Difference between revisions of "Measures of national income and output" - New World Encyclopedia

| (107 intermediate revisions by 5 users not shown) | |||

| Line 1: | Line 1: | ||

| + | {{Images OK}}{{Approved}}{{copyedited}} | ||

[[Category:Politics and social sciences]] | [[Category:Politics and social sciences]] | ||

[[Category:Economics]] | [[Category:Economics]] | ||

| − | '''Measures of national income and output''' are used in [[economics]] to | + | '''Measures of national income and output''' are used in [[economics]] to measure a nation's economic activity by totaling the value of [[goods]] and [[services]] produced in its [[economy]]. [[Simon Kuznets]] developed the system of national accounting in the 1940s and 1960s. Some of the more common measures are '''Gross National Product''' (GNP), '''Gross National Income''' (GNI), '''Gross Domestic Product''' (GDP), '''Net National Product''' (NNP), and '''Net National Income''' (NNI). |

| − | + | These measurements are not easy to calculate accurately, for various reasons. Comparisons between different countries, where the measures may have been based on different calculations, may be misleading. Nevertheless, these measures are a valuable tool in assessing a country's economic health in relation to its history, and may provide comparisons of economies in different countries with the caveat that the methods of calculating them must be as similar as possible. | |

| + | {{toc}} | ||

| + | Attempts have been made to use these measures to assess the [[standard of living]] and the welfare (or [[quality of life]]) of the members of different societies. This effort has serious problems, as was noted by Kuznets. Although the standard of living can be viewed as a purely economic measure, since a nation's production may provide great or little economic benefit to its population, these measures are not closely correlated enough to allow them to be used interchangeably. The prosperity of the society as a whole does not necessarily translate into prosperity of the individuals within that society, even on a simple economic basis. The quality of life of individuals is not a purely economic matter, but has significant [[psychology|psychological]] and [[sociology|sociological]] components. Thus, to view the greater economic production of a nation as leading to greater well-being of its citizens is an inadequate assumption. Human beings need more than material [[wealth]] in order to experience [[happiness]]. | ||

| − | + | ==Overview== | |

| + | The original motivation for the development of national accounts and the systematic measurement of employment was the need for accurate measures of aggregate economic activity. This was made more pressing by the [[Great Depression]] and as a basis for [[Keynesian]] [[macroeconomics|macroeconomic]] stabilization policy and wartime economic planning. The first efforts to develop such measures were undertaken in the late 1920s and 1930s, notably by [[Colin Clark]]. [[Simon Kuznets]] developed the first usable models in the 1940s. [[Richard Stone]] led later contributions. | ||

| − | + | International rules for national accounting are defined by the [[United Nations System of National Accounts]]. In Europe, the worldwide System of National Accounts has been transposed into a [[European System of Accounts]] (ESA), which is applied by members of the [[European Union]] and many other European countries. | |

| − | |||

| − | |||

| − | + | National account systems provide a complete and consistent conceptual framework for measuring the economic activity of a nation using detailed underlying measures that rely on [[double-entry accounting]]. Such [[accounting]] makes the totals on both sides of an account equal even though they each measure different characteristics. | |

| − | + | There are several different ways of calculating measures of national income and output. | |

| + | *The '''expenditure approach''' determines Gross National Expenditure (GNE) by summing [[consumption]], [[investment]], government expenditure, and net exports. | ||

| + | *On the other hand, the '''income approach,''' yielding Gross National Income (GNI), and the closely related '''output approach,''' yielding Gross National Product (GNP), can been seen as the summation of consumption, [[savings]], and [[taxation]]. | ||

| − | + | The three methods must yield the same results because the total expenditures on [[goods]] and [[services]] (GNE) must by definition be equal to the value of the goods and services produced (GNP) which must be equal to the total income paid to the factors that produced these goods and services (GNI). | |

| − | + | Thus, GNP = GNI = GNE by definition. | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| + | However, in practice minor differences are obtained from the various methods due to changes in [[inventory]] levels. This is because goods in inventory have been produced (therefore included in GNP), but not yet sold (therefore not yet included in GNE). Similar timing issues can also cause a slight discrepancy between the value of goods produced (GNP) and the payments to the factors that produced the goods, particularly if inputs are purchased on [[credit]], and also because wages are often collected after a period of production. | ||

| − | + | In the following calculations, "Gross" means that [[depreciation]] of [[capital stock]] is not subtracted from the total value. If net investment (which is gross investment minus depreciation) is substituted for gross investment in the equation, then the formula for [[net domestic product]] is obtained. Consumption and investment in this equation are expenditure on [[final goods|final]] goods and services. The exports-minus-imports part of the equation (often called "net exports") adjusts this by subtracting the part of this expenditure not produced domestically (the imports), and adding back in domestic area (the exports). | |

| − | == | + | ==Gross National Product== |

| + | Gross National Product (GNP) is the total value of final goods and services produced in a year by domestically owned factors of production. | ||

| + | Final goods are goods that are ultimately consumed rather than used in the production of another good. | ||

| + | |||

| + | '''Example:''' A car sold to a consumer is a final good; the components such as tires sold to the car manufacturer are not; they are intermediate goods used to make the final good. The same tires, if sold to a consumer, would be a final good. Only final goods are included when measuring national income. If intermediate goods were included too, this would lead to double counting; for example, the value of the tires would be counted once when they are sold to the car manufacturer, and again when the car is sold to the consumer. | ||

| − | + | '''NOTE:''' Only newly produced goods are counted. Transactions in existing goods, such as second-hand cars, are not included, as these do not involve the production of new goods. | |

| − | |||

| − | |||

| − | |||

| − | + | Income is counted as part of GNP according to who owns the factors of production rather than where the production takes place. | |

| − | : '' | + | '''Example:''' In the case of a German-owned car factory operating in the U.S., the profits from the factory would be counted as part of German GNP rather than U.S. GNP because the capital used in production (the factory, machinery, and so on) is German owned. The wages of the American workers would be part of U.S. GNP, while wages of any German workers on the site would be part of German GNP. |

| − | + | ====Real and nominal values==== | |

| + | Nominal GNP measures the value of output during a given year using the prices prevailing during that year. Over time, the general level of prices rise due to inflation, leading to an increase in nominal GNP even if the volume of goods and services produced is unchanged. | ||

| − | + | Real GNP measures the value of output in two or more different years by valuing the goods and services produced at the same prices. For example, GNP might be calculated for 2000, 2001, and 2002 using the prices prevailing in 2002 for all of the calculations. This gives a measure of national income which is not distorted by inflation. | |

| − | + | ||

| − | + | ====Depreciation and Net National Product==== | |

| + | Not all GNP data show the production of final [[goods]] and [[services]]—part represents output that is set aside to maintain the nation's productive capacity. [[Capital good]]s, such as buildings and machinery, lose value over time due to wear and tear and obsolescence. | ||

| − | + | [[Depreciation]] (also known as [[consumption of fixed capital]]) measures the amount of GNP that must be spent on new capital goods to maintain the existing physical capital stock. | |

