Land value tax

| Taxation |

|

|

|

| Types of Tax |

|---|

| Ad valorem tax ·  Consumption tax Corporate tax ·  Excise Gift tax ·  Income tax Inheritance tax ·  Land value tax Luxury tax ·  Poll tax Property tax ·  Sales tax Tariff ·  Value added tax |

| Tax incidence |

| Flat tax ·  Progressive tax Regressive tax ·  Tax haven Tax rate |

Land value taxation (LVT) (or site value taxation) is an ad valorem tax where only the value of land itself is taxed. This ignores buildings, improvements, and personal property. Because of this, LVT is different from other property taxes on real estate‚ÄĒthe combination of land, buildings, and improvements to land.

Land and natural resources were not created by human effort or ingenuity. Improvements, however, depend upon human labor and capital. Property taxes in their current form, by taxing the value of both land and buildings, penalize people who develop their land and maintain improvements by imposing higher tax payments, while at the same time rewarding with lower payments those who let their buildings fall into disrepair or leave their land unused and uncared for. LVT encourages good stewardship of land without distorting market incentives.

History

Land value taxation has ancient roots, tracing back to after the introduction of agriculture. One of the oldest forms of taxation, it was originally based on crop yield. This early version of the tax required simply sharing the yield at the time of the harvest, akin to paying a yearly rent.[1]

Physiocrats

The Physiocrats were a group of economists who believed that the wealth of nations was derived solely from the value of land agriculture or land development. Physiocracy is considered one of the "early modern" schools of economics. Their theories originated in France and were most popular during the second half of the eighteenth century. The movement was particularly dominated by Anne Robert Jacques Turgot (1727‚Äď1781) and Fran√ßois Quesnay (1694‚Äď1774).[2] It immediately preceded the first modern school, classical economics, which began with the publication of Adam Smith's The Wealth of Nations in 1776.

Physiocrats called for the abolition of all existing taxes, completely free trade, and a single tax on land;[3] they did not distinguish, however, between intrinsic value of land and ground rent.[4]

Quesnay (founder of the Physiocratic school) claimed in his Fourth Maxim:

That the ownership of the landed properties and the mobile wealth be assured to those who are their legitimate possessors; for the security of property is the essential fundamental of the economic order of society.[5]

Quesnay argued that ‚Äúthe security of property is the fundamental essential of the economic order of society‚ÄĚ because:

Without the certainty of ownership, the territory would rest uncultivated. There would be neither proprietors nor tenants responsible for making the necessary expenditures to develop and cultivate it, if the preservation of the land and produce were not assured to those who advance these expenditures. It is the security of permanent possession which induces the work and the employment of wealth to the improvement and to the cultivation of land and to the enterprises of commerce and industry.[5]

Physiocrat influence in the United States came by Benjamin Franklin and Thomas Jefferson as Ambassadors to France,[6] and Jefferson brought his friend Pierre du Pont to the United States to promote the idea.[7] A statement in the 36th Federalist Paper reflects that influence, "A small land tax will answer the purpose of the States, and will be their most simple and most fit resource."[8]

Classical economists

Adam Smith, in his 1776 book The Wealth of Nations, first rigorously analyzed the effects of a land value tax, pointing out how it would not hurt economic activity, and how it would not raise land rents. He brought the new terms "ground rent" (sometimes "ground lease") into his treatise. Land value, directly related to the value it can provide over a certain period of time, is known known as ground-rent. Thus the capitalization of this ground-rent by the land market is what creates land prices, the other measure of land value.

