Difference between revisions of "Fractional Reserve Banking" - New World Encyclopedia

m |

m |

||

| (41 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

| + | {{Copyedited}}{{Paid}}{{Approved}}{{Images OK}}{{Submitted}}{{Status}} | ||

{{Finance sidebar |banking}} | {{Finance sidebar |banking}} | ||

| + | '''Fractional Reserve Banking''' is an accounting process that creates [[money]] and enables the expansion of an economy. It is used by most [[Bank|banking]] systems worldwide.<ref>Frederic S. Mishkin, ''Economics of Money, Banking and Financial Markets,'' 10th Edition. Prentice Hall 2012</ref><ref>{{Cite book|last= Christophers|first= Brett|title= Banking Across Boundaries: Placing Finance in Capitalism|publisher= John Wiley and Sons|year= 2013|isbn= 978-1-4443-3829-4|location= New York}}</ref> This process enables banks to lend out money that does not exist as new loans while only holding a percentage as deposits in reserve, often 10 percent. The borrower can use the new money to build a house, set up a factory, or engage in productive activities that add to the assets in the economy. When the loan is repaid to the bank, the balance on the bank's books is erased, destroying money. | ||

| − | + | Through fractional reserve banking, an economy can expand faster than with 100 percent reserves. With a [[money multiplier]] effect<ref>calculated by dividing one by the percentage on reserve</ref>, the money supply can be many times more than a deposit put into the bank. To avoid bank failures if too many depositors try to withdraw their deposits simultaneously, banks provide temporary loans to each other, and depositors have a minimum amount of deposits guaranteed by insurance. In the United States, the [[FDIC]] guarantees $250,000. | |

| − | Fractional reserve banking is a primary component of modern [[capitalism]]. | + | Fractional reserve banking is a primary component of modern [[capitalism]]. It allows, through the wide availability of loans, an opportunity for everyone to pursue their own building and business ventures when they are ready. However, the ethical control of this system has been elusive. Financial institutions and governments widely abuse fractional reserve banking. Central banks interfere with their role as a referee and clearing house for local banks when they manipulate interest rates and buy and lend out money themselves. Government/bank cabals have greatly corrupted the process when governments borrow money from central banks. |

| − | + | When a central bank creates new money through a government loan, the loan guarantees are based on future tax receipts instead of the production of future assets. Interest attached to the loan means more money has to be repaid than has been created. Governments use this new money for non-productive purposes like war, welfare, or expanded bureaucracy and keep borrowing without restraint. This causes inflation instead of economic development and shifts the balance of money in the supply from productive citizens and industries to elites in government and central bankers. Excessive government borrowing can lead to hyperinflation and economic collapse. To allow government borrowing from the Federal Reserve in the United States, a private central bank, the [[Sixteenth Amendment]] to the [[U.S. Constitution]] was necessary, as the founders had forbidden direct taxation of the citizens by the federal government. The Sixteenth Amendment eliminated this important check and balance on federal economic tyranny. | |

| + | |||

| + | In a well-regulated banking system, central banks only serve as clearing houses that issue new money to other banks. They act as a referee and not a player with a conflict of interest. Central banks would not be allowed to purchase securities or lend money to the government or anyone else. As a referee, a central bank would not charge interest on new money entering the economy but charge a small service fee for printing and handling. This limitation prevents governments from using central banks as their own money tree, paid for by the citizens they are supposed to serve. | ||

| + | |||

| + | When governments are required to borrow from other lenders, they are forced to maintain balanced budgets and must repay the loans like everyone else. When the role of the central bank is limited to that of the bank system referee, the economic system is competitive, efficient, stable, and market-driven, and currency devaluation is minimized. | ||

==Current Theory and Practice== | ==Current Theory and Practice== | ||

| − | Fractional-reserve banking is the system of banking under which banks that take [[bank deposits|deposits]] from the public | + | Fractional-reserve banking is the system of banking under which banks that take [[bank deposits|deposits]] from the public can lend out more to borrowers, holding only a fraction of their [[Liability (financial accounting)|deposit liabilities]] in liquid assets as a reserve.<ref name="AbelAndrew">{{Cite book |last1= Abel |first1= Andrew |last2= Bernanke |first2= Ben |author-link2= Ben Bernanke |title= Macroeconomics |publisher= Pearson |year= 2005 |edition= 5th|pages= 522–532 |chapter= 14}}</ref> [[Bank reserves]] are held as [[cash]] in the bank or as balances in the bank's account at the [[central bank]]. The country's laws determine the minimum amount that banks must hold in liquid assets, called the "[[reserve requirement]]" or "reserve ratio." Most commercial banks hold more than this minimum amount as [[excess reserves]]. |

| − | Bank deposits are usually of | + | Bank deposits are usually of relatively short-term duration and may be "at call," while loans made by banks tend to be longer-term,<ref> |

Compare: | Compare: | ||

{{cite book | {{cite book | ||

| Line 27: | Line 33: | ||

| access-date = 22 August 2020 | | access-date = 22 August 2020 | ||

| quote = [...] while in the earlier years, long-term deposits financed short-term loans, now relatively short-term deposits finance long-term loans. | | quote = [...] while in the earlier years, long-term deposits financed short-term loans, now relatively short-term deposits finance long-term loans. | ||

| − | }}</ref> resulting in a risk that customers may at any time collectively | + | }}</ref> resulting in a risk that customers may at any time collectively withdraw cash out of their accounts in excess of the bank's reserves. The reserves only provide [[Market liquidity|liquidity]] to cover withdrawals within a normal pattern. Banks and the central bank expect that, generally, only a proportion of deposits will be withdrawn simultaneously and that reserves will be sufficient to meet the demand for cash. However, if banks find themselves in a shortfall situation when depositors wish to withdraw more funds than the reserves held by the bank, they may borrow short-term funds in the [[interbank lending market]] from other banks with excess reserves. In exceptional situations, such as during an unexpected [[bank run]], the central bank may provide funds to cover the short-term shortfall as [[lender of last resort]].<ref name="AbelAndrew" /><ref name="Mankiw"/> To protect depositors in the event of a bank failure, banks are often required to have deposit insurance to guarantee a minimum amount of the deposit can be returned. |

| − | Because banks hold amounts in reserve less than their deposit liabilities, and because the deposit liabilities are considered money in | + | Because banks hold amounts in reserve less than their deposit liabilities, and because the deposit liabilities are considered money in the [[money supply]] (see [[commercial bank money]]), fractional-reserve banking permits the money supply to grow beyond the amount of the underlying [[base money]] originally created by the central bank.<ref name="AbelAndrew"/><ref name="Mankiw">{{Cite book |last= Mankiw |first= N. Gregory |title= Macroeconomics |publisher= Worth |year= 2002 |edition= 5th |pages= 482–489 |chapter= 18}}</ref> In most countries, the [[central bank]] (or other [[monetary policy]] authority) regulates bank-credit creation, imposing [[reserve requirements]] and [[capital adequacy]] ratios. This helps ensure that banks remain solvent and have enough funds to meet the demand for withdrawals, and can be used to influence the process of [[money creation]] in the banking system.<ref name="Mankiw"/> However, rather than directly controlling the money supply, central banks usually pursue an [[interest rate targeting|interest-rate target]] to control bank issuance of credit and the rate of [[inflation]].<ref name="hando"> |

