Fraud

In law, fraud is intentional deception to secure unfair or unlawful gain, or to deprive a victim of a legal right. Fraud can violate civil law, in which case a fraud victim may sue the fraud perpetrator to avoid the fraud or recover monetary compensation, or criminal law for which a fraud perpetrator may be prosecuted and imprisoned by governmental authorities. It may cause no loss of money, property, or legal right but still be an element of another civil or criminal wrong.

The purpose of fraud may be monetary gain or other benefits. Fraud is thus distinguished from a hoax, which involves deliberate deception without the intention of gain or of materially damaging or depriving a victim. The seriousness of fraud, beyond the financial cost, is violation of trust. When human beings lose trust in each other, the smooth functioning of an organization or even society as a whole is threatened.

Definitions

Fraud is any activity that relies on deception in order to achieve a gain by depriving a person or organization of money or property. It consists of:

all multifarious means which human ingenuity can devise, and which are resorted to by one individual to get an advantage over another by false suggestions or suppression of the truth. It includes all surprises, tricks, cunning or dissembling, and any unfair way which another is cheated.[1]

Fraud can be defined as "the intentional use of deceit, a trick or some dishonest means to deprive another of his/her/its money, property or a legal right."[2]

Donald Ray Cressey, the criminologist whose research on embezzlers produced the term ‚Äútrust violators,‚ÄĚ defined fraud as a "violation of a position of financial trust."[3]

Fraud becomes a crime when it is a “knowing misrepresentation of the truth or concealment of a material fact to induce another to act to his or her detriment.[4] Thus, fraud can violate civil law, for example a fraud victim may sue the fraud perpetrator to avoid the fraud or recover monetary compensation), or criminal law such that a fraud perpetrator may be prosecuted and imprisoned by governmental authorities, or it may cause no loss of money, property, or legal right but still be an element of another civil or criminal wrong.

Types of fraudulent acts

The purpose of fraud is to gain monetary or other benefits. It is not a new phenomenon, being recorded as prevalent in late Ming China.[5] However, the types and methods of fraudulent activities have changed along with technological advancements. Contemporary examples of fraud include obtaining a passport, travel document, or driver's license, or mortgage fraud, where the perpetrator may attempt to qualify for a mortgage by way of false statements.

Fraud can be committed through many media including mail, wire, phone, and the Internet (computer crime and Internet fraud). Given the international nature of the web and ease with which users can hide their location, obstacles to checking identity and legitimacy online, and the variety of hacker techniques available to gain access to PII have all contributed to the very rapid growth of Internet fraud.[6]

Falsification of documents

The falsification of documents, known as forgery, and counterfeiting are types of fraud involved in physical duplication or fabrication.

Forgery is a white-collar crime that generally refers to the false making or material alteration of a legal instrument with the specific intent to defraud. Tampering with a certain legal instrument may be forbidden by law in some jurisdictions but such an offense is not related to forgery unless the tampered legal instrument was actually used in the course of the crime to defraud another person or entity. Copies, studio replicas, and reproductions are not considered forgeries, though they may later become forgeries through knowing and willful misrepresentations.

Forging money or currency is more often called counterfeiting. But consumer goods may also be counterfeits if they are not manufactured or produced by the designated manufacturer or producer given on the label or flagged by the trademark symbol. When the object forged is a record or document it is often called a false document.

Identity theft

The "theft" of one's personal information or identity, like one finding out another's social security number and then using it as identification, is a type of fraud. Identity theft involves obtaining somebody else's identifying information and using it for a criminal purpose.[7] Most often that purpose is to commit financial fraud, such as by obtaining loans or credits in the name of the person whose identity has been stolen.[8] Stolen identifying information might also be used for other reasons, such as to obtain identification cards or for purposes of employment by somebody not legally authorized to work in the United States.[9]

There have also been fraudulent "discoveries" in science, where the purpose is prestige rather than immediate monetary gain.[10]