Ground-rents are a still more proper subject of taxation than the rent of houses. A tax upon ground-rents would not raise the rents of houses. It would fall altogether upon the owner of the ground-rent, who acts always as a monopolist, and exacts the greatest rent which can be got for the use of his ground. ... In every country the greatest number of rich competitors is in the capital, and it is there accordingly that the highest ground-rents are always to be found. ... Whether the tax was to be advanced by the inhabitant, or by the owner of the ground, would be of little importance. The more the inhabitant was obliged to pay for the tax, the less he would incline to pay for the ground; so that the final payment of the tax would fall altogether upon the owner of the ground-rent.[9]

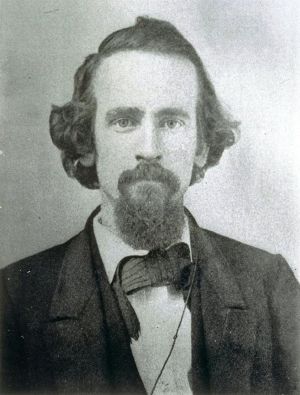

Henry George’s Proposal

Henry George (September 2, 1839 ‚Äď October 29, 1897) was perhaps the most famous advocate of recovering land rents for public purposes. An American Journalist and political economist, he advocated a "Single Tax" on land. In 1879 he authored Progress and Poverty, which significantly influenced land taxation in the United States.

His single tax solution lay in the taxation of the rent of land and natural opportunities ‚ÄĒ that is, the recapture of rent for public use, rather than the taxation of labor and capital.

According to George:

We have reached the deplorable circumstance where in large measure a very powerful few are in possession of the earth's resources, the land and its riches and all the franchises and other privileges that yield a return. These positions are maintained virtually without taxation; they are immune to the demands made on others. ... The very poor, who have nothing, are the object of compulsory charity. And the rest ‚ÄĒ the workers, the middle-class, the backbone of the country ‚ÄĒ are made to support the lot by their labor. ... We are taxed at every point of our lives, on everything we earn, on everything we save, on much that we inherit, on much that we buy at every stage of the manufacture and on the final purchase. The taxes are punishing, crippling, demoralizing. Also they are, to a great extent, unnecessary.[10]

George warned that:

The nation is no longer comprised of the thirteen original states, nor of the thirty-seven younger sister states, but of the real powers: the cartels, the corporations. Owning the bulk of our productive resources, they are the issue of that concentration of ownership that George saw evolving, and warned against.[11]

George saw nothing wrong with private corporations owning the means of producing wealth. Rather:

It is the insidious linking together of special privilege, the unjust outright private ownership of natural or public resources, monopolies, franchises, that produce unfair domination and autocracy.[11]

However, shortly after George's death, his ideas dropped out of the political field. His plan of social action based on a single land value tax has been unpopular, except in Australia, New Zealand, Taiwan, Hong Kong, and scattered cities around the world.

Arguments for Land Value Taxation

First, it should be noted that every jurisdiction that has a real estate property tax has an element of land value tax (LVT), because land value contributes to overall property value.[12]

Land value tax has been referred to as "the perfect tax."[13]

In theory, levying a Land Value Tax is straightforward, requiring only a valuation of the land and a register of the identities of the landholders. There is no need for the tax payers to deal with complicated forms or to give up personal information as with an income tax. Because land cannot be hidden, removed to a tax haven or concealed in an electronic data system, the tax can not be evaded.[14]

Economic considerations

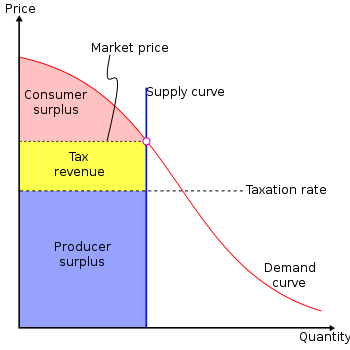

Most taxes distort economic decisions. If labor, buildings, or machinery and plants are taxed, people are dissuaded from constructive and beneficial activities, and enterprise and efficiency are penalized due to the burden of taxation. This does not apply to LVT, which is payable regardless of whether or how well the land is actually used, because the supply of land is inelastic, market land rents depend on what tenants are prepared to pay rather than on the expenses of landlords, and so LVT cannot be passed on to tenants.[9]

There are both equity and efficiency arguments for land value taxation:

