monetary Fund,‚ÄĚ World Development 33, 12: 1993-2011. ISSN 0305-750X

- Rivalries between IMF and IBRD, "Sister-talk," The Economist (2007-03-01) ISSN 0013-0613

- Strand, Jonathan R and David P. Rapkin (2005) ‚ÄúVoting Power Implications of a Double Majority Voting Procedure in the IMF‚Äôs Executive Board,‚ÄĚ in Reforming the Governance of the IMF and World Bank, Ariel Buira, ed, London: Anthem Press. ISBN 9781843312116

- Williamson, John. (August 1982). The Lending Policies of the International Monetary Fund, Policy Analyses in International Economics 1, Washington D.C., Institute for International Economics. ISBN 9780881320008

External links

All links retrieved November 30, 2024.

- International Monetary Fund website

- Finance & Development - A quarterly magazine of the IMF

- Annual Reports of the Executive Board

- World Economic Outlook Reports

- IMF Publications

- Kenneth Rogoff - The sisters at 60

- How the IMF Props Up the Dollar System

- Political Forecasting? The IMF’s Flawed Growth Projections for Argentina and Venezuela by David Rosnick and Mark Weisbrot, Center for Economic and Policy Research

| International trade | |

|---|---|

| Definitions | Balance of payments · Current account (Balance of trade) · Capital account · Foreign exchange reserves · Sovereign wealth funds · Net Capital Outflow · Comparative advantage · Absolute advantage · Import substitution · International trade |

| Organizations and policies | World Trade Organization · International Monetary Fund · World Bank Group · International Trade Centre · Trade bloc · Free trade zone · Trade barrier · Import quota · Tariff |

| Schools of thought | Free trade · Balanced trade · Mercantilism · Protectionism |

| Related issues | Globalization · Outsourcing · Trade justice · Fair trade |

| ||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||

Credits

New World Encyclopedia writers and editors rewrote and completed the Wikipedia article in accordance with New World Encyclopedia standards. This article abides by terms of the Creative Commons CC-by-sa 3.0 License (CC-by-sa), which may be used and disseminated with proper attribution. Credit is due under the terms of this license that can reference both the New World Encyclopedia contributors and the selfless volunteer contributors of the Wikimedia Foundation. To cite this article click here for a list of acceptable citing formats.The history of earlier contributions by wikipedians is accessible to researchers here:

The history of this article since it was imported to New World Encyclopedia:

Note: Some restrictions may apply to use of individual images which are separately licensed.