| − | |||

| − | |||

| − | + | '''NOTE:''' Depreciation measures the amount of GNP that must be spent on new capital goods to offset this effect. | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | + | '''Net National Product''' (NNP) is the total [[market value]] of all final [[Good (economics and accounting)|goods]] and [[Service (economics)|services]] produced by [[citizen]]s of an economy during a given period of time ([[Gross National Product]] or GNP) minus [[depreciation]]. Net National Product can be similarly applied at a country's domestic output level. | |

| − | |||

| − | + | NNP is the amount of goods in a given year which can be consumed without reducing the amount which can be consumed in the future. Setting part of NNP aside for [[investment]] permits the growth of the capital stock and the [[Consumption (economics)|consumption]] of more goods in the future. | |

| − | + | NNP can also be expressed as total [[compensation of employees]] + net indirect tax paid on current production + [[operating surplus]]. | |

| − | + | Hence, through the income approach one defines: | |

| − | + | *Net National Product (NNP) is GNP minus depreciation | |

| + | *Net National Income (NNI) is NNP minus indirect taxes | ||

| + | *Personal Income (PI) is NNI minus retained earnings, corporate taxes, transfer payments, and interest on the public debt | ||

| + | *Personal Disposable Income (PDI) is PI minus personal taxes, plus transfer payments | ||

| − | == | + | Then, in summary, one has: |

| − | + | *Personal savings (S) plus personal consumption (C) = personal disposable income (PDI) | |

| − | + | *PDI plus personal taxes paid minus transfer payments received = personal income (PI) | |

| − | + | *PI plus retained earnings plus corporate taxes plus transfer payments plus interest on the public debt = net national income (NNI) | |

| − | + | *NNI plus indirect taxes = net national product (NNP) | |

| + | *NNP plus depreciation = gross national product (GNP) | ||

| − | + | ==Gross Domestic Product== | |

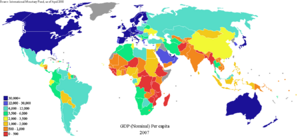

| − | + | [[Image:GDP nominal per capita world map IMF 2007.PNG|300px|thumb|Map of countries by 2007 GDP (nominal) per capita (IMF, April 2008).]] | |

| − | == | + | Gross Domestic Product (GDP) is the total value of final goods and services produced within a country's borders in a year. GDP counts income according to where it is earned rather than who owns the factors of production. |

| − | |||

| − | + | '''Example:''' In the above case of a German-owned car factory operating in the U.S., all of the income from the car factory would be counted as U.S. GDP rather than German GDP. | |

| − | + | ===Measuring GDP=== | |

| − | + | There are two ways to measure GDP. The most common approach to measuring and understanding GDP is the expenditure method. The other is the income method. | |

| − | |||

| − | |||

| − | + | ;Expenditure method | |

| + | Measured according to the expenditure method, GDP is equal to consumption + investment + government expenditures + exports - imports, which can be written as | ||

| + | :'''GDP = C + I + G + NX''' | ||

| + | where: | ||

| + | *C = [[Consumption (economics)|Consumption]] | ||

| + | *I = [[Investments]] | ||

| + | *G = [[Government spending]] | ||

| + | *NX = net exports ([[exports]] minus [[imports]]) | ||

| − | + | '''Example 1:''' If an individual spends money to renovate their hotel so that occupancy rates increase, that is private investment, but if they buy shares in a consortium to do the same thing it is [[saving]]. The former is included when measuring GDP (in '''I'''), the latter is not. However, when the consortium conducts the renovation the expenditure involved would be included in GDP. | |

| − | : | + | '''Example 2:''' If a hotel is a private home then renovation spending would be measured as '''C'''onsumption, but if a government agency is converting the hotel into an office for civil servants the renovation spending would be measured as part of public sector spending '''(G)'''. |

| − | + | '''Example 3:''' If the renovation involves the purchase of a [[chandelier]] from abroad, that spending would ''also'' be counted as an increase in imports, so that '''NX''' would fall and the total GDP is affected by the purchase. (This highlights the fact that GDP is intended to measure domestic production rather than total consumption or spending. Spending is really a convenient means of estimating production.) | |

| − | + | '''Example 4:''' If a domestic producer is paid to make the chandelier for a foreign hotel, the situation would be reversed, and the payment would be counted in '''NX''' (positively, as an export). Again, GDP is attempting to measure production through the means of [[expenditure]]; if the chandelier produced had been bought domestically it would have been included in the GDP figures (in '''C''' or '''I''') when purchased by a consumer or a business, but because it was exported it is necessary to "correct" the amount consumed domestically to give the amount produced domestically. | |

| − | |||

| − | |||

| − | + | ;Income method | |

| + | The income approach focuses on finding the total output of a nation by finding the total income of a nation. This is acceptable, because all money spent on the production of a good—the total value of the good—is paid to workers as income. | ||

| − | + | The main types of income that are included in this measurement are [[rent]] (the money paid to owners of land), [[salaries]] and [[wages]] (the money paid to workers who are involved in the production process, and those who provide the natural resources), [[interest]] (the money paid for the use of man-made resources, such as machines used in production), and [[profit]] (the money gained by the [[entrepreneur]]—the businessman who combines these resources to produce a good or service). | |

| − | |||

| − | |||

| − | + | In this income approach, GDP(I) is equal to Net Domestic Income (NDI at factor cost) + indirect taxes + depreciation – [[subsidy]], where Net Domestic Income (NDI) is the sum of returns of factors of production in the society. Thus, | |

| − | Net | + | :Net Domestic Income (NDI) = compensation of employees + net interest (credit – debit) + corporate profits (distributed + undistributed) + proprietor’s income (self-employed + small business) + rental income. |

| − | + | The difference between basic prices and final prices (those used in the expenditure calculation) is the total taxes and subsidies that the government has levied or paid on that production. So adding taxes less subsidies on production and imports converts GDP at factor cost to GDP(I) in the above equation. | |

| − | The | ||

| − | |||

| − | |||

| − | + | In calculating GDP, just as with GNP, only the price of final goods are included, not the prices of intermediate goods used in production of final goods. | |

| − | |||

| − | |||

| − | + | '''Example:''' The intermediate goods' selling prices for a textbook (sold in a bookstore) are as follows: A tree company sells wood to a paper mill for $1; the paper mill sells paper to a textbook publisher for $3; the publisher sells the book to a bookstore for $7, and the bookstore sells the textbook for $75. Although the sum of all intermediate prices plus the selling price of the book comes to $86, we add to GDP only the final selling price $75. The price of the "tree," "paper," and "book" is included in the final selling price of the textbook by the bookstore. To include these amounts in GDP calculation would be to "double count." | |

| − | + | ===Net Domestic Product=== | |

| + | Net Domestic Product (NDP) is the equivalent application of NNP. Thus, NDP is equal to Gross Domestic Product (GDP) minus [[depreciation]]: Net domestic product (NDP) equals the [[gross domestic product]] (GDP) minus depreciation on a country's [[capital (economics)|capital]] goods. | ||

| + | :'''NDP = GDP – Depreciation''' | ||

| − | + | NDP is an estimate of how much the country has to spend to maintain the current GDP. If the country is not able to replace the capital stock lost through depreciation, then GDP will fall. In addition, a growing gap between GDP and NDP indicates increasing obsolescence of capital goods, while a narrowing gap would mean that the condition of capital [[stock]] in the country is improving. | |