- The equity argument is that land is given by nature and the base value of the land was not created by human effort. Furthermore, increases in the value of land are caused by public services and economic development in the neighborhood, not by the effort of the landowner. Therefore, because the landowner has done nothing to deserve the gain from his ownership of land, the government should capture this gain through taxation and use it for the benefit of all members of society.[15]

- The efficiency argument is that LVT is efficient because, unlike labor and capital, land cannot move to escape tax. The supply of land is fixed, given by nature. A tax on the value of land (based on its potential use), will not discourage the landowner from making the land available. Such a tax does not discourage productive activity or distort choices among consumer goods. Theoretically, the owner must pay the same tax regardless of what he does or does not do with the land. It should be noted that the method of assessing land values is crucial; changes in the market value of land attributable to permanent improvements to a site should not be included in the taxable land value.[15]

The only alleged direct effect of LVT on prices is to lower the market price of land. Put another way, LVT is often said to be justified for economic reasons because if it is implemented properly, it will not deter production, distort market mechanisms or otherwise create deadweight losses the way other taxes do.

The value of land can be expressed in two ways. Land value is directly related to the value it can provide over a certain period of time, also known as ground rent. The capitalization of this ground-rent by the land market is what creates land prices, the other measure of land value. When ground-rent is redirected to the public, through LVT for example, the price of land will decrease, holding all else constant. The rent charged for land also changes as a result of efficiency gains from the ad valorem aspect of LVT.

LVT is arguably an ecotax because it discourages the waste of prime locations, which are a finite natural resource.[16] The tax may encourage landowners to develop vacant/underused land or to sell it. Because LVT deters speculative land holding, dilapidated inner city areas return to productive use, reducing the pressure to build on undeveloped sites and so reducing urban sprawl.[17]

When the necessity to pay the tax encourages landowners to develop vacant and under-used land properly or to make way for others who will, it may change dilapidated areas of a city. For example, Harrisburg, Pennsylvania has taxed land at a rate three times that on improvements since 1975, rewarding productivity and investment. The two-tier policy was credited by mayor Stephen R. Reed with revitalizing the city by greatly reducing the number of vacant structures in downtown Harrisburg.[18]

Ethics

In religious terms, it has been claimed that land is a common gift to all of mankind.[19] For example, the Catholic Church as part of its "Universal Destination" principle asserts:

Everyone knows that the Fathers of the Church laid down the duty of the rich toward the poor in no uncertain terms. As St. Ambrose put it: "You are not making a gift of what is yours to the poor man, but you are giving him back what is his. You have been appropriating things that are meant to be for the common use of everyone. The earth belongs to everyone, not to the rich."[20]

LVT is also purported to act as a value capture tax.[21] A new public works project may make adjacent land go up considerably in value, and thus, with a tax on land values, the tax on adjacent land goes up. Thus, the new public improvements would be paid for by those most benefited by the new public improvements - both the owners of the land and the owners of the adjacent land whose whose land value has gone considerably higher too, following the principle of ad valorem taxes.

Real estate values

The selling price of land titles is proportional to the expected profits from rent or investment after taxes, so LVT could reduce the capital value of the real estate owners' holdings, significantly or not at all as in the case of Harrisburg, Pennsylvania.[22]

If the value to landowners were reduced to zero (in the extreme but only theoretical case) or near zero by recovering effectively all its rent, total privately held asset values could decline disrupting the economy as the land value element was stripped out, representing a shift in apparent private sector wealth but which is in fact a paper value only. Hence, most LVT advocates support a gradual shift to avoid disrupting the economy, and argue that the reduction in private rent collection would result in increased net wages received from employment and asset growth from entrepreneurial activity.

Advocates also claim that LVT reduces the speculative element in land pricing, thereby leaving more money for productive capital investment. Investment would divert into expanding businesses, creating more jobs, and stimulating greater productivity.[23] The same people also warn that a rapid reduction of real estate values could have profoundly negative effects on banks and other financial institutions whose asset portfolios are dominated by real estate mortgage debt, and could thus threaten the stability of the whole financial system. This happened in the 2008 housing crisis when the real estate bubble contributed to a major recession.