{{cite book|last= Hubbard and O'Brien|title= Economics|location= Chapter 25: Monetary Policy, p. 943}} | {{cite book|last= Hubbard and O'Brien|title= Economics|location= Chapter 25: Monetary Policy, p. 943}} | ||

</ref> | </ref> | ||

| Line 36: | Line 42: | ||

{{Main|History of banking}} | {{Main|History of banking}} | ||

{{See also|Banknote}} | {{See also|Banknote}} | ||

| − | Fractional-reserve banking predates the existence of governmental monetary authorities and originated with bankers' realization that, generally, not all depositors demand payment simultaneously. In the past, savers looking to keep their coins and valuables in safekeeping depositories deposited [[gold]] and [[silver]] at [[goldsmith]]s, receiving in exchange a [[Promissory note|note]] for their [[deposit account|deposit]]. The [[Bank of Amsterdam]] (1609-1820) was a precursor to modern central banks in the role of an exchange bank. It exchanged currencies from different countries and with different gold and silver contents and created a standard of exchange as an accounting unit known as a florin. The florin was originally fully backed by coins and precious metals held by the bank. These notes gained acceptance as a [[medium of exchange]] for commercial transactions and thus became an early form of circulating [[paper money]].<ref name="moneyfacts">{{cite book |last=United States. Congress. House. Banking and Currency Committee. |title=Money facts; 169 questions and answers on money – a supplement to A Primer on Money, with index, Subcommittee on Domestic Finance ... 1964. |location=Washington D.C. |year=1964 |url=http://www.baldwinlivingtrust.com/pdfs/AllAboutMoney.pdf}}</ref> | + | Fractional-reserve banking predates the existence of governmental monetary authorities and originated with bankers' realization that, generally, not all depositors demand payment simultaneously. In the past, savers looking to keep their coins and valuables in safekeeping depositories deposited [[gold]] and [[silver]] at [[goldsmith]]s, receiving in exchange a [[Promissory note|note]] for their [[deposit account|deposit]]. The [[Bank of Amsterdam]] (1609-1820) was a precursor to modern central banks in the role of an exchange bank. It exchanged currencies from different countries and with different gold and silver contents and created a standard of exchange as an accounting unit known as a florin. The florin was originally fully backed by coins and precious metals held by the bank. These notes gained acceptance as a [[medium of exchange]] for commercial transactions and thus became an early form of circulating [[paper money]].<ref name="moneyfacts">{{cite book |last=United States. Congress. House. Banking and Currency Committee. |title=Money facts; 169 questions and answers on money – a supplement to A Primer on Money, with index, Subcommittee on Domestic Finance ... 1964. |location=Washington D.C. |year=1964 |url=http://www.baldwinlivingtrust.com/pdfs/AllAboutMoney.pdf}}</ref> |

| − | + | As the notes were used directly in [[trade]], the goldsmiths observed that people would not usually redeem all their notes at the same time, and they saw the opportunity to invest their coin reserves in interest-bearing loans. This generated [[income]] for the goldsmiths but left them with more notes on issue than reserves with which to pay them. A process was started that altered the role of the goldsmiths from passive guardians of [[bullion]], charging fees for safe storage, to interest-paying and interest-earning banks. Thus fractional-reserve banking was born.<ref>Thus, by the 19th century, we find "[i]n ordinary cases of deposits of money with banking corporations, or bankers, the transaction amounts to a mere loan or mutuum, and the bank is to restore, not the same money, but an equivalent sum, whenever it is demanded." Joseph Story, ''Commentaries on the Law of Bailments'' (1832, p. 66) and "Money, when paid into a bank, ceases altogether to be the money of the principal (see Parker v. Marchant, 1 Phillips 360); it is then the money of the banker, who is bound to return an equivalent by paying a similar sum to that deposited with him when he is asked for it." Lord Chancellor Cottenham, ''Foley v Hill'' (1848) 2 HLC 28.</ref> | |

| − | + | However, bankers often unethically treated the depositor's money as their own money and profited from it while paying the depositor little or nothing. If [[creditor]]s (note holders of gold originally deposited) lost faith in the ability of a bank to pay their notes, however, many would try to redeem their notes at the same time. If, in response, a bank could not raise enough funds by calling in loans or selling bills, the bank would either go into [[insolvency]] or default on its notes. Such a situation is called a [[bank run]] and caused the demise of many early banks.<ref name="moneyfacts"/> These early financial crises led to the creation of government-regulated banks. Laws regarding the Bank of Amsterdam and earlier the Bank of Venice required banks to charge fees for their services and not gamble with depositors' money. | |

| − | + | The Swedish [[Sveriges Riksbank|Riksbank]] was the world's first modern [[central bank]], created in 1668.<ref>Michael D. Bordo, "A Brief History of Central Banks," Federal Reserve Bank of Cleveland, 12/01/2007.</ref> Many nations followed suit in the late 1600s to establish central banks that were given the legal power to set the [[reserve requirement]] and to specify the form in which such assets (called the [[monetary base]]) are required to be held.<ref>Charles P. Kindleberger, ''A Financial History of Western Europe''. Routledge 2007</ref> To mitigate the impact of bank failures and financial crises, central banks were also granted the authority to centralize banks' storage of precious metal reserves, thereby facilitating the transfer of gold in the event of bank runs, to regulate commercial banks, to impose reserve requirements, and to act as lender-of-last-resort if any bank faced a bank run. The emergence of central banks reduced the risk of bank runs which is inherent in fractional-reserve banking, and it allowed the practice to continue as it does today.<ref name="Mankiw"/> | |

| − | + | However, the centralization of reserves proved tempting for the governments. In less than 30 years, the "Bank of England was founded as a joint stock company to purchase government debt."<ref>Michael D. Bordo, "A Brief History of Central Banks," op.cit.</ref> When the bank collapsed two years later, the government bailed it out, proclaiming notes from the Bank of England to be the only legal tender, suspended the exchange of notes for gold, and harshly punished counterfeiters. This was the beginning of government/bank cabals that proliferated as banks made huge profits and governments could borrow virtually unlimited amounts of money from the central banks. The citizens bore the brunt of these cabals through inflation and tax debt. | |