Internal fraud

Internal fraud, also known as "insider fraud," is fraud committed or attempted by someone within an organization such as an employee. This type of fraud comes from a current or former employee, contractor, or business partner who carries out a fraudulent scheme that takes advantage of the data or processes they have access to in the context of their job. These insiders often have unique opportunities in the form of access to valuable data or they may perform tasks like processing payments.[11]

Commodities fraud

Securities and commodities fraud refer to the illegal act of obtaining (or the attempt of obtaining) a certain amount of currency in accordance with a contract that promises the later exchange of equated assets, which ultimately never arrive:

Securities fraud is any occurrence of an intentionally false, misleading, or fraudulent statement about the stock of a company or its value. Based on that information, another person would make a decision about trading securities or commodities. Commodities fraud is defined as the sale or purported sale of a commodity through illegal means. This may or may not involve securities fraud.[12]

As a civil wrong

In common law jurisdictions, as a civil wrong, fraud is a tort. While the precise definitions and requirements of proof vary among jurisdictions, the requisite elements of fraud as a tort are generally the intentional misrepresentation or concealment of an important fact upon which the victim is meant to rely, and in fact does rely, to the harm of the victim. For example, in California: The elements of fraud that will give rise to a tort action for deceit are:

(a) misrepresentation (false representation, concealment, or nondisclosure); (b) knowledge of falsity (or ‚Äėscienter‚Äô); (c) intent to defraud, i.e., to induce reliance; (d) justifiable reliance; and (e) resulting damage.[13]

Proving fraud in a California court of law requires the following elements:

(1) a knowingly false representation by the defendant; (2) an intent to deceive or induce reliance; (3) justifiable reliance by the plaintiff; and (4) resulting damages.[13]

It is often difficult to prove fraud as the intention to defraud is the key element in question.[14] As such, proving fraud comes with a "greater evidentiary burden than other civil claims." This difficulty is exacerbated by the fact that some jurisdictions require the victim to prove fraud by clear and convincing evidence.[15]

Remedies for fraud include rescission (reversal) of a fraudulently obtained agreement or transaction, the recovery of a monetary award to compensate for the harm caused, punitive damages to punish or deter the misconduct, and possibly others.[16] In cases of a fraudulently induced contract, fraud may serve as a defense in a civil action for breach of contract.

As a criminal offense

In common law jurisdictions, as a criminal offense, fraud takes many different forms, some general (such as theft by false pretense) and some specific to particular categories of victims or misconduct (for example, bank fraud, insurance fraud, forgery). The elements of fraud as a crime similarly vary. The requisite elements of perhaps the most general form of criminal fraud, theft by false pretense, are the intentional deception of a victim by false representation or pretense with the intent of persuading the victim to part with property and with the victim parting with property in reliance on the representation or pretense and with the perpetrator intending to keep the property from the victim.

For example, the Criminal Code of Canada defines the crime of fraud as follows:

Fraud is the wrongful or criminal deception intended to result in financial or personal gain. The definition of Fraud is left ambiguous in order to capture the vast nature that these offences occur. There are many examples of Fraud, but most commonly seen are Telemarketing scams, online scams, Identity Theft and Business scams.[17]

Canadian Criminal Courts have determined that the offense of fraud consists of two distinct elements:

First, a prohibited act of deceit, falsehood or other fraudulent means. In the absence of these, the courts will look objectively for a "dishonest act". Secondly, the deprivation or loss must be caused by the prohibited act, and must relate to money, property or any valuable security or service. Thus, by this determination, one could potentially be charged with fraud for stealing money from clients, or by stealing someone's identity.[17]

Reasons for committing fraud

Fraud is an act committed by people in a position of trust. Trust is the willingness of one party (the trustor) to become vulnerable to another party (the trustee) on the presumption that the trustee will act in ways that benefit the trustor. To be trusted, generally speaking people have previously shown that they are honest, with a moral compass that guides them to act in ways worthy of that trust. Of course, there are those "con artists" who practice confidence tricks, deliberating gaining the trust and confidence of a victim in order to defraud them. However, the question here is, why do people who formerly were trustworthy then violate that trust?