| − | |||

| − | |||

| − | + | ==Gross National Income== | |

| + | '''Gross national income''' (GNI) is GDP less net taxes on production and imports, less compensation of employees and property income payable to the rest of the world plus the corresponding items receivable from the rest of the world. It includes [[wages]], [[rent]]s, [[interest]], and [[profit]]s, not only in the form of cash payments, but as income from contributions made by employers to [[pension fund]]s, income of the self-employed, and undistributed business profits. | ||

| + | |||

| + | In other words, Gross national income (GNI) is GDP less primary incomes payable to non-resident units plus primary incomes receivable from non-resident units. From this point of view, GNP is the better indicator of a country’s economic trend. | ||

| − | + | However, calculating the real GDP growth allows economists to determine if production increased or decreased, regardless of changes in the purchasing power of the [[currency]]. | |

| − | + | An alternative approach to measuring GNI at market prices is as the aggregate value of the balances of gross primary incomes for all sectors. | |

| − | + | '''NOTE:''' GNI is identical to gross national product (GNP) as, generally, used previously in national accounts and we may formulate basic principle of fundamental national accounting: | |

| + | :'''The value of total output equals the value of total income''' | ||

| − | + | This makes another very important point: | |

| − | + | <blockquote>Real income cannot be increased without producing more, redistributing income does nothing to increase the amount of wealth available at any point in time (Mings and Marlin 2000).</blockquote> | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | + | ===Net National Income=== | |

| − | + | '''Net National Income''' (NNI) can be defined as the [[Net National Product]] (NNP) minus [[indirect tax]]es. Net National Income encompasses the income of [[household]]s, [[business]]es, and the [[government]]. It can be expressed as: | |

| − | + | :'''NNI = C + I + G + (NX) + net foreign factor income - indirect taxes - [[depreciation]]''' | |

| − | + | Where again: | |

| − | + | *C = [[Consumption (economics)|Consumption]] | |

| + | *I = [[Investments]] | ||

| + | *G = [[Government spending]] | ||

| + | *NX = net exports ([[exports]] minus [[imports]]) | ||

| − | + | ==GDP vs. GNP== | |

| − | + | To convert from GDP to GNP you must add factor input payments to foreigners that correspond to goods and services produced in the domestic country using the factor inputs supplied by foreigners. | |

| − | |||

| − | + | To convert from GNP to GDP one must subtract factor income receipts from foreigners that correspond to goods and services produced abroad using factor inputs supplied by domestic sources. | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | + | NOTE: GDP is a better measure of the state of production in the short term. GNP is a better when analyzing sources and uses of income on a longer term basis. | |

| − | + | ==Relationship to welfare== | |

| − | + | These measures of national economic activity have often been used as indicators of the welfare or [[quality of life]] of citizens in different countries. | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | == | + | ===GNP=== |

| + | GNP per person is often used as a measure of people's welfare. Countries with higher GNP often score highly on other measures of welfare, such as life expectancy. However, there are serious limitations to the usefulness of GNP as such a measure: | ||

| + | |||

| + | *Measures of GNP typically exclude unpaid economic activity, most importantly domestic work such as childcare. This can lead to distortions; for example, a paid childminder's income will contribute to GNP, whereas an unpaid mother's time spent caring for her children will not, even though they are both carrying out the same activity. | ||

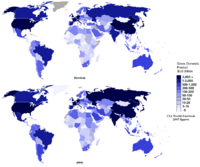

| − | + | *GNP takes no account of the inputs used to produce the output. For example, if everyone worked for twice the number of hours, then GNP might roughly double, but this does not necessarily mean that workers are better off as they would have less leisure time. Similarly, the impact of economic activity on the environment is not directly taken into account in calculating GNP. | |

| + | [[Image:Gdp nominal and ppp 2005 world map single colour.png|thumb|right|200px|''CIA World Factbook'' 2007 figures of total [[Real versus nominal value (economics)|nominal]] GDP (top) compared to [[Purchasing power parity]] (PPP)-adjusted GDP (bottom).]] | ||

| + | *Comparison of GNP from one country to another may be distorted by movements in exchange rates. Measuring national income at [[purchasing power parity]] (PPP) can help to overcome this problem. The PPP theory uses the long-term equilibrium [[exchange rate]] of two currencies to equalize their [[purchasing power]]. Developed by [[Gustav Cassel]] in 1920, it is based on the [[law of one price]] which states that, in an ideally efficient market, identical goods should have only one price. | ||

| − | + | ===GDP=== | |

| − | + | [[Simon Kuznets]], the inventor of the GDP, had this to say in his very first report to the U.S. Congress in 1934: | |

| + | <blockquote> …the welfare of a nation [can] scarcely be inferred from a measure of national income… (Kuznets 1934). </blockquote> In 1962, Kuznets stated: <blockquote>Distinctions must be kept in mind between quantity and quality of growth, between costs and returns, and between the short and long run. Goals for more growth should specify more growth of what and for what (Kuznets 1962).</blockquote> | ||

| − | + | Kuznets’ own uncertainty about GDP being a good measure of national welfare is well founded.The standard of living is a measure of economic welfare. It generally refers to the availability of scarce goods and services, usually measured by per capita income or per capita consumption, calculated in constant dollars, to satisfy wants rather than needs. | |

| − | + | Because the well-being that living standards are supposed to measure is an individual matter, per capita availability of goods and services in a country is a measure of general welfare only if the goods and services are distributed fairly evenly among people. Besides, just as Kuznets hinted, improvement in standard of living can result from improvements in economic factors such as productivity or per capita real economic growth, income distribution and availability of public services, and non-economic factors, such as protection against unsafe working conditions, clean environment, low crime rate, and so forth. | |

| − | + | ;Disadvantage | |

| − | The | + | The major disadvantage of using GDP as an indicator of standard of living is that it is not, strictly speaking, a measure of standard of living, which can be generally defined as "the quality and quantity of goods and services available to people, and the way these goods and services are distributed within a population." |

| − | + | GDP does not distinguish between consumer and capital goods; it does not take income distribution into account; it does not take account of differences in the economic goods and services that are not measured in GDP at all; it is subject to the vagaries of translating income measures into a common currency and it fails to take into account differences of tastes among nations. | |

| + | [[Image:World GDP Capita 1-2003 C.E..png|right|thumb|200px|World GDP per capita (in 1990 [[Geary-Khamis dollar]]s) changed very little for most of human history before the [[industrial revolution]]. (Note the empty areas mean no data, not very low levels. There are data for the years 1, 1000, 1500, 1600, 1700, 1820, 1900, and 2003.)]] | ||

| + | ;Advantage | ||

| + | All these items notwithstanding, GDP per capita is often used as an indicator of [[standard of living]] in an [[economic system|economy]], the rationale being that all citizens benefit from their country's increased economic production. | ||

| − | The | + | The major advantages to using GDP per capita as an indicator of standard of living are that it is measured frequently, widely, and consistently; frequently in that most countries provide information on GDP on a quarterly basis (which allows trends to be spotted quickly), widely in that some measure of GDP is available for practically every [[country]] in the [[world]] (allowing crude comparisons between the standard of living in different countries), and consistently in that the technical definitions used within GDP are relatively consistent between countries (so there can be confidence that the same thing is being measured in each country). |