This 2008 financial crisis happened because banks were able to create too much money too quickly for buyers of new houses that were built too quickly. Speculators bought cheap land in the suburbs and almost tax-free land (with dilapidated structures) in the core of metropolis and put up whole new housing communities there. These were sold to mostly first-time home-buyers who obtained loans with virtually no checks on the mortgage-holders' ability to pay them back.[24] If LVT had been applied instead of property tax, as in the Harrisburg example above, people would not have lost all their life savings as the prices of the houses (and hence the mortgages) would not have increased to such an extent.

Well-being of Inhabitants

The current structure of the property tax system encourages sprawl. Since municipalities calculate property taxes based on the value of the land plus the value of the buildings on the site, landowners who improve buildings or use land more efficiently face increased taxes. This creates a disincentive to re-development into more people-friendly communities.

On the outskirts of cities, land is bought by speculators who then wait for land values to rise as the suburbs move closer. Then, the speculator sells the land to a developer, who puts up buildings quickly and cheaply to maximize profit. This creates unimaginative and inefficient suburbs, rather than more walkable, self-contained communities where people can live, work, shop, and play.

At the city core, speculation works the other way. Speculators buy run-down properties and deliberately keep them in poor condition until they can negotiate tax breaks on the improvements. If reduced assessments are not forthcoming, they demolish the buildings. These vacant lots and abandoned buildings deprive cities of much-needed tax revenue, reduce property values, and detract from the vibrancy and livability of the city. The solution is to allow market mechanisms to curb sprawl by shifting property taxes off buildings and onto land.[25]

Arguments against Land Value Taxation

Value Assessment

Critics point out that determining the value of land can be difficult in practice. In a 1796 United States Supreme Court opinion, Justice William Paterson noted that leaving the valuation process up to assessors would cause numerous bureaucratic complexities, as well as non-uniform assessments due to imperfect policies and their interpretations.[26] Austrian School economist Murray Rothbard later raised similar concerns, stating that no government can fairly assess value, which can only be determined by a free market.[27]

When compared to modern-day property tax evaluations, valuations of land involve fewer variables and have smoother gradients than valuations that include improvements. This is due to variation of building style, quality and size between lots. Modern computerization and statistical techniques have eased the process; in the 1960s and 1970s, multivariate analysis was introduced as a method of assessing land.[28]

Political Considerations

Landowners often possess significant political influence. Thus, advocates of any tax reform proposal need to consider likely sources of opposition and support and to devise strategies to minimize opposition and build a coalition of supporters.

Opponents of land value taxation have often charged that this would shift the burden of taxation to farmers, who own large areas of land. In fact, some farmers might benefit from an increase in the tax rate on land value offset by a reduction in the tax on improvements.[29] A reform strategy assuaging farmers' fears would have greater chance of success. Limiting land value taxation to urban areas rather than adopting it as the "single tax" for all state and local government revenues would eliminate opposition from farmers.

Environmentalists support replacing the property tax on improvements with land value taxation in urban areas because it would encourage more development in urban centers and discourage sprawl.[30]

Implementation Issues

The implementation of any tax reform affecting the taxation of durable assets raises serious equity issues, and land is the most durable of assets. This is due to "tax capitalization": The value of an asset reflects the present value of the expected future income to be derived from that asset. Anticipated future taxes reduce the expected future income and thus are "capitalized" in the value of the asset.[15]

[C]onsider an unanticipated shift from a property tax applied at the same rate to land and improvements to a tax on only land value that yields the same total revenue. Compare the effects of this change on the values of two properties, a parking lot and a parcel with a ten-story office building. Almost all of the value of the parking lot is the land value, but most of the value of the parcel with the office building consists of "improvements." The market value of the office building will increase as the anticipated future taxes fall, and the value of the parking lot will fall as the tax rate on the land value increases. When the current owners of these properties purchased them, they each paid a price that reflected the expectation that the old property tax system would continue into the future. The unanticipated tax reform causes a "windfall gain" to the owner of the office building and a "windfall loss" to the owner of the parking lot. Many people consider such windfalls "unfair."[15]

To reduce the unfair impact of such windfalls tax reforms need to be implemented gradually.