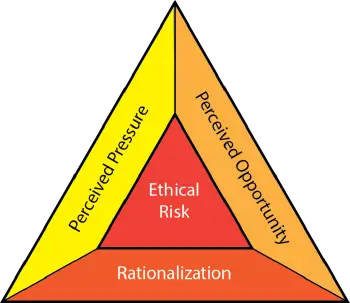

The answer involves three components. The "Fraud Triangle," or "Compromise Triangle," was first proposed in 1951 by Donald Cressey and Edwin Sutherland.[18] They posited that individuals are motivated to commit fraud based on three elements: some kind of perceived pressure, perceived opportunity, and a way to rationalize the fraud as not being inconsistent with one's values.[19] In other words, a person is highly likely to pursue fraudulent activities if these three components are all present: financial need, perceived opportunity, and rationalization.[20]

Cressey's research confirmed that:

Trusted persons become trust violators when they conceive of themselves as having a financial problem that is non-sharable, are aware that this problem can be secretly resolved by violation of the position of financial trust, and are able to apply to their contacts in that situation verbalizations which enable them to adjust their conceptions of themselves as users of the entrusted funds or property. (In other words, they're able to rationalize their dishonest actions, and so they aren't ‚ÄĒ in their minds ‚ÄĒ inconsistent with their personal codes of conduct.)[3]

Cost

In the UK, fraud has been estimated to cost around £200 billion per year, with the most common form being online fraud. In 2016 the overall cost of all forms of fraud was reported to be £10 billion to individuals and £144 billion to the private sector:

Fraud is now the most commonly experienced crime in England and Wales, is growing rapidly and demands an urgent response. Yet fraud is not a strategic priority for local police forces and the response from industry is uneven.[21]

Based on their study with data from 133 countries, the Association of Certified Fraud Examiners (ACFE) estimated that the typical organization loses five percent of its annual revenue to fraud, a total of $4.7 trillion lost to fraud globally. The median loss was $117,000 per case, with the average loss $1,783,000. Although Owners/executives committed only 23 percent of occupational frauds, they caused the largest losses.[22]

Beyond the financial cost of fraud, which is extremely high, is another cost: violation of trust. As Cressey found, fraud is carried out by trusted persons who become "trust violators" who rationalize their dishonest actions as justifiable given the circumstances.[3] However, violation of trust is a serious matter, and not one that can easily be remedied. Even if the money or property are returned, incalculable damage has been done to a personal relationship or to the violator's ability to perform their responsibilities to the organization.

Detection

Fraud represents a significant problem for governments and businesses and specialized analysis techniques for discovering fraud using them are required. The detection of fraudulent activities on a large scale is possible with the use of electronic data to reconstruct or detect financial fraud: the harvesting of massive amounts of financial data paired with predictive analytics or forensic analytics. Some of these methods include knowledge discovery in databases (KDD), data mining, machine learning, and statistics. They offer applicable and successful solutions in different areas of electronic fraud crimes.[23]

In general, the primary reason to use data analytics techniques is to tackle fraud since many internal control systems have serious weaknesses. For example, an approach employed by many law enforcement agencies to detect companies involved in potential cases of fraud consists in receiving circumstantial evidence or complaints from whistleblowers.[24]

Anti-fraud provisioning

Beyond laws that aim at prevention of fraud, there are also governmental and non-governmental organizations that aim to fight fraud.

In the United States, between 1911 and 1933 47 states adopted the so-called Blue Sky Laws status.[25] These laws were enacted and enforced at the state level and regulated the offering and sale of securities to protect the public from fraud. Though the specific provisions of these laws varied among states, they all required the registration of all securities offerings and sales, as well as of every U.S. stockbroker and brokerage firm.[26] However, these Blue Sky laws were generally found to be ineffective.