| − | + | ===Critique by Austrian economists=== | |

| − | + | [[Austrian school of economics|Austrian economists]] are critical of the basic idea of attempting to quantify national output. [[Frank Shostak]] (2001) quotes Austrian economist [[Ludwig von Mises]]: | |

| − | + | <blockquote>The attempt to determine in money the wealth of a nation or the whole mankind are as childish as the mystic efforts to solve the riddles of the universe by worrying about the dimension of the pyramid of Cheops.</blockquote> | |

| − | + | Shostak elaborated in his own criticism: | |

| − | The | + | <blockquote>The GDP framework cannot tell us whether [[final goods|final]] goods and services that were produced during a particular period of time are a reflection of real wealth expansion, or a reflection of capital consumption. … For instance, if a government embarks on the building of a pyramid, which adds absolutely nothing to the well-being of individuals, the GDP framework will regard this as economic growth. In reality, however, the building of the pyramid will divert real funding from wealth-generating activities, thereby stifling the production of wealth (Shostak 2001).</blockquote> |

| − | + | ==Conclusion== | |

| + | Various national accounting formulas for GDP, GNP, and GNI may now be summarized here: | ||

| + | *GDP = C + I + G + (X - M) | ||

| + | *GNP = C + I + G + (X - M) + NR | ||

| + | *GNI = C + I + G + (X - M) + NR - CC – IBT. | ||

| + | where C = Personal consumption expenditures; | ||

| + | :I = Gross private domestic investment; | ||

| + | :G = Government consumption expenditures; | ||

| + | :X = Net exports of goods and services; | ||

| + | :M = Net imports of goods and services; | ||

| + | :NR = Net income from assets abroad; | ||

| + | :CC = Consumption of fixed capital; | ||

| + | :IBT = Indirect business taxes | ||

| − | + | These measures are valuable tools in assessing the state of a nation's economy. However, using these strictly economic statistics (GNP, GDP) as attempts to capture the [[standard of living]] trends and their mapping in any particular country, has serious problems. Even more problematic is their use in assessing [[quality of life]] or "well-being" of the citizens, which is far from a purely economic measure. | |

| + | |||

| + | There are two reasons why these economic statistics tell little or nothing about the well-being of the society, even if taken on a per capita basis. True, we can infer that if GDP (or GNP) per capita series in constant dollars grows within the short period of years, the standard of living may increase as well; but that is all we can say. As the [[Austrian school of economics|Austrian economist]] [[Frank Shostak]] stated, as noted above, if any government starts building [[pyramid]]s, GDP will be growing, yet—as the pyramids have no use for anybody—the standard of living will not (Shostak 2001). | ||

| − | + | The other reason is that we cannot compare or statistically infer anything regarding two or more environments that are independent from each other. In this case, on the one hand is the economy, and on the other is [[sociology]] combined with [[psychology]]. While there are factors that affect both, there is not a [[correlation]], let alone a causal relationship, between them. For example, the distribution of income, not just the aggregate or per capita average, is important in determining the standard of living and sense of well-being of individuals within the country. | |

| − | + | '''Example 1:''' Imagine an [[oil]]-rich developing country where all the monetary growth (mapped by GDP, GNP per capita, and so forth) goes to a ruling clique and virtually nothing to the rest of the society. There, although the GDP per capita may increase, most of the society’s expectations and dreams of a better life are shattered and the coefficient of “well-being” (which is based on “feeling good”) may actually decrease. | |

| − | + | '''Example 2:''' In [[Eastern Europe]] under the [[Communism|Communist]] regimes everybody, with the exception of a few elites, was equally [[poverty|poor]] (no matter what job they did), yet the [[mood]], and to large extent even their expression of being content with the situation, and [[morality]] (though not necessarily [[ethics]]) were quite high. However, once the “democratic” turnaround, propelled by the old Communist constitution, gave rise to the new class of ''nouveau riche'' (namely old Communist apparatchiks who acquired state property because there was nothing in the constitution to prevent them) the rest of society, still as poor as before, experienced a drastic downturn of “mood” and thus, sense of “well-being,” even though the GDP and such measures kept rising. This can be explained by the fact that the income distribution (mapped by the [[Gini Index]]) showed incredibly high [[social stratification]] which, in Europe, historically has led to the society's doldrums (Karasek 2005). | |

| − | |||

| − | : | + | Nevertheless, even in the strictly economic sphere, these measures of national income and output can serve their purpose—comparing economic trends within its own country’s history, or with other countries’ trends; provide short-term forecasting, and so forth—only under specific conditions. These conditions require the following: |

| − | + | *The definition of each of the statistical characteristics (measures) must be kept constant over a long period of time (ideally not changed at all throughout the society’s history). With regards to comparison with other countries, the problem of considerably different basic definitions, due to political or other “societal” considerations, should be looked for, Thus, for example: | |

| − | + | <blockquote>Using Marxist principles, those countries sometimes exclude from aggregate output the value of a wide range of services, such as government administration and transportation. Attention is instead concentrated on output of goods. The exclusion understates GNP and influences planning, which tend to neglect transport, distribution and services. Aggregate growth rates are overstated since productivity increases more rapidly in the (counter) goods-producing sectors than in neglected service sectors (Herrick and Kindleberger 1983).</blockquote> | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | + | *In analysis of historical trends, comparisons with other countrys' trends and, above all, modeling and forecasts, work only with constant data series. This means that [[inflation]] or [[deflation]] must be left out of all the data-series (Karasek 1988: 36, 73-74, 82). | |

| − | + | *Still a significant problem remains with regard to the question of comparison of the [[standard of living|standards of living]] among several countries. Even though we have characteristics, such as Personal Disposable Income (PDI) computed for an individual country’s [[currency]], the official [[exchange rate]]s are not a sufficient equalizer. We have to go through the “typical consumers’ baskets” of the needs of an individual (or a household) that have to be bought in a certain period (week or month). These “baskets” represent the [[cost of living]] and have to be compared with personal (or household) income for the same period. Then and only then we can have a more precise international comparison of living standards for the given countries. | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | + | *When using various quantitative data-series (monetary, physical, and so forth) for statistical “massaging” and modeling, the “technique of transformation of absolute values into growth rates” has proved to yield the best and most statistically credible result (Karasek 1988: 33, 73-75). | |

| + | To conclude the almost impossible task of international comparisons of income and output statistics, the warning of [[Oskar Morgenstern]] must also be heeded: | ||

| + | :10 to 30 percent error can be expected in any real numerical (economic) datum (Morgenstern 1963: Ch. 6, fn. 14). | ||