Sufficiency of revenue

In the context of land value taxation as a single tax (replacing all other taxes), some have argued that LVT alone cannot raise large enough revenues.[31] However, this is based on the fallacious assumption that land values would not change as existing taxes were phased out.

However, the presence of other taxes can reduce land values and hence the amount of revenue that can be raised from them. Thus, most modern LVT systems function alongside other taxes and thus only reduce their impact without removing them.

If a jurisdiction attempted to levy a land tax that was higher than the entire landowner surplus, it would result in the abandonment of property by those who would be paying and a sharp decline in tax revenue.[21] Whilst this is obviously the case only theoretically, it sets a natural ceiling on the amount of LVT that can be levied. The exception to this would be when the jurisdiction pursues a policy of increasing the well-being of the population of a certain area, as in the case of revitalizing downtown Harrisburg.

Existing tax systems

United States

Land value taxes are used in various jurisdictions of the United States, particularly in the state of Pennsylvania.

Every single state in the United States has some form of property tax on real estate and hence, in part, a tax on land value. There are several cities that use LVT to varying degrees, but LVT in its purest form is not used on state or national levels. Land value taxation was tried in the South during Reconstruction as a way to promote land reform.

There have also been several attempts throughout history to introduce land value taxation on a national level. In Hylton v. United States (1796), the Supreme Court directly acknowledged that a Land Tax was constitutional, so long as it was apportioned equally among the states. Two of the associate justices explained in their summaries, stating:

[T]he Constitution declares, ... both in theory and practice, a tax on land is deemed to be a direct tax. ... I never entertained a doubt, that the principal, I will not say, the only, objects, that the framers of the Constitution contemplated as falling within the rule of apportionment, were a capitation tax and a tax on land. Justice William Paterson[26]

I am inclined to think, but of this I do not give a judicial opinion, that the direct taxes contemplated by the Constitution, are only two, to wit, a capitation, or poll tax, simply, without regard to property, profession, or any other circumstance; and a tax on land. Justice Samuel Chase[26]

- Single tax

The first city in the United States to enact land value taxation was Hyattsville, Maryland in 1898, through the efforts of Judge Jackson H. Ralston. The Maryland Courts subsequently found it to be barred by the Maryland Constitution. Judge Ralston and his supporters commenced a campaign to amend the state Constitution which culminated in the Article 15 of the Declaration of Rights (which remains today part of the Maryland State Constitution). In addition, he helped see that enabling legislation for towns be passed in 1916, which also remains in effect today. The towns of Fairhope, Alabama and Arden, Delaware were later founded as model Georgist communities or "single tax colonies."

- Two-rate taxation

Nearly 20 Pennsylvania cities employ a two-rate or split-rate property tax: taxing the value of land at a higher rate and the value of the buildings and improvements at a lower one. This can be seen as a compromise between pure LVT and an ordinary property tax falling on real estate (land value plus improvement value). Alternatively, two-rate taxation may be seen as a form that allows gradual transformation of the traditional real estate property tax into a pure land value tax.