To increase public trust in the capital markets during the Great Depression that followed the Crash of 1929, President Franklin D. Roosevelt, established the U.S. Securities and Exchange Commission (SEC) as an independent, quasi-judicial regulatory agency. The SEC was created by the Securities Exchange Act of 1934 to regulate the stock market and prevent corporate abuses relating to the offering and sale of securities and corporate reporting. It was given the power to license and regulate stock exchanges, the companies whose securities traded on them, and the brokers and dealers who conducted the trading. Today, the SEC is responsible for enforcing major laws that govern the securities industry, including: the Securities Act of 1933, the Trust Indenture Act of 1939, the Investment Company Act of 1940, the Investment Advisers Act of 1940, the Sarbanes‚ÄďOxley Act of 2002, and the Credit Rating Agency Reform Act of 2006. [27]

In the UK, the Serious Fraud Office (SFO) is a non-ministerial government department that investigates and prosecutes serious or complex fraud and corruption in England, Wales and Northern Ireland, but not Scotland, the Isle of Man, or the Channel Islands. This department investigates suspected offenses which involve serious or complex fraud, bribery, or corruption. The SFO was created and given its powers under the Criminal Justice Act 1987 and was established in 1988. The SFO is unusual in the UK in that it both investigates and prosecutes cases, allowing lawyers and investigators to work together from the beginning.[28]

Also in the UK, there is Cifas, a not-for-profit fraud prevention membership organization for all sectors. Their database of instances of fraudulent conduct is the largest in the country and enables organizations to share and access fraud data.[29] Cifas is dedicated to the prevention of fraud, including internal fraud by staff, and the identification of financial and related crime.

Notes

- ‚ÜĎ G. Michael Lawrence and Joseph T. Wells, Basic Legal Concepts Journal of Accountancy, October 1, 2004. Retrieved February 1, 2023.

- ‚ÜĎ Gerald and Kathleen Hill, The People's Law Dictionary Retrieved February 1, 2023.

- ‚ÜĎ 3.0 3.1 3.2 Donald Ray Cressey, Other People's Money: Study in the Social Psychology of Embezzlement (Wadsworth Pub. Co, 1971, ISBN 978-0534001421).

- ‚ÜĎ Bryan A. Garner (ed.), Black‚Äôs Law Dictionary (Thomson Reuters, 2019, ISBN 1539229750).

- ‚ÜĎ Yingyu Zhang, The Book of Swindles (Columbia University Press, 2017 (original ca. 1617), ISBN 978-0231178631).

- ‚ÜĎ Jean-Loup Richet, How cybercriminal communities grow and change: An investigation of ad-fraud communities Technological Forecasting and Social Change 174 (January 2022):121282. Retrieved February 1, 2023.

- ‚ÜĎ Aaron Larson, What Is Identity Theft? Expert Law, April 11, 2018. Retrieved February 1, 2023.

- ‚ÜĎ Alison Grace Johansen, What is Loan Fraud and How Does it Occur? LifeLock, August 8, 2017. Retrieved February 1, 2023.

- ‚ÜĎ Joe Guzzardi, Identity theft an overlooked wrinkle of illegal immigration USA Today, July 3, 2017. Retrieved February 1, 2023.

- ‚ÜĎ M.J. M√ľller, B. Landsberg, and J. Ried, Fraud in science: a plea for a new culture in research European Journal of Clinical Nutrition 68(4) (2014):411‚Äď415. Retrieved February 1, 2023.

- ‚ÜĎ What is insider fraud? Financial IT, May 7, 2021. Retrieved February 1, 2023.

- ‚ÜĎ Commodities Fraud Lowther & Walker. Retrieved February 1, 2023.

- ‚ÜĎ 13.0 13.1 Intentional Misrepresentation Judicial Council of California Civil Jury Instructions (2022 edition) Retrieved February 2, 2023.

- ‚ÜĎ Peter J. Henning, The Difficulty of Proving Financial Crimes The New York Times, December 13, 2010. Retrieved February 2, 2023.