==References== | ==References== | ||

| − | + | *Cobb, Clifford, Ted Halstead, and Jonathan Rowe. 1995. If the GDP is up, why is America down? ''The Atlantic Monthly''. 276(4): 59-78. | |

| − | + | *Herrick, Bruce, and Charles P. Kindleberger. 1983. ''Economic Development''. McGraw-Hill Book Co. ISBN 0070345848. | |

| + | *Karasek, Mirek. 2005. Institutional and Political Challenges and Opportunities for Integration in Central Asia. ''CAG Portal Forum 2005''. | ||

| + | *Karasek, Mirek, Waddah K. Alem, and Wasfy B. Iskander. 1988. ''Socio-Economic Modelling & Forecasting in Lesser Developed Countries''. London: The Book Guild Ltd. ISBN 0863322204. | ||

| + | *Kuznets, Simon. 1934. [http://library.bea.gov/u?/SOD,888 National Income, 1929-1932]. 73rd US Congress, 2d session. Senate document no. 124, 7. Retrieved December 10, 2008. | ||

| + | *Kuznets, Simon. 1948. Discussion of the new Department of Commerce Income Series; National Income: A new version. ''The Review of Economics and Statistics''. XXX(3): 151-179. | ||

| + | *Kuznets, Simon. 1956. Quantitative Aspects of the Economic Growth of Nations. I. Levels and Variability of Rates of Growth. ''Economic Development and Cultural Change''. 5: 1-94. | ||

| + | *Kuznets, Simon. 1962. How To Judge Quality. ''The New Republic''. | ||

| + | *Kuznets, Simon. 1966. ''Modern Economic Growth Rate Structure and Spread''. New Haven, CT: Yale University Press. | ||

| + | *Kuznets, Simon. 1971. ''Economic Growth of Nations: Total Output and Production Structure''. Cambridge, MA: Harvard University Press. ISBN 0674227808. | ||

| + | *Mings, Turley, and Matthew Marlin. 2000. ''The Study of Economics: Principles, Concepts, and Applications,'' 6th ed. Dushkin/McGraw-Hill. ISBN 0073662445. | ||

| + | *Morgenstern, O. 1963. ''On the Accuracy of Economic Observations''. Princeton, NJ: Princeton University Press. ISBN 0691003513. | ||

| + | *Shostak, Frank. 2001. [http://mises.org/story/770 What is up with the GDP?] ''Von Mises Institute Papers''. Retrieved December 10, 2008. | ||

==External links== | ==External links== | ||

| − | + | All links retrieved November 8, 2022. | |

| − | + | *[http://www.abs.gov.au/Ausstats/abs@.nsf/66f306f503e529a5ca25697e0017661f/3f880ee1d366198cca2569a400061616!OpenDocument Australian Bureau of Statistics Manual on GDP measurement] | |

| − | + | *[http://www.bea.gov/national/index.htm#gdp Bureau of Economic Analysis: Official United States GDP data] | |

| − | + | *[http://pages.stern.nyu.edu/~nroubini/MEASURE.HTM Output and Inflation: Are We Mismeasuring Them? The "CPI Inflation" and "Chain-Weight GDP" Debates] | |

| − | + | *[http://www.historicalstatistics.org Portal for historical statistics] | |

| − | * [http://www.abs.gov.au/Ausstats/abs@.nsf/66f306f503e529a5ca25697e0017661f/3f880ee1d366198cca2569a400061616!OpenDocument Australian Bureau of Statistics Manual on GDP measurement | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | * [http://www.bea.gov/national/index.htm#gdp Bureau of Economic Analysis: Official United States GDP data | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | * [http://pages.stern.nyu.edu/~nroubini/MEASURE.HTM | ||

| − | |||

| − | * [http://www. | ||

| − | |||

| − | |||

| − | {{Credits|Measures_of_national_income_and_output|247994787|Gross_domestic_product|254076562|}} | + | {{Credits|Measures_of_national_income_and_output|247994787|Gross_domestic_product|254076562|Gross_National_Income|223775128|Net_National_Product|250829455|Net_National_Income|195911191|Net_domestic_product|249991445|National_accounts|253906318}} |

Latest revision as of 19:46, 7 July 2023

Measures of national income and output are used in economics to measure a nation's economic activity by totaling the value of goods and services produced in its economy. Simon Kuznets developed the system of national accounting in the 1940s and 1960s. Some of the more common measures are Gross National Product (GNP), Gross National Income (GNI), Gross Domestic Product (GDP), Net National Product (NNP), and Net National Income (NNI).

These measurements are not easy to calculate accurately, for various reasons. Comparisons between different countries, where the measures may have been based on different calculations, may be misleading. Nevertheless, these measures are a valuable tool in assessing a country's economic health in relation to its history, and may provide comparisons of economies in different countries with the caveat that the methods of calculating them must be as similar as possible.

Attempts have been made to use these measures to assess the standard of living and the welfare (or quality of life) of the members of different societies. This effort has serious problems, as was noted by Kuznets. Although the standard of living can be viewed as a purely economic measure, since a nation's production may provide great or little economic benefit to its population, these measures are not closely correlated enough to allow them to be used interchangeably. The prosperity of the society as a whole does not necessarily translate into prosperity of the individuals within that society, even on a simple economic basis. The quality of life of individuals is not a purely economic matter, but has significant psychological and sociological components. Thus, to view the greater economic production of a nation as leading to greater well-being of its citizens is an inadequate assumption. Human beings need more than material wealth in order to experience happiness.

Overview

The original motivation for the development of national accounts and the systematic measurement of employment was the need for accurate measures of aggregate economic activity. This was made more pressing by the Great Depression and as a basis for Keynesian macroeconomic stabilization policy and wartime economic planning. The first efforts to develop such measures were undertaken in the late 1920s and 1930s, notably by Colin Clark. Simon Kuznets developed the first usable models in the 1940s. Richard Stone led later contributions.

International rules for national accounting are defined by the United Nations System of National Accounts. In Europe, the worldwide System of National Accounts has been transposed into a European System of Accounts (ESA), which is applied by members of the European Union and many other European countries.

National account systems provide a complete and consistent conceptual framework for measuring the economic activity of a nation using detailed underlying measures that rely on double-entry accounting. Such accounting makes the totals on both sides of an account equal even though they each measure different characteristics.

There are several different ways of calculating measures of national income and output.

- The expenditure approach determines Gross National Expenditure (GNE) by summing consumption, investment, government expenditure, and net exports.

- On the other hand, the income approach, yielding Gross National Income (GNI), and the closely related output approach, yielding Gross National Product (GNP), can been seen as the summation of consumption, savings, and taxation.

The three methods must yield the same results because the total expenditures on goods and services (GNE) must by definition be equal to the value of the goods and services produced (GNP) which must be equal to the total income paid to the factors that produced these goods and services (GNI).

Thus, GNP = GNI = GNE by definition.

However, in practice minor differences are obtained from the various methods due to changes in inventory levels. This is because goods in inventory have been produced (therefore included in GNP), but not yet sold (therefore not yet included in GNE). Similar timing issues can also cause a slight discrepancy between the value of goods produced (GNP) and the payments to the factors that produced the goods, particularly if inputs are purchased on credit, and also because wages are often collected after a period of production.

In the following calculations, "Gross" means that depreciation of capital stock is not subtracted from the total value. If net investment (which is gross investment minus depreciation) is substituted for gross investment in the equation, then the formula for net domestic product is obtained. Consumption and investment in this equation are expenditure on final goods and services. The exports-minus-imports part of the equation (often called "net exports") adjusts this by subtracting the part of this expenditure not produced domestically (the imports), and adding back in domestic area (the exports).