| − | The [[Federal Reserve]] system in the U.S. and the European Central Bank are such twentieth-century central banks, but they have been unable to regulate themselves or the spending | + | During the twentieth century, to keep the cabals in place, the role of the central bank grew to include managing economic stability and various macroeconomic policy variables, including measures of inflation, unemployment, and the international [[balance of payments]]. This includes managing interest rates, reserve requirements, and various measures of the money supply and [[monetary base]].<ref name="paf">[http://www.stls.frb.org:80/publications/pleng/PDF/PlainEnglish.pdf The Federal Reserve in Plain English] – An easy-to-read guide to the structure and functions of the Federal Reserve System (See page 5 of the document for the purposes and functions)</ref> |

| + | |||

| + | The [[Federal Reserve]] system in the U.S. and the European Central Bank are such twentieth-century central banks, but they have ultimately been unable to regulate themselves or the governments' spending. The misuse of centralized wealth, the lending of central banks for non-productive purposes, and the buying and selling of secondary notes and derivatives in financial markets have caused inflation and tax burdens that are unsustainable. The elites who get the newly printed money prosper, while the once-booming middle classes find it hard to own homes and get out of debt. This unsustainability led to the Global Financial Crisis of 2007-2008, which was temporarily rescued by government bailouts of the large banks that grew larger and absorbed smaller banks, making the current system yet more unstable. | ||

==Economic function== | ==Economic function== | ||

===Expanded liquidity=== | ===Expanded liquidity=== | ||

| − | Fractional-reserve banking allows banks to provide expanded credit, providing immediate liquidity to short-term borrowers and act as [[Financial intermediary|financial intermediaries]] for long-term loans.<ref name="Mankiw"/><ref name="Abel_Bernanke">{{Cite book |last1=Abel |first1=Andrew |last2=Bernanke |first2=Ben |author-link2=Ben Bernanke |title=Macroeconomics |publisher=Pearson |year=2005 |edition=5th|pages=266–269 |chapter=7}}</ref> Less liquid forms of deposit (such as [[time deposits]]) or riskier classes of financial assets (such as equities or long-term bonds) may lock up a depositor's wealth for a period of time, making it unavailable for use on demand. This "borrowing short, lending long" or [[maturity transformation]] function of fractional-reserve banking is a role that, according to many economists, can be considered | + | Fractional-reserve banking allows banks to provide expanded credit, providing immediate liquidity to short-term borrowers and act as [[Financial intermediary|financial intermediaries]] for long-term loans.<ref name="Mankiw"/><ref name="Abel_Bernanke">{{Cite book |last1=Abel |first1=Andrew |last2=Bernanke |first2=Ben |author-link2=Ben Bernanke |title=Macroeconomics |publisher=Pearson |year=2005 |edition=5th|pages=266–269 |chapter=7}}</ref> Less liquid forms of deposit (such as [[time deposits]]) or riskier classes of financial assets (such as equities or long-term bonds) may lock up a depositor's wealth for a period of time, making it unavailable for use on demand. This "borrowing short, lending long" or [[maturity transformation]] function of fractional-reserve banking is a role that, according to many economists, can be considered an important function of the commercial banking system.<ref>[http://delong.typepad.com/sdj/2010/03/the-maturity-transformation-and-liquidity-transformation-and-safety-transformation-industtry.html Maturity Transformation] Brad DeLong</ref> |

The process of fractional-reserve banking expands the money supply of the economy. Modern central banking allows banks to practice fractional-reserve banking with inter-bank business transactions with a reduced risk of bankruptcy of an individual bank meeting a sudden withdrawal demand.<ref name="purpose">Page 57 of 'The FED today', a publication on an educational site affiliated with the Federal Reserve Bank of Kansas City, designed to educate people on the history and purpose of the United States Federal Reserve system. [http://www.philadelphiafed.org/publications/economic-education/fed-today/fed-today_lesson-6.pdf The FED today Lesson 6] {{Webarchive|url=https://web.archive.org/web/20110313201251/http://www.philadelphiafed.org/publications/economic-education/fed-today/fed-today_lesson-6.pdf |date=13 March 2011 }}</ref><ref>{{cite web |url=http://www.bankofengland.co.uk/publications/speeches/2009/speech381.pdf | The process of fractional-reserve banking expands the money supply of the economy. Modern central banking allows banks to practice fractional-reserve banking with inter-bank business transactions with a reduced risk of bankruptcy of an individual bank meeting a sudden withdrawal demand.<ref name="purpose">Page 57 of 'The FED today', a publication on an educational site affiliated with the Federal Reserve Bank of Kansas City, designed to educate people on the history and purpose of the United States Federal Reserve system. [http://www.philadelphiafed.org/publications/economic-education/fed-today/fed-today_lesson-6.pdf The FED today Lesson 6] {{Webarchive|url=https://web.archive.org/web/20110313201251/http://www.philadelphiafed.org/publications/economic-education/fed-today/fed-today_lesson-6.pdf |date=13 March 2011 }}</ref><ref>{{cite web |url=http://www.bankofengland.co.uk/publications/speeches/2009/speech381.pdf | ||

| − | |title=Mervyn King, Finance: A Return from Risk | + | |title=Mervyn King, ''Finance: A Return from Risk'' |

| − | |publisher=Bank of England|quote=Banks are dangerous institutions. They borrow short and lend long. They create liabilities | + | |publisher=Bank of England|quote=Banks are dangerous institutions. They borrow short and lend long. They create liabilities that promise to be liquid and hold a few liquid assets themselves. That, though, is very valuable for the rest of the economy. Household savings can be channeled to finance illiquid investment projects while providing access to liquidity for those savers who may need it.... If a large number of depositors want liquidity at the same time, banks are forced into early liquidation of assets – lowering their value ...'}}</ref> |

| − | + | In [[macroeconomics|macroeconomic]] theory, a well-regulated fractional-reserve bank system also benefits the economy by providing regulators with powerful tools for influencing the [[money supply]] and interest rates. Many economists believe that these should be adjusted by the government to promote [[Economic stability|macroeconomic stability]].<ref name="Mankiw_Ch9">{{Cite book |last=Mankiw |first=N. Gregory |title=Macroeconomics |publisher=Worth |year=2002 |edition=5th |pages=238–255 |chapter=9}}</ref> | |