- ‚ÜĎ Louis C. Long, Robert W. Cameron, William B. Mallin, and Patrick R. Kingsley, Fraud Litigation in Pennsylvania National Business Institute, Inc, 1993. Retrieved February 2, 2023.

- ‚ÜĎ What is Rescission: Everything You Need to Know UpCounsel. Retrieved February 2, 2023.

- ‚ÜĎ 17.0 17.1 Section 380(1) Fraud Criminal Code of Canada. Retrieved February 2, 2023.

- ‚ÜĎ Donald Ray Cressey and Edwin Sutherland, "Why Do Trusted Persons Commit Fraud? A Social-Psychological Study of Defalcators," Journal of Accountancy (1951).

- ‚ÜĎ W. Steve Albrecht, Iconic Fraud Triangle endures Fraud Magazine, July/August 2014. Retrieved February 1, 2023.

- ‚ÜĎ Fraud 101: What Is Fraud? Association of Certified Fraud Examiners (ACFE). Retrieved February 1, 2023.

- ‚ÜĎ Online fraud costs public billions but is still not a police priority, says watchdog The Guardian, June 30, 2017. Retrieved February 2, 2023.

- ‚ÜĎ Occupational Fraud 2022: A Report to the Nations Association of Certified Fraud Examiners. Retrieved February 3, 2023.

- ‚ÜĎ Roman Chuprina, The In-depth 2020 Guide to E-commerce Fraud Detection Data Science Central, April 13, 2020. Retrieved February 2, 2023.

- ‚ÜĎ Rafael B. Velasco, Igor Carpanese, Ruben Interian, Oct√°vio C. G. Paulo Neto, and Celso C. Ribeiro, A decision support system for fraud detection in public procurement International Transactions in Operational Research 28(1) (January 2021): 27-47. Retrieved February 2, 2023.

- ‚ÜĎ Stephen M. Cutler, Remarks at the F. Hodge O'Neal Corporate and Securities Law Symposium February 21, 2003. Retrieved February 3, 2023.

- ‚ÜĎ Blue Sky Law SEC Law. Retrieved February 3, 2023.

- ‚ÜĎ Securities and Exchange Commission ("SEC") Investors Hub. Retrieved February 3, 2023.

- ‚ÜĎ About us Serious Fraud Office. Retrieved February 3, 2023.

- ‚ÜĎ What is Cifas? Cifas. Retrieved February 3, 2023.

ReferencesISBN links support NWE through referral fees

- Balleisen, Edward J. Fraud: An American History from Barnum to Madoff. Princeton University Press, 2018. ISBN 978-0691183077

- Cressey, Donald Ray. Other People's Money: Study in the Social Psychology of Embezzlement. Wadsworth Pub. Co, 1971., ISBN 978-0534001421

- Garner, Bryan A.(ed.). Black’s Law Dictionary. Thomson Reuters, 2019. ISBN 1539229750

- Green, Stuart P. Lying, Cheating, and Stealing: A Moral Theory of White Collar Crime. Oxford University Press, 2006. ISBN 978-0199268580

- Zhang, Yingyu. The Book of Swindles. Columbia University Press, 2017 (original ca. 1617). ISBN 978-0231178631

External links

All links retrieved April 11, 2024.

- What is Fraud? Association of Certified Fraud Examiners

- Fraud Section U.S. Department of Justice

- Serious Fraud Office UK

- Cifas The UK's Fraud Prevention Community

Credits

New World Encyclopedia writers and editors rewrote and completed the Wikipedia article in accordance with New World Encyclopedia standards. This article abides by terms of the Creative Commons CC-by-sa 3.0 License (CC-by-sa), which may be used and disseminated with proper attribution. Credit is due under the terms of this license that can reference both the New World Encyclopedia contributors and the selfless volunteer contributors of the Wikimedia Foundation. To cite this article click here for a list of acceptable citing formats.The history of earlier contributions by wikipedians is accessible to researchers here:

The history of this article since it was imported to New World Encyclopedia:

Note: Some restrictions may apply to use of individual images which are separately licensed.