Gross National Product

Gross National Product (GNP) is the total value of final goods and services produced in a year by domestically owned factors of production. Final goods are goods that are ultimately consumed rather than used in the production of another good.

Example: A car sold to a consumer is a final good; the components such as tires sold to the car manufacturer are not; they are intermediate goods used to make the final good. The same tires, if sold to a consumer, would be a final good. Only final goods are included when measuring national income. If intermediate goods were included too, this would lead to double counting; for example, the value of the tires would be counted once when they are sold to the car manufacturer, and again when the car is sold to the consumer.

NOTE: Only newly produced goods are counted. Transactions in existing goods, such as second-hand cars, are not included, as these do not involve the production of new goods.

Income is counted as part of GNP according to who owns the factors of production rather than where the production takes place.

Example: In the case of a German-owned car factory operating in the U.S., the profits from the factory would be counted as part of German GNP rather than U.S. GNP because the capital used in production (the factory, machinery, and so on) is German owned. The wages of the American workers would be part of U.S. GNP, while wages of any German workers on the site would be part of German GNP.

Real and nominal values

Nominal GNP measures the value of output during a given year using the prices prevailing during that year. Over time, the general level of prices rise due to inflation, leading to an increase in nominal GNP even if the volume of goods and services produced is unchanged.

Real GNP measures the value of output in two or more different years by valuing the goods and services produced at the same prices. For example, GNP might be calculated for 2000, 2001, and 2002 using the prices prevailing in 2002 for all of the calculations. This gives a measure of national income which is not distorted by inflation.

Depreciation and Net National Product

Not all GNP data show the production of final goods and services—part represents output that is set aside to maintain the nation's productive capacity. Capital goods, such as buildings and machinery, lose value over time due to wear and tear and obsolescence.

Depreciation (also known as consumption of fixed capital) measures the amount of GNP that must be spent on new capital goods to maintain the existing physical capital stock.

NOTE: Depreciation measures the amount of GNP that must be spent on new capital goods to offset this effect.

Net National Product (NNP) is the total market value of all final goods and services produced by citizens of an economy during a given period of time (Gross National Product or GNP) minus depreciation. Net National Product can be similarly applied at a country's domestic output level.

NNP is the amount of goods in a given year which can be consumed without reducing the amount which can be consumed in the future. Setting part of NNP aside for investment permits the growth of the capital stock and the consumption of more goods in the future.

NNP can also be expressed as total compensation of employees + net indirect tax paid on current production + operating surplus.

Hence, through the income approach one defines:

- Net National Product (NNP) is GNP minus depreciation

- Net National Income (NNI) is NNP minus indirect taxes

- Personal Income (PI) is NNI minus retained earnings, corporate taxes, transfer payments, and interest on the public debt

- Personal Disposable Income (PDI) is PI minus personal taxes, plus transfer payments

Then, in summary, one has:

- Personal savings (S) plus personal consumption (C) = personal disposable income (PDI)

- PDI plus personal taxes paid minus transfer payments received = personal income (PI)

- PI plus retained earnings plus corporate taxes plus transfer payments plus interest on the public debt = net national income (NNI)

- NNI plus indirect taxes = net national product (NNP)

- NNP plus depreciation = gross national product (GNP)

Gross Domestic Product

Gross Domestic Product (GDP) is the total value of final goods and services produced within a country's borders in a year. GDP counts income according to where it is earned rather than who owns the factors of production.

Example: In the above case of a German-owned car factory operating in the U.S., all of the income from the car factory would be counted as U.S. GDP rather than German GDP.

Measuring GDP

There are two ways to measure GDP. The most common approach to measuring and understanding GDP is the expenditure method. The other is the income method.

- Expenditure method

Measured according to the expenditure method, GDP is equal to consumption + investment + government expenditures + exports - imports, which can be written as

- GDP = C + I + G + NX

where:

- C = Consumption

- I = Investments

- G = Government spending

- NX = net exports (exports minus imports)

Example 1: If an individual spends money to renovate their hotel so that occupancy rates increase, that is private investment, but if they buy shares in a consortium to do the same thing it is saving. The former is included when measuring GDP (in I), the latter is not. However, when the consortium conducts the renovation the expenditure involved would be included in GDP.

Example 2: If a hotel is a private home then renovation spending would be measured as Consumption, but if a government agency is converting the hotel into an office for civil servants the renovation spending would be measured as part of public sector spending (G).

Example 3: If the renovation involves the purchase of a chandelier from abroad, that spending would also be counted as an increase in imports, so that NX would fall and the total GDP is affected by the purchase. (This highlights the fact that GDP is intended to measure domestic production rather than total consumption or spending. Spending is really a convenient means of estimating production.)

Example 4: If a domestic producer is paid to make the chandelier for a foreign hotel, the situation would be reversed, and the payment would be counted in NX (positively, as an export). Again, GDP is attempting to measure production through the means of expenditure; if the chandelier produced had been bought domestically it would have been included in the GDP figures (in C or I) when purchased by a consumer or a business, but because it was exported it is necessary to "correct" the amount consumed domestically to give the amount produced domestically.

- Income method

The income approach focuses on finding the total output of a nation by finding the total income of a nation. This is acceptable, because all money spent on the production of a good—the total value of the good—is paid to workers as income.

The main types of income that are included in this measurement are rent (the money paid to owners of land), salaries and wages (the money paid to workers who are involved in the production process, and those who provide the natural resources), interest (the money paid for the use of man-made resources, such as machines used in production), and profit (the money gained by the entrepreneur—the businessman who combines these resources to produce a good or service).

In this income approach, GDP(I) is equal to Net Domestic Income (NDI at factor cost) + indirect taxes + depreciation – subsidy, where Net Domestic Income (NDI) is the sum of returns of factors of production in the society. Thus,

- Net Domestic Income (NDI) = compensation of employees + net interest (credit – debit) + corporate profits (distributed + undistributed) + proprietor’s income (self-employed + small business) + rental income.

The difference between basic prices and final prices (those used in the expenditure calculation) is the total taxes and subsidies that the government has levied or paid on that production. So adding taxes less subsidies on production and imports converts GDP at factor cost to GDP(I) in the above equation.

In calculating GDP, just as with GNP, only the price of final goods are included, not the prices of intermediate goods used in production of final goods.

Example: The intermediate goods' selling prices for a textbook (sold in a bookstore) are as follows: A tree company sells wood to a paper mill for $1; the paper mill sells paper to a textbook publisher for $3; the publisher sells the book to a bookstore for $7, and the bookstore sells the textbook for $75. Although the sum of all intermediate prices plus the selling price of the book comes to $86, we add to GDP only the final selling price $75. The price of the "tree," "paper," and "book" is included in the final selling price of the textbook by the bookstore. To include these amounts in GDP calculation would be to "double count."

Net Domestic Product

Net Domestic Product (NDP) is the equivalent application of NNP. Thus, NDP is equal to Gross Domestic Product (GDP) minus depreciation: Net domestic product (NDP) equals the gross domestic product (GDP) minus depreciation on a country's capital goods.