| − | === | + | ===Current money creation process=== |

{{Main|Money creation}} | {{Main|Money creation}} | ||

| − | + | When a commercial bank makes a loan, the bank creates new demand deposits, and the money supply expands by the size of the loan.<ref name="Mankiw"/> The proceeds of most commercial bank loans are not in the form of currency. Banks typically make loans by accepting [[promissory note]]s in exchange for credit to the borrowers' deposit accounts.<ref>Eric N. Compton, ''Principles of Banking'', p. 150, American Bankers Ass'n (1979).</ref> Deposits created in this way are sometimes called derivative deposits.<ref>Paul M. Horvitz, ''Monetary Policy and the Financial System'', pp. 56–57, Prentice-Hall, 3rd ed. (1974).</ref> Issuing loan proceeds in the form of paper currency and current coins is considered to be a weakness in central control.<ref>See, generally, ''Industry Audit Guide: Audits of Banks'', p. 56, Banking Committee, American Institute of Certified Public Accountants (1983).</ref> | |

| + | |||

| + | The money creation process is also affected by the currency drain ratio (the propensity of the public to hold banknotes rather than deposit them with a commercial bank) and the safety reserve ratio ([[excess reserves]] beyond the legal requirement that commercial banks voluntarily hold). Data for "excess" reserves and vault cash are published regularly by the [[Federal Reserve in the United States]].<ref>[http://www.federalreserve.gov/releases/h3/Current/ Federal Reserve Board, "Aggregate Reserves of Depository Institutions and the Monetary Base"] (Updated weekly).</ref> | ||

| + | |||

| + | In modern economies, most money is created by commercial loans backed by paper credit and government debt, not by loans backed by real assets in local banks. Such loans have hijacked the purpose of fractional reserve banking to create new assets and productive businesses, expanding the economy. "If the Fed wants to inject $1 billion into the economy, it can simply buy $1 billion worth of Treasury bonds in the market and deposit $1 billion of new money into the reserves of banks."<ref>Sean Ross, "Understanding How the Federal Reserve Creates Money," ''Investopedia,'' April 30, 2023. https://www.investopedia.com/articles/investing/081415/understanding-how-federal-reserve-creates-money.asp</ref> This central bank manipulation of government debt, through buying and selling treasury bonds is not based on tangible economic assets, but on a debt placed on the taxpayer without their agreement. When the central bank charges interest on this debt, it profits at taxpayers' expense, shifting new money from productive working people to bankers and the government. Central banks and governments are incentivized to use fractional reserve banking and government debt for self-enrichment. | ||

| + | |||

| + | One strategy to rein in government spending has been for Congress to legislate a debt ceiling. This is a temporary restraint in most democracies because the citizens they represent also want a portion of this government-created money as payments promised by the government. A solution to this problem is to change the process by limiting the role of the central bank to that of a clearing house and money provider for other banks only and not allow fractional reserve loans for derivatives in the commercial market. Then central governments would be forced to balance budgets like state governments in the United States are forced to because they cannot print their own money. It is a conflict of interest for the entity that creates money to use it. This is similar to counterfeiting and a criminal enterprise. Current government/bank cabals are unrestrained in this behavior. Money creation through fractional reserve banking should be limited to bank loans for productive activities that increase assets and the value of the economy. | ||

| + | |||

| + | ==Money supply== | ||

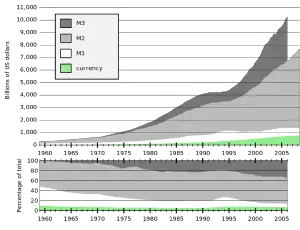

| + | [[File:1024px-Components of the United States money supply2.svg.png|thumb|50%|Components of US money supply (currency, [[Money supply#Empirical measures in the United States Federal Reserve System|M1, M2, and M3]]) since 1959. In January 2007, the amount of "central bank money" was $750.5 billion, while the amount of "commercial bank money" (in the M2 supply) was $6.33 trillion. M1 is currency plus demand deposits; M2 is M1 plus time deposits, savings deposits, and some money-market funds; and M3 is M2 plus large-time deposits and other forms of money. | ||

| + | The M3 data ends in 2006 because [http://www.federalreserve.gov/releases/h6/discm3.htm the federal reserve ceased reporting it].<!-- this, and [[Money supply]], still needs improving: what is large and what is not, and what is "other larger liquid assets." —>]] | ||

| + | |||

| + | {{See also|Money supply}} | ||

| − | The | + | The [[money supply]] is measured in categories called M1, M2, and M3. This varies according to liquidity. M1 is currency and cash deposits that can be withdrawn on demand. M2 is M1 plus time deposits, savings deposits, and some money-market funds that can be withdrawn in a short period of time. M3 is M2 plus large-time deposits and other forms of money. The "other forms of money" is controversial, not agreed upon, and difficult to measure. Some countries describe M4 as "broad money," including M3 and long-term commercial paper, bonds, and other non-liquid notes. M4 is not easily converted for economic transactions and, therefore, not usually considered money. |

| − | + | Fractional reserve banking is M1 when paid in currency to a borrower and M2 and M3 on the bank journal ledger. From an accounting perspective, the money supply is doubled by the cash amount created by the loan. In countries with fractional-reserve banking, [[commercial bank money]] usually forms most of the money supply.<ref name="bis"/> The acceptance and value of commercial bank money are based on the fact that it can be exchanged freely at a commercial bank for central bank money.<ref name="bis"/><ref name="ecb"/> | |

| + | |||

| + | The actual increase in the money supply through this process may be lower, as (at each step) banks may choose to hold [[excess reserves|reserves in excess]] of the statutory minimum, borrowers may let some funds sit idle. Some members of the public may choose to hold cash. There also may be delays or frictions in the lending process.<ref>[https://books.google.com/books?id=I-49pxHxMh8C&pg=PA303&dq=deposit+reserves&lr=&sig=hMQtESrWP6IBRYiiaZgKwIoDWVk#PPA295,M1 William MacEachern (2014) ''Macroeconomics: A Contemporary Introduction''], p. 295, University of Connecticut, ISBN 9780324288742</ref> Government regulations may also limit the money creation process by preventing banks from giving out loans even when the reserve requirements have been fulfilled.<ref>[http://www.federalreserve.gov/pf/pf.htmebook ''The Federal Reserve – Purposes and Functions''] | ||

| + | (See pages 13 and 14 of the pdf version for information on government regulations and supervision over banks)</ref> | ||

| − | |||

===Types of money=== | ===Types of money=== | ||

| Line 73: | Line 95: | ||

:"Contemporary monetary systems are based on the mutually reinforcing roles of central bank money and commercial bank monies."</ref><ref name="ecb">[http://www.ecb.int/press/key/date/2000/html/sp001109_2.en.html European Central Bank – Domestic payments in Euroland]: commercial and central bank money: | :"Contemporary monetary systems are based on the mutually reinforcing roles of central bank money and commercial bank monies."</ref><ref name="ecb">[http://www.ecb.int/press/key/date/2000/html/sp001109_2.en.html European Central Bank – Domestic payments in Euroland]: commercial and central bank money: | ||