Nearly two dozen local Pennsylvania jurisdictions (such as Harrisburg) use two-rate property taxation in which the tax on land value is higher and the tax on improvement value is lower. Pittsburgh used the two-rate system from 1913 to 2001 when a countywide property reassessment led to a drastic increase in assessed land values during 2001 after years of underassessment, and the system was abandoned in favor of the traditional single-rate property tax. The tax on land in Pittsburgh was about 5.77 times the tax on improvements. Notwithstanding the change in 2001, the Pittsburgh Improvement District still employs a pure land value taxation as a surcharge on the regular property tax. Comparing Pennsylvania cities using a higher tax rate on land value and a lower rate on improvements with similar sized Pennsylvania cities using the same rate on land and improvements, the higher land value taxation was found to lead to increased construction within the jurisdiction.[32][33]

Other countries

Pure LVT, apart from real estate or generic property taxation, is used in Taiwan, Singapore, and Estonia. Many more countries have used it in the past, particularly Denmark and Japan. Hong Kong is perhaps the best modern example of the successful implementation of a high LVT.[34]

Several cities around the world also use LVT, including Sydney, Canberra, and others in Australia, as well as in Mexicali, Mexico.

Conclusion

For those who believe markets generally allocate resources efficiently, the best tax is one which creates the least distortion of market incentives. A tax on the value of land meets this criterion. Furthermore, the benefits of local government services will be reflected in the value of land within the locality. Therefore, it may be deemed fair that landowners pay taxes to finance these services in proportion to the value of the benefits they receive.

Land and natural resources were not created by human effort or ingenuity. Improvements, however, depend upon human labor and capital. Property taxes in their current form, by taxing not only the land but also the property developed on that land, penalize people who improve their buildings by imposing higher tax payments, while at the same time rewarding with lower taxes those who let their buildings fall into disrepair. Land Value Tax could change this:

LVT would bring idle land in towns and cities into use. This would reduce costly urban sprawl. The extra supply of land would cut land prices and so cut accommodation costs for homes and business premises.[23]

Although Henry George advocated a tax on land values as the "single tax" to replace all other taxes, a tax on land value seems especially appropriate for municipal governments. If a complete shift from the current property tax to a tax on land value alone seems too radical, municipal governments might reduce the property tax rate on improvements while imposing a higher tax rate on the value of land.

Notes

- ‚ÜĎ Edwin R. Seligman, Encyclopedia of the Social Sciences (Macmillan, 1937, ISBN 978-0026096102).

- ‚ÜĎ Phillippe Steiner, "Physiocracy and French Pre-Classical Political Economy" in Warren J. Samuels, Jeff E. Biddle, and John B. Davis (eds.), A Companion to the History of Economic Thought (Wiley-Blackwell, 2006, ISBN 978-1405134590), 62.

- ‚ÜĎ Gon√ßalo L. Fonseca, The Physiocrats The History of Economic Thought Website. Retrieved July 3, 2023.

- ‚ÜĎ Axel Fraenckel, The Physiocrats and Henry George 4th International Conference of the International Union for Land Value Taxation and Free Trade, The School of Cooperative Individualism, 1929. Retrieved July 3, 2023.

- ‚ÜĎ 5.0 5.1 Auguste Oncken, (ed.), Oeuvres Economiques et Philosophiques de F. Quesnay (Paris: Joseph Baer, 1888), 331-332.

- ‚ÜĎ Mason Gaffney, Notes on the Physiocrats School of Cooperative Individualism, 1998. Retrieved July 3, 2023.

- ‚ÜĎ Thomas Jefferson, Correspondence Between Thomas Jefferson And Pierre Samuel Du Pont De Nemours 1789-1817. Retrieved July 3, 2023.

- ‚ÜĎ Federalist Paper #36 Constitution Society.

- ‚ÜĎ 9.0 9.1 Adam Smith, "Article I: Taxes upon the Rent of Houses," Book V, Chapter 2, An Inquiry into the Nature and Causes of the Wealth of Nations (The Wealth of Nations) (Oxford: Oxford University Press, 1998 (original 1776), ISBN 978-0192835468).

- ‚ÜĎ Henry George, Progress and Poverty (Cosimo Classics, 2006, ISBN 978-1596059511).

- ‚ÜĎ 11.0 11.1 Agnes George de Mille, Preface to the Centenary Edition Progress and Poverty, 1979. Retrieved July 3, 2023.

- ‚ÜĎ Steven Ginsberg, Two cheers for the property tax: everyone hates it, but the property tax has some good attributes that make it indispensible Washington Monthly (October, 1997). Retrieved July 3, 2023.