- NDP = GDP – Depreciation

NDP is an estimate of how much the country has to spend to maintain the current GDP. If the country is not able to replace the capital stock lost through depreciation, then GDP will fall. In addition, a growing gap between GDP and NDP indicates increasing obsolescence of capital goods, while a narrowing gap would mean that the condition of capital stock in the country is improving.

Gross National Income

Gross national income (GNI) is GDP less net taxes on production and imports, less compensation of employees and property income payable to the rest of the world plus the corresponding items receivable from the rest of the world. It includes wages, rents, interest, and profits, not only in the form of cash payments, but as income from contributions made by employers to pension funds, income of the self-employed, and undistributed business profits.

In other words, Gross national income (GNI) is GDP less primary incomes payable to non-resident units plus primary incomes receivable from non-resident units. From this point of view, GNP is the better indicator of a country’s economic trend.

However, calculating the real GDP growth allows economists to determine if production increased or decreased, regardless of changes in the purchasing power of the currency.

An alternative approach to measuring GNI at market prices is as the aggregate value of the balances of gross primary incomes for all sectors.

NOTE: GNI is identical to gross national product (GNP) as, generally, used previously in national accounts and we may formulate basic principle of fundamental national accounting:

- The value of total output equals the value of total income

This makes another very important point:

Real income cannot be increased without producing more, redistributing income does nothing to increase the amount of wealth available at any point in time (Mings and Marlin 2000).

Net National Income

Net National Income (NNI) can be defined as the Net National Product (NNP) minus indirect taxes. Net National Income encompasses the income of households, businesses, and the government. It can be expressed as:

- NNI = C + I + G + (NX) + net foreign factor income - indirect taxes - depreciation

Where again:

- C = Consumption

- I = Investments

- G = Government spending

- NX = net exports (exports minus imports)

GDP vs. GNP

To convert from GDP to GNP you must add factor input payments to foreigners that correspond to goods and services produced in the domestic country using the factor inputs supplied by foreigners.

To convert from GNP to GDP one must subtract factor income receipts from foreigners that correspond to goods and services produced abroad using factor inputs supplied by domestic sources.

NOTE: GDP is a better measure of the state of production in the short term. GNP is a better when analyzing sources and uses of income on a longer term basis.

Relationship to welfare

These measures of national economic activity have often been used as indicators of the welfare or quality of life of citizens in different countries.

GNP

GNP per person is often used as a measure of people's welfare. Countries with higher GNP often score highly on other measures of welfare, such as life expectancy. However, there are serious limitations to the usefulness of GNP as such a measure:

- Measures of GNP typically exclude unpaid economic activity, most importantly domestic work such as childcare. This can lead to distortions; for example, a paid childminder's income will contribute to GNP, whereas an unpaid mother's time spent caring for her children will not, even though they are both carrying out the same activity.

- GNP takes no account of the inputs used to produce the output. For example, if everyone worked for twice the number of hours, then GNP might roughly double, but this does not necessarily mean that workers are better off as they would have less leisure time. Similarly, the impact of economic activity on the environment is not directly taken into account in calculating GNP.

- Comparison of GNP from one country to another may be distorted by movements in exchange rates. Measuring national income at purchasing power parity (PPP) can help to overcome this problem. The PPP theory uses the long-term equilibrium exchange rate of two currencies to equalize their purchasing power. Developed by Gustav Cassel in 1920, it is based on the law of one price which states that, in an ideally efficient market, identical goods should have only one price.

GDP

Simon Kuznets, the inventor of the GDP, had this to say in his very first report to the U.S. Congress in 1934:

…the welfare of a nation [can] scarcely be inferred from a measure of national income… (Kuznets 1934).

In 1962, Kuznets stated:

Distinctions must be kept in mind between quantity and quality of growth, between costs and returns, and between the short and long run. Goals for more growth should specify more growth of what and for what (Kuznets 1962).

Kuznets’ own uncertainty about GDP being a good measure of national welfare is well founded.The standard of living is a measure of economic welfare. It generally refers to the availability of scarce goods and services, usually measured by per capita income or per capita consumption, calculated in constant dollars, to satisfy wants rather than needs.

Because the well-being that living standards are supposed to measure is an individual matter, per capita availability of goods and services in a country is a measure of general welfare only if the goods and services are distributed fairly evenly among people. Besides, just as Kuznets hinted, improvement in standard of living can result from improvements in economic factors such as productivity or per capita real economic growth, income distribution and availability of public services, and non-economic factors, such as protection against unsafe working conditions, clean environment, low crime rate, and so forth.

- Disadvantage

The major disadvantage of using GDP as an indicator of standard of living is that it is not, strictly speaking, a measure of standard of living, which can be generally defined as "the quality and quantity of goods and services available to people, and the way these goods and services are distributed within a population."

GDP does not distinguish between consumer and capital goods; it does not take income distribution into account; it does not take account of differences in the economic goods and services that are not measured in GDP at all; it is subject to the vagaries of translating income measures into a common currency and it fails to take into account differences of tastes among nations.

- Advantage

All these items notwithstanding, GDP per capita is often used as an indicator of standard of living in an economy, the rationale being that all citizens benefit from their country's increased economic production.

The major advantages to using GDP per capita as an indicator of standard of living are that it is measured frequently, widely, and consistently; frequently in that most countries provide information on GDP on a quarterly basis (which allows trends to be spotted quickly), widely in that some measure of GDP is available for practically every country in the world (allowing crude comparisons between the standard of living in different countries), and consistently in that the technical definitions used within GDP are relatively consistent between countries (so there can be confidence that the same thing is being measured in each country).

Critique by Austrian economists

Austrian economists are critical of the basic idea of attempting to quantify national output. Frank Shostak (2001) quotes Austrian economist Ludwig von Mises:

The attempt to determine in money the wealth of a nation or the whole mankind are as childish as the mystic efforts to solve the riddles of the universe by worrying about the dimension of the pyramid of Cheops.

Shostak elaborated in his own criticism:

The GDP framework cannot tell us whether final goods and services that were produced during a particular period of time are a reflection of real wealth expansion, or a reflection of capital consumption. … For instance, if a government embarks on the building of a pyramid, which adds absolutely nothing to the well-being of individuals, the GDP framework will regard this as economic growth. In reality, however, the building of the pyramid will divert real funding from wealth-generating activities, thereby stifling the production of wealth (Shostak 2001).

Conclusion

Various national accounting formulas for GDP, GNP, and GNI may now be summarized here:

- GDP = C + I + G + (X - M)

- GNP = C + I + G + (X - M) + NR

- GNI = C + I + G + (X - M) + NR - CC – IBT.

where C = Personal consumption expenditures;

- I = Gross private domestic investment;

- G = Government consumption expenditures;

- X = Net exports of goods and services;

- M = Net imports of goods and services;

- NR = Net income from assets abroad;

- CC = Consumption of fixed capital;

- IBT = Indirect business taxes

These measures are valuable tools in assessing the state of a nation's economy. However, using these strictly economic statistics (GNP, GDP) as attempts to capture the standard of living trends and their mapping in any particular country, has serious problems. Even more problematic is their use in assessing quality of life or "well-being" of the citizens, which is far from a purely economic measure.