One quotation from the article referencing the two types of money: | One quotation from the article referencing the two types of money: | ||

| − | :"At the beginning of the 20th almost the totality of retail payments were made in central bank money. Over time, this monopoly came to be shared with commercial banks | + | :"At the beginning of the 20th almost the totality of retail payments were made in central bank money. Over time, this monopoly came to be shared with commercial banks when deposits and their transfer via cheques and giros became widely accepted. Banknotes and commercial bank money became fully interchangeable payment media that customers could use according to their needs. While transaction costs in commercial bank money were shrinking, cashless payment instruments became increasingly used, at the expense of banknotes"</ref><ref>[https://books.google.com/books?hl=en&id=EkUTaZofJYEC&dq=British+Parliamentary+reports+on+international+finance&printsec=frontcover&source=web&ots=kHxssmPNow&sig=UyopnsiJSHwk152davCIyQAMVdw&sa=X&oi=book_result&resnum=1&ct=result#PPA34,M1 Macmillan report 1931] account of how fractional banking works</ref> |

# '''Central bank money:''' money created or adopted by the central bank regardless of its form – precious metals, commodity certificates, banknotes, coins, electronic money loaned to commercial banks, or anything else the central bank chooses as its form of money. | # '''Central bank money:''' money created or adopted by the central bank regardless of its form – precious metals, commodity certificates, banknotes, coins, electronic money loaned to commercial banks, or anything else the central bank chooses as its form of money. | ||

| − | # '''Commercial bank money:''' demand deposits in the commercial banking system; also referred to as " | + | # '''Commercial bank money:''' demand deposits in the commercial banking system; also referred to as "checkbook money," "sight deposits," or simply "credit." |

== Regulatory framework== | == Regulatory framework== | ||

| − | In banking before the 18th century, a bank deposit | + | In banking before the 18th century, a bank deposit was the customer's property held in safekeeping by a bank. Today most legal frameworks allow the deposited funds to become the bank's property. The depositor, in turn, receives an asset called a [[deposit account]] (a [[checking account|checking]] or [[savings account]]). That deposit account is a ''liability'' on the [[balance sheet]] of the bank.<ref>Thus, by the 19th century, we find "[i]n ordinary cases of deposits of money with banking corporations, or bankers, the transaction amounts to a mere loan or mutuum, and the bank is to restore, not the same money, but an equivalent sum, whenever it is demanded." Joseph Story, ''Commentaries on the Law of Bailments'' (1832, p. 66) and "Money, when paid into a bank, ceases altogether to be the money of the principal (see Parker v. Marchant, 1 Phillips 360); it is then the money of the banker, who is bound to return an equivalent by paying a similar sum to that deposited with him when he is asked for it." Lord Chancellor Cottenham, Foley v Hill (1848) 2 HLC 28.</ref> |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | + | Each bank is legally authorized to issue credit up to a specified multiple of its reserves, so reserves available to satisfy payment of deposit liabilities are less than the total amount the bank is obligated to pay in satisfaction of demand deposits. Normally, fractional-reserve banking functions smoothly, and banks maintain enough of a buffer of reserves to cover depositors' cash withdrawals and other demands for funds. However, during a bank run or a [[financial crisis]] in the economy, demands for withdrawal can exceed the bank's reserves, and the bank will be forced to raise additional reserves quickly to avoid default. A bank can raise funds from additional borrowing (e.g., from [[interbank lending market]] or the central bank), by selling assets, or by calling in short-term loans. If creditors fear the bank is running out of reserves or is insolvent, they have the incentive to redeem their deposits before other depositors take the remaining reserves. Thus the fear of a bank run can precipitate a crisis. Contemporary regulation of banks and central banks designed to prevent bank runs includes the centralized [[Clearing (finance)|clearing]] of payments, central bank lending to member banks, regulatory auditing, and government-administered [[deposit insurance]]. | |

| − | |||

| − | |||

| − | [[ | ||

| − | |||

| − | + | Fractional reserve lending has been difficult to limit and enforce because governments are tempted to enter into cabals with central banks. This started with the Bank of England in 1896 and became a problem when the [[Federal Reserve]] bank was created in 1913 in the U.S. Large sums of money became available for these governments to enter into war, expand government bureaucracies, and offer all kinds of subsidies with strings attached to states, institutions, and individuals. | |

| − | + | Fractional reserve lending has been difficult to limit and enforce in the commercial sector because new money is created through loans and used by banks to speculate wildly in the stock markets holding depositors' money at risk. This behavior caused the stock market collapse in 1929 and many bank failures (1930-1932), causing the [[Great Depression]]. This crisis led to new bank regulations in the 1930s, such as the [[Glass-Steagall Act]] (1933) and the creation of the Federal Deposit Insurance Corporation (FDIC) that restricted bank speculation and protected depositors. However, this was repealed under bank lobbying pressure in 1999 and followed immediately by Enron, WorldCom, and other financial scandals and eventually the 2007-2008 bank crisis and bailout. However, instead of reinstating the Glass-Steagall Act, the large banks and accounting firms pressured the government to adopt their legislation, the [[Sarbanes-Oxley Act]] (2002) and the [[Dodd-Frank Act]] (2010) that enabled big banks to continue speculation while creation complicated regulations small banks could not afford. The political will to restrain all banks equally and create a level playing field for new banks to enter the market did not develop as it did in the 1930s. | |

| − | ( | ||

| − | + | Financial institutions that handle mortgage-backed securities (MBS) and secondary paper and do not produce assets, though more regulated, are still allowed to borrow and trade with the central bank and newly created money rather than forced to work with existing money outside of fractional reserve banking. This incentivizes speculation and financial instability. For example, originating banks are incentivized to make risky loans and immediately sell them to mortgage bundlers and make a profit, leaving the bundlers with a junk portfolio. | |

| − | |||

| − | + | Instituting laws that require banks only to charge a service fee in handling other people's money, rather than giving ownership of the deposits to the banks, such as once applied to the Bank of Amsterdam and the Bank of Venice,<ref>Gordon L. Anderson, ''Integral Society: Social Institutions and Individual Sovereignty'', Paragon House, 2023, pp.112-113. ISBN 9781557789495</ref> would eliminate the ethical problem of banks misusing other people's money. In such cases, profits derived from fractional reserve lending would go to the depositors, with the banks only receiving a fee for their lending service that the depositors approve. This would make the individuals, not banks, the sovereigns in the economy. | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