- ‚ÜĎ Merryn Somerset Webb, How a levy based on location values could be the perfect tax The Financial Times (September 27, 2013). Retrieved July 3, 2023.

- ‚ÜĎ Land Value Tax FAQ, FEASTA. Retrieved July 3, 2023.

- ‚ÜĎ 15.0 15.1 15.2 15.3 John H. Beck, "Libertarianism and Land Value Taxation" Free State Project Forum, 2004.

- ‚ÜĎ Joseph A. DiMasi, "The Effects of Site Value Taxation in an Urban Area: A General Equilibrium Computational Approach" National Tax Journal 40(4) (December, 1987): 577-590.

- ‚ÜĎ Fred E. Foldvary, Geo-Rent: A Plea to Public Economists Econ Journal Watch, 2(1) (2005): 106-132. Retrieved July 3, 2023.

- ‚ÜĎ Alanna Hartzok, Pennsylvania's Success with Local Property Tax Reform ‚ÄĒ The Split Rate Tax The American Journal of Economics and Sociology 56(2) (Apr., 1997) 205-213. Retrieved July 3, 2023.

- ‚ÜĎ Harry Gunnison Brown, "A Defense of the Single-Tax Principle" Annals of the American Academy of Political and Social Sciences 183 (January): 63-69. Retrieved July 3, 2023.

- ‚ÜĎ Pope Paul VI, Populorum Progressio, item 23 March 26, 1967. Retrieved July 3, 2023.

- ‚ÜĎ 21.0 21.1 J. Anthony Coughlan, "Land Value Taxation and Constitutional Uniformity" George Mason Law Review 7(2) (Winter 1999): 261-292. Retrieved July 3, 2023.

- ‚ÜĎ Murray N. Rothbard, The Logic of Action I: Method, Money, and the Austrian School (London: Edward Elgar, 1997, ISBN 978-1858980157), 305-310.

- ‚ÜĎ 23.0 23.1 Dave Wetzel, The case for taxing land New Statesman (September 20, 2004). Retrieved July 3, 2023.

- ‚ÜĎ Mirek Karasek and Jennifer P. Tanabe, The Crucial Challenge for International Aid: Making the Donor-Recipient Relationship Work to Prevent Catastrophe (Raleigh, NC: LuluPress Inc., 2014, ISBN 978-1312704282).

- ‚ÜĎ Frank DeJong, Untax Buildings, Uptax Land Henry George Foundation of Canada, November 30, 2011. Retrieved July 3, 2023.

- ‚ÜĎ 26.0 26.1 26.2 Hylton v. United States 3 U.S. 171 (1796). Retrieved July 3, 2023.

- ‚ÜĎ Murray Rothbard, The Single Tax: Economic and Moral Implications and A Reply to Georgist Criticisms The Mises Institute, 1997. Retrieved July 3, 2023.

- ‚ÜĎ Paul B. Downing, "Estimating Residential Land Value by Multivariate Analysis" in The Assessment of Land Value Daniel M. Holland (ed.), (Committee on Taxation, Resources and Economic Development by University of Wisconsin Press, 1970, ISBN 978-0299056209).

- ‚ÜĎ Kenneth C. Wenzer, (ed.), Land-value Taxation: The Equitable and Efficient Source of Public Finance (London, UK: Shepheard-Walwyn Publishers Ltd, 1999, ISBN 978-0856831812), 239-268.

- ‚ÜĎ Alan Thein Durning and Yoram Bauman, Tax Shift: How to Help the Economy, Improve the Environment, and Get the Tax Man off Our Backs (Seattle: Northwest Environment Watch, 1998, ISBN 978-1886093072), 57-65.

- ‚ÜĎ Richard A. Posner, Economic Analysis of Law (Wolters Kluwer Law & Business, 2014, ISBN 978-1454833888).