There are two reasons why these economic statistics tell little or nothing about the well-being of the society, even if taken on a per capita basis. True, we can infer that if GDP (or GNP) per capita series in constant dollars grows within the short period of years, the standard of living may increase as well; but that is all we can say. As the Austrian economist Frank Shostak stated, as noted above, if any government starts building pyramids, GDP will be growing, yet—as the pyramids have no use for anybody—the standard of living will not (Shostak 2001).

The other reason is that we cannot compare or statistically infer anything regarding two or more environments that are independent from each other. In this case, on the one hand is the economy, and on the other is sociology combined with psychology. While there are factors that affect both, there is not a correlation, let alone a causal relationship, between them. For example, the distribution of income, not just the aggregate or per capita average, is important in determining the standard of living and sense of well-being of individuals within the country.

Example 1: Imagine an oil-rich developing country where all the monetary growth (mapped by GDP, GNP per capita, and so forth) goes to a ruling clique and virtually nothing to the rest of the society. There, although the GDP per capita may increase, most of the society’s expectations and dreams of a better life are shattered and the coefficient of “well-being” (which is based on “feeling good”) may actually decrease.

Example 2: In Eastern Europe under the Communist regimes everybody, with the exception of a few elites, was equally poor (no matter what job they did), yet the mood, and to large extent even their expression of being content with the situation, and morality (though not necessarily ethics) were quite high. However, once the “democratic” turnaround, propelled by the old Communist constitution, gave rise to the new class of nouveau riche (namely old Communist apparatchiks who acquired state property because there was nothing in the constitution to prevent them) the rest of society, still as poor as before, experienced a drastic downturn of “mood” and thus, sense of “well-being,” even though the GDP and such measures kept rising. This can be explained by the fact that the income distribution (mapped by the Gini Index) showed incredibly high social stratification which, in Europe, historically has led to the society's doldrums (Karasek 2005).

Nevertheless, even in the strictly economic sphere, these measures of national income and output can serve their purpose—comparing economic trends within its own country’s history, or with other countries’ trends; provide short-term forecasting, and so forth—only under specific conditions. These conditions require the following:

- The definition of each of the statistical characteristics (measures) must be kept constant over a long period of time (ideally not changed at all throughout the society’s history). With regards to comparison with other countries, the problem of considerably different basic definitions, due to political or other “societal” considerations, should be looked for, Thus, for example:

Using Marxist principles, those countries sometimes exclude from aggregate output the value of a wide range of services, such as government administration and transportation. Attention is instead concentrated on output of goods. The exclusion understates GNP and influences planning, which tend to neglect transport, distribution and services. Aggregate growth rates are overstated since productivity increases more rapidly in the (counter) goods-producing sectors than in neglected service sectors (Herrick and Kindleberger 1983).

- In analysis of historical trends, comparisons with other countrys' trends and, above all, modeling and forecasts, work only with constant data series. This means that inflation or deflation must be left out of all the data-series (Karasek 1988: 36, 73-74, 82).

- Still a significant problem remains with regard to the question of comparison of the standards of living among several countries. Even though we have characteristics, such as Personal Disposable Income (PDI) computed for an individual country’s currency, the official exchange rates are not a sufficient equalizer. We have to go through the “typical consumers’ baskets” of the needs of an individual (or a household) that have to be bought in a certain period (week or month). These “baskets” represent the cost of living and have to be compared with personal (or household) income for the same period. Then and only then we can have a more precise international comparison of living standards for the given countries.

- When using various quantitative data-series (monetary, physical, and so forth) for statistical “massaging” and modeling, the “technique of transformation of absolute values into growth rates” has proved to yield the best and most statistically credible result (Karasek 1988: 33, 73-75).

To conclude the almost impossible task of international comparisons of income and output statistics, the warning of Oskar Morgenstern must also be heeded:

- 10 to 30 percent error can be expected in any real numerical (economic) datum (Morgenstern 1963: Ch. 6, fn. 14).

ReferencesISBN links support NWE through referral fees

- Cobb, Clifford, Ted Halstead, and Jonathan Rowe. 1995. If the GDP is up, why is America down? The Atlantic Monthly. 276(4): 59-78.

- Herrick, Bruce, and Charles P. Kindleberger. 1983. Economic Development. McGraw-Hill Book Co. ISBN 0070345848.

- Karasek, Mirek. 2005. Institutional and Political Challenges and Opportunities for Integration in Central Asia. CAG Portal Forum 2005.

- Karasek, Mirek, Waddah K. Alem, and Wasfy B. Iskander. 1988. Socio-Economic Modelling & Forecasting in Lesser Developed Countries. London: The Book Guild Ltd. ISBN 0863322204.

- Kuznets, Simon. 1934. National Income, 1929-1932. 73rd US Congress, 2d session. Senate document no. 124, 7. Retrieved December 10, 2008.

- Kuznets, Simon. 1948. Discussion of the new Department of Commerce Income Series; National Income: A new version. The Review of Economics and Statistics. XXX(3): 151-179.

- Kuznets, Simon. 1956. Quantitative Aspects of the Economic Growth of Nations. I. Levels and Variability of Rates of Growth. Economic Development and Cultural Change. 5: 1-94.

- Kuznets, Simon. 1962. How To Judge Quality. The New Republic.

- Kuznets, Simon. 1966. Modern Economic Growth Rate Structure and Spread. New Haven, CT: Yale University Press.

- Kuznets, Simon. 1971. Economic Growth of Nations: Total Output and Production Structure. Cambridge, MA: Harvard University Press. ISBN 0674227808.

- Mings, Turley, and Matthew Marlin. 2000. The Study of Economics: Principles, Concepts, and Applications, 6th ed. Dushkin/McGraw-Hill. ISBN 0073662445.

- Morgenstern, O. 1963. On the Accuracy of Economic Observations. Princeton, NJ: Princeton University Press. ISBN 0691003513.

- Shostak, Frank. 2001. What is up with the GDP? Von Mises Institute Papers. Retrieved December 10, 2008.

External links

All links retrieved November 8, 2022.

- Australian Bureau of Statistics Manual on GDP measurement

- Bureau of Economic Analysis: Official United States GDP data

- Output and Inflation: Are We Mismeasuring Them? The "CPI Inflation" and "Chain-Weight GDP" Debates

- Portal for historical statistics

Credits

New World Encyclopedia writers and editors rewrote and completed the Wikipedia article in accordance with New World Encyclopedia standards. This article abides by terms of the Creative Commons CC-by-sa 3.0 License (CC-by-sa), which may be used and disseminated with proper attribution. Credit is due under the terms of this license that can reference both the New World Encyclopedia contributors and the selfless volunteer contributors of the Wikimedia Foundation. To cite this article click here for a list of acceptable citing formats.The history of earlier contributions by wikipedians is accessible to researchers here:

- Measures_of_national_income_and_output history

- Gross_domestic_product history

- Gross_National_Income history

- Net_National_Product history

- Net_National_Income history

- Net_domestic_product history

- National_accounts history

The history of this article since it was imported to New World Encyclopedia:

Note: Some restrictions may apply to use of individual images which are separately licensed.