===Reserve requirements=== | ===Reserve requirements=== | ||

| − | + | [[Reserve requirement]]s are intended to prevent banks from: | |

# generating too much money by making too many loans against a narrow money deposit base; | # generating too much money by making too many loans against a narrow money deposit base; | ||

| − | # having a shortage of cash when large deposits are withdrawn (although a legal minimum reserve amount is often established as a regulatory requirement, reserves may be made available | + | # having a shortage of cash when large deposits are withdrawn (although a legal minimum reserve amount is often established as a regulatory requirement, reserves may be made available temporarily in the event of a crisis or [[bank run]]). |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | + | In some jurisdictions (such as the European Union), the central bank does not require reserves to be held during the day. Reserve requirements are intended to ensure that the banks have sufficient supplies of highly liquid assets so that the system operates in an orderly fashion and maintains public confidence. | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | In | + | In the United States, the central bank dropped reserve requirements on March 26, 2020,<ref>https://www.federalreserve.gov/monetarypolicy/reservereq.htm</ref> allowing the banks to issue an infinite amount of loans and putting the central bank on the hook for all cash withdrawals. This is part of a controversial plan to create a [[Central Bank Digital Currency]] (CDBC) that would not require local banks to have large amounts of currency reserves. Nigerians are rejecting a CBDC that has been instituted there as most people have more faith in traditional currency, and some do not have easy access to digital currency. They have protested the system as an infringement on their economic freedom.<ref>Nicholas Anthony, "Nigerians’ Rejection of Their CBDC Is a Cautionary Tale for Other Countries," ''Coindesk,'' March 6, 2023. https://www.coindesk.com/consensus-magazine/2023/03/06/nigerians-rejection-of-their-cbdc-is-a-cautionary-tale-for-other-countries/</ref> |

| − | + | In addition to reserve requirements, there are other required [[financial ratio]]s that affect the amount of loans that a bank can fund. The [[Capital requirement|capital requirement ratio]] is perhaps the most important of these other required ratios. When there are [[Reserve requirement#Reserve ratios|no mandatory reserve requirements]], which are considered by some economists to restrict lending, the capital requirement ratio acts to prevent an infinite amount of bank lending. | |

| − | The | ||

| − | + | == Criticism of Fractional Reserve Banking == | |

| − | + | [[Austrian School]] economists such as [[Jesús Huerta de Soto]] and [[Murray Rothbard]] strongly criticized fractional-reserve banking, calling for it to be outlawed and criminalized. According to them, not only does money creation cause macroeconomic instability (based on the [[Austrian Business Cycle Theory]]), but it is a form of [[embezzlement]] or financial [[fraud]], legalized only due to the influence of powerful rich bankers on corrupt governments around the world.<ref name=rothbard>{{cite book|last1=Rothbard|first1=Murray|title=The Mystery of Banking|date=1983|isbn=9780943940045}}</ref><ref>{{cite book|author=Jesús Huerta de Soto |title=Money, Bank Credit, and Economic Cycles |url=https://www.mises.org/store/Money-Bank-Credit-and-Economic-Cycles-P290C0.aspx | year=2012 | publisher= Ludwig von Mises Institute | location= Auburn, AL | pages = 881 | edition= 3d | isbn= 9781610161893 | oclc= 807678778}} (with Melinda A. Stroup, translator) Also available as a [http://library.freecapitalists.org//books/Jesus%20Huerta%20de%20Soto/Money,%20Bank%20Credit,%20and%20Economic%20Cycles_Vol_4.pdf PDF here]</ref> US Politician [[Ron Paul]] has also criticized fractional-reserve banking based on Austrian School arguments.<ref>{{cite book |last=Paul |first=Ron |title=End the Fed |year=2009 |publisher=[[Grand Central Pub.]] |location=New York |isbn=978-0-446-54919-6 |chapter-url=https://mises.org/daily/3687 |author-link=Ron Paul |chapter=2 The Origin and Nature of the Fed|title-link=End the Fed }}</ref> | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | + | However, this criticism is only partly true. Fractional reserve banking can either be used to expand the economy or, when governments and central banks use it as players, it becomes a corrupt criminal enterprise that redistributes the money supply from producers of economic goods to a criminal cabal. The criticism of a cabal's use of fractional reserve banking is in order, and central banks should be restrained and restructured to only play a role in genuine productive economic activity. | |

| − | == | + | == Conclusion == |

| − | + | Fractional reserve banking can be a valuable part of a well-governed economic system. It can enable money to be available for loans that is readily available to anyone who wishes to build a home, start a business, build a highway, or engage in any other economic activity that produces assets, goods, and services. It has enabled the tremendous economic growth the world has witnessed in the last 400 years. | |

| − | |||

| − | + | However, governments and central banks have hijacked the process of fractional reserve banking for selfish ends and non-productive purposes. This has caused a shift of money and wealth from working people who create economic value to political and banking elites who take much of the fruit of their labor by the tax burden government borrowing imposes. Another form of money creation caused the rise of feudalism in the Middle Ages, the dilution of gold or silver in coins. This new money also entered the economy by distribution from the emperors' mint to bureaucrats, cronies, and warriors. They, in turn, used this unethically produced money to buy up land and businesses from the middle classes—leaving them to become serfs and creating feudalism.<ref>Gordon L. Anderson, ''Integral Society,'' pp. 49-51. ISBN 9781557789495</ref>Today's banking cabals using fractional reserve lending to governments are causing a rise in what is being called "neo-feudalism."<ref>Joel Kotkin, ''The Coming of Neo-Feudalism: A Warning to the Global Middle Class'', Encounter Books, 2020 ISBN 9781641770941</ref> | |

| − | |||

| − | + | Laws should prevent the hijacking of fractional reserve banking by: | |

| − | + | #Limiting the role of central banks to a clearing house and currency provider for other banks. | |

| + | #Prohibiting central banks from buying securities or lending money to anyone. | ||

| + | #Limit fractional reserve lending to loans for productive economic activities and prohibit when lending for secondary mortgages or securities. | ||

| + | #Central banks enter new money into the system without charging interest, eliminating debt-financed money. Central banks should only be paid a service fee for offsetting the value of their labor. | ||

| − | + | These changes should eliminate a dangerous conflict of interest, where those who print money can spend it. It should put an end to the government/bank cabals that are destroying the middle class and creating neo-feudalism | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

==Notes== | ==Notes== | ||

{{Reflist|group=note}} | {{Reflist|group=note}} | ||

| − | |||

| − | |||

| − | |||

==Further reading== | ==Further reading== | ||

* Crick, W.F. (1927), The genesis of bank deposits, ''Economica'', vol 7, 1927, pp 191–202. | * Crick, W.F. (1927), The genesis of bank deposits, ''Economica'', vol 7, 1927, pp 191–202. | ||

* [[Milton Friedman|Friedman, Milton]] (1960), ''A Program for Monetary Stability'', New York, [[Fordham University Press]]. | * [[Milton Friedman|Friedman, Milton]] (1960), ''A Program for Monetary Stability'', New York, [[Fordham University Press]]. | ||

| − | * [[John Lanchester|Lanchester, John]], "The Invention of Money: How the heresies of two bankers became the basis of our modern economy" | + | * [[John Lanchester|Lanchester, John]], "The Invention of Money: How the heresies of two bankers became the basis of our modern economy," ''[[The New Yorker]]'', 5 & 12 August 2019, pp. 28–31. |

* Meigs, A.J. (1962), ''Free reserves and the money supply'', Chicago, University of Chicago, 1962. | * Meigs, A.J. (1962), ''Free reserves and the money supply'', Chicago, University of Chicago, 1962. | ||

* Philips, C.A. (1921), ''Bank Credit'', New York, Macmillan, chapters 1–4, 1921, | * Philips, C.A. (1921), ''Bank Credit'', New York, Macmillan, chapters 1–4, 1921, | ||

| Line 308: | Line 157: | ||

* [http://www.bis.org/publ/cpss55.pdf Bank for International Settlements – The Role of Central Bank Money in Payment Systems] | * [http://www.bis.org/publ/cpss55.pdf Bank for International Settlements – The Role of Central Bank Money in Payment Systems] | ||

| − | + | [[Category:Politics]] | |

| − | + | [[Category:Social sciences]] | |

| − | + | [[Category:Economics]] | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | [[Category: | ||

| − | [[Category: | ||

| − | [[Category: | ||

| − | {{credits| | + | {{credits|1150460103}} |

Latest revision as of 16:22, 18 June 2023

| Finance

| |

| Financial markets Bond market | |

| Market participants Investors | |

| Corporate finance Structured finance | |

| Personal finance Credit and Debt | |

| Public finance Tax | |

| Banks and banking Fractional-reserve banking | |

| Financial regulation Finance designations | |

| History of finance Stock market bubble | |

Fractional Reserve Banking is an accounting process that creates money and enables the expansion of an economy. It is used by most banking systems worldwide.[1][2] This process enables banks to lend out money that does not exist as new loans while only holding a percentage as deposits in reserve, often 10 percent. The borrower can use the new money to build a house, set up a factory, or engage in productive activities that add to the assets in the economy. When the loan is repaid to the bank, the balance on the bank's books is erased, destroying money.

Through fractional reserve banking, an economy can expand faster than with 100 percent reserves. With a money multiplier effect[3], the money supply can be many times more than a deposit put into the bank. To avoid bank failures if too many depositors try to withdraw their deposits simultaneously, banks provide temporary loans to each other, and depositors have a minimum amount of deposits guaranteed by insurance. In the United States, the FDIC guarantees $250,000.

Fractional reserve banking is a primary component of modern capitalism. It allows, through the wide availability of loans, an opportunity for everyone to pursue their own building and business ventures when they are ready. However, the ethical control of this system has been elusive. Financial institutions and governments widely abuse fractional reserve banking. Central banks interfere with their role as a referee and clearing house for local banks when they manipulate interest rates and buy and lend out money themselves. Government/bank cabals have greatly corrupted the process when governments borrow money from central banks.

When a central bank creates new money through a government loan, the loan guarantees are based on future tax receipts instead of the production of future assets. Interest attached to the loan means more money has to be repaid than has been created. Governments use this new money for non-productive purposes like war, welfare, or expanded bureaucracy and keep borrowing without restraint. This causes inflation instead of economic development and shifts the balance of money in the supply from productive citizens and industries to elites in government and central bankers. Excessive government borrowing can lead to hyperinflation and economic collapse. To allow government borrowing from the Federal Reserve in the United States, a private central bank, the Sixteenth Amendment to the U.S. Constitution was necessary, as the founders had forbidden direct taxation of the citizens by the federal government. The Sixteenth Amendment eliminated this important check and balance on federal economic tyranny.

In a well-regulated banking system, central banks only serve as clearing houses that issue new money to other banks. They act as a referee and not a player with a conflict of interest. Central banks would not be allowed to purchase securities or lend money to the government or anyone else. As a referee, a central bank would not charge interest on new money entering the economy but charge a small service fee for printing and handling. This limitation prevents governments from using central banks as their own money tree, paid for by the citizens they are supposed to serve.

When governments are required to borrow from other lenders, they are forced to maintain balanced budgets and must repay the loans like everyone else. When the role of the central bank is limited to that of the bank system referee, the economic system is competitive, efficient, stable, and market-driven, and currency devaluation is minimized.

Current Theory and Practice

Fractional-reserve banking is the system of banking under which banks that take deposits from the public can lend out more to borrowers, holding only a fraction of their deposit liabilities in liquid assets as a reserve.[4] Bank reserves are held as cash in the bank or as balances in the bank's account at the central bank. The country's laws determine the minimum amount that banks must hold in liquid assets, called the "reserve requirement" or "reserve ratio." Most commercial banks hold more than this minimum amount as excess reserves.

Bank deposits are usually of relatively short-term duration and may be "at call," while loans made by banks tend to be longer-term,[5] resulting in a risk that customers may at any time collectively withdraw cash out of their accounts in excess of the bank's reserves. The reserves only provide liquidity to cover withdrawals within a normal pattern. Banks and the central bank expect that, generally, only a proportion of deposits will be withdrawn simultaneously and that reserves will be sufficient to meet the demand for cash. However, if banks find themselves in a shortfall situation when depositors wish to withdraw more funds than the reserves held by the bank, they may borrow short-term funds in the interbank lending market from other banks with excess reserves. In exceptional situations, such as during an unexpected bank run, the central bank may provide funds to cover the short-term shortfall as lender of last resort.[4][6] To protect depositors in the event of a bank failure, banks are often required to have deposit insurance to guarantee a minimum amount of the deposit can be returned.

Because banks hold amounts in reserve less than their deposit liabilities, and because the deposit liabilities are considered money in the money supply (see commercial bank money), fractional-reserve banking permits the money supply to grow beyond the amount of the underlying base money originally created by the central bank.[4][6] In most countries, the central bank (or other monetary policy authority) regulates bank-credit creation, imposing reserve requirements and capital adequacy ratios. This helps ensure that banks remain solvent and have enough funds to meet the demand for withdrawals, and can be used to influence the process of money creation in the banking system.[6] However, rather than directly controlling the money supply, central banks usually pursue an interest-rate target to control bank issuance of credit and the rate of inflation.[7]

History

Fractional-reserve banking predates the existence of governmental monetary authorities and originated with bankers' realization that, generally, not all depositors demand payment simultaneously. In the past, savers looking to keep their coins and valuables in safekeeping depositories deposited gold and silver at goldsmiths, receiving in exchange a note for their deposit. The Bank of Amsterdam (1609-1820) was a precursor to modern central banks in the role of an exchange bank. It exchanged currencies from different countries and with different gold and silver contents and created a standard of exchange as an accounting unit known as a florin. The florin was originally fully backed by coins and precious metals held by the bank. These notes gained acceptance as a medium of exchange for commercial transactions and thus became an early form of circulating paper money.[8]

As the notes were used directly in trade, the goldsmiths observed that people would not usually redeem all their notes at the same time, and they saw the opportunity to invest their coin reserves in interest-bearing loans. This generated income for the goldsmiths but left them with more notes on issue than reserves with which to pay them. A process was started that altered the role of the goldsmiths from passive guardians of bullion, charging fees for safe storage, to interest-paying and interest-earning banks. Thus fractional-reserve banking was born.[9]

However, bankers often unethically treated the depositor's money as their own money and profited from it while paying the depositor little or nothing. If creditors (note holders of gold originally deposited) lost faith in the ability of a bank to pay their notes, however, many would try to redeem their notes at the same time. If, in response, a bank could not raise enough funds by calling in loans or selling bills, the bank would either go into insolvency or default on its notes. Such a situation is called a bank run and caused the demise of many early banks.[8] These early financial crises led to the creation of government-regulated banks. Laws regarding the Bank of Amsterdam and earlier the Bank of Venice required banks to charge fees for their services and not gamble with depositors' money.

The Swedish Riksbank was the world's first modern central bank, created in 1668.[10] Many nations followed suit in the late 1600s to establish central banks that were given the legal power to set the reserve requirement and to specify the form in which such assets (called the monetary base) are required to be held.[11] To mitigate the impact of bank failures and financial crises, central banks were also granted the authority to centralize banks' storage of precious metal reserves, thereby facilitating the transfer of gold in the event of bank runs, to regulate commercial banks, to impose reserve requirements, and to act as lender-of-last-resort if any bank faced a bank run. The emergence of central banks reduced the risk of bank runs which is inherent in fractional-reserve banking, and it allowed the practice to continue as it does today.[6]

However, the centralization of reserves proved tempting for the governments. In less than 30 years, the "Bank of England was founded as a joint stock company to purchase government debt."[12] When the bank collapsed two years later, the government bailed it out, proclaiming notes from the Bank of England to be the only legal tender, suspended the exchange of notes for gold, and harshly punished counterfeiters. This was the beginning of government/bank cabals that proliferated as banks made huge profits and governments could borrow virtually unlimited amounts of money from the central banks. The citizens bore the brunt of these cabals through inflation and tax debt.

During the twentieth century, to keep the cabals in place, the role of the central bank grew to include managing economic stability and various macroeconomic policy variables, including measures of inflation, unemployment, and the international balance of payments. This includes managing interest rates, reserve requirements, and various measures of the money supply and monetary base.[13]

The Federal Reserve system in the U.S. and the European Central Bank are such twentieth-century central banks, but they have ultimately been unable to regulate themselves or the governments' spending. The misuse of centralized wealth, the lending of central banks for non-productive purposes, and the buying and selling of secondary notes and derivatives in financial markets have caused inflation and tax burdens that are unsustainable. The elites who get the newly printed money prosper, while the once-booming middle classes find it hard to own homes and get out of debt. This unsustainability led to the Global Financial Crisis of 2007-2008, which was temporarily rescued by government bailouts of the large banks that grew larger and absorbed smaller banks, making the current system yet more unstable.

Economic function

Expanded liquidity

Fractional-reserve banking allows banks to provide expanded credit, providing immediate liquidity to short-term borrowers and act as financial intermediaries for long-term loans.[6][14] Less liquid forms of deposit (such as time deposits) or riskier classes of financial assets (such as equities or long-term bonds) may lock up a depositor's wealth for a period of time, making it unavailable for use on demand. This "borrowing short, lending long" or maturity transformation function of fractional-reserve banking is a role that, according to many economists, can be considered an important function of the commercial banking system.[15]

The process of fractional-reserve banking expands the money supply of the economy. Modern central banking allows banks to practice fractional-reserve banking with inter-bank business transactions with a reduced risk of bankruptcy of an individual bank meeting a sudden withdrawal demand.[16][17]

In macroeconomic theory, a well-regulated fractional-reserve bank system also benefits the economy by providing regulators with powerful tools for influencing the money supply and interest rates. Many economists believe that these should be adjusted by the government to promote macroeconomic stability.[18]

Current money creation process

When a commercial bank makes a loan, the bank creates new demand deposits, and the money supply expands by the size of the loan.[6] The proceeds of most commercial bank loans are not in the form of currency. Banks typically make loans by accepting promissory notes in exchange for credit to the borrowers' deposit accounts.[19] Deposits created in this way are sometimes called derivative deposits.[20] Issuing loan proceeds in the form of paper currency and current coins is considered to be a weakness in central control.[21]

The money creation process is also affected by the currency drain ratio (the propensity of the public to hold banknotes rather than deposit them with a commercial bank) and the safety reserve ratio (excess reserves beyond the legal requirement that commercial banks voluntarily hold). Data for "excess" reserves and vault cash are published regularly by the Federal Reserve in the United States.[22]

In modern economies, most money is created by commercial loans backed by paper credit and government debt, not by loans backed by real assets in local banks. Such loans have hijacked the purpose of fractional reserve banking to create new assets and productive businesses, expanding the economy. "If the Fed wants to inject $1 billion into the economy, it can simply buy $1 billion worth of Treasury bonds in the market and deposit $1 billion of new money into the reserves of banks."[23] This central bank manipulation of government debt, through buying and selling treasury bonds is not based on tangible economic assets, but on a debt placed on the taxpayer without their agreement. When the central bank charges interest on this debt, it profits at taxpayers' expense, shifting new money from productive working people to bankers and the government. Central banks and governments are incentivized to use fractional reserve banking and government debt for self-enrichment.

One strategy to rein in government spending has been for Congress to legislate a debt ceiling. This is a temporary restraint in most democracies because the citizens they represent also want a portion of this government-created money as payments promised by the government. A solution to this problem is to change the process by limiting the role of the central bank to that of a clearing house and money provider for other banks only and not allow fractional reserve loans for derivatives in the commercial market. Then central governments would be forced to balance budgets like state governments in the United States are forced to because they cannot print their own money. It is a conflict of interest for the entity that creates money to use it. This is similar