- ‚ÜĎ Florenz Plassmann and Nicolaus Tideman, "A Markov Chain Monte Carlo Analysis of the Effect of Two-Rate Property Taxes on Construction" Journal of Urban Economics 47(2) (2000): 216-247. Retrieved July 3, 2023.

- ‚ÜĎ S. Cord, ‚ÄúTaxing Land More Than Buildings: The Record In Pennsylvania.‚ÄĚ In C. Lowell Harriss (ed.) The Property Tax and Local Finance (New York: The Academy of Political Science, 1983, ISBN 978-9994983643), 172-179.

- ‚ÜĎ Michel Bauwens, Successfull examples of land value tax reforms P2P Foundation (February 5, 2011). Retrieved July 3, 2023.

ReferencesISBN links support NWE through referral fees

- Durning, Alan Thein, and Yoram Bauman. Tax Shift: How to Help the Economy, Improve the Environment, and Get the Tax Man off Our Backs. Seattle: Northwest Environment Watch, 1998. ISBN 978-1886093072

- Fetter, Frank. Capital, Interest, and Rent. New York University Press, 1980. ISBN 978-0836206845

- George, Henry. Progress and Poverty Cosimo Classics, 2006 (original 1879). ISBN 978-1596059511

- Harriss, C. Lowell (ed.). Property Tax and Local Finance. Academy of Political Science, 1983. ISBN 978-9994983643

- Holland, Daniel M. (ed.). The Assessment of Land Value. Committee on Taxation, Resources and Economic Development by University of Wisconsin Press, 1970. ISBN 978-0299056209

- Karasek, Mirek, and Jennifer P. Tanabe. The Crucial Challenge for International Aid: Making the Donor-Recipient Relationship Work to Prevent Catastrophe. Raleigh, NC: LuluPress Inc., 2014. ISBN 978-1312704282

- Oncken, Auguste (ed.). Oeuvres Economiques et Philosophiques de F. Quesnay. Legare Street Press, 2022 (original 1888). ISBN 978-1016607919

- Posner, Richard A. Economic Analysis of Law. Wolters Kluwer Law & Business, 2014. ISBN 978-1454833888

- Rothbard, Murray N. The Logic of Action I: Method, Money, and the Austrian School. London: Edward Elgar, 1997. ISBN 978-1858980157

- Samuels, Warren J., Jeff E. Biddle, and John B. Davis (eds.). A Companion to the History of Economic Thought. Wiley-Blackwell, 2006. ISBN 978-1405134590

- Seligman, Edwin R. Encyclopedia of the Social Sciences. Macmillan, 1937. ISBN 978-0026096102

- Smith, Adam. An Inquiry into the Nature and Causes of the Wealth of Nations (The Wealth of Nations). Oxford: Oxford University Press, 1998 (original 1776). ISBN 978-0192835468

- Wenzer, Kenneth C. (ed.). Land-value Taxation: The Equitable and Efficient Source of Public Finance. London, UK: Shepheard-Walwyn Publishers Ltd, 1999. ISBN 978-0856831812

External links

All links retrieved March 7, 2025.

- Why land value taxes are so popular, yet so rare The Economist, November 10, 2014.

- Why Henry George had a point The Economist, April 1, 2015.

- The time may be right for land-value taxes The Economist, August 9, 2018.

- The Problem With 100% Land Value Taxes Forbes, March 29, 2015.

Credits

New World Encyclopedia writers and editors rewrote and completed the Wikipedia article in accordance with New World Encyclopedia standards. This article abides by terms of the Creative Commons CC-by-sa 3.0 License (CC-by-sa), which may be used and disseminated with proper attribution. Credit is due under the terms of this license that can reference both the New World Encyclopedia contributors and the selfless volunteer contributors of the Wikimedia Foundation. To cite this article click here for a list of acceptable citing formats.The history of earlier contributions by wikipedians is accessible to researchers here:

The history of this article since it was imported to New World Encyclopedia:

Note: Some restrictions may apply to use of individual images which are separately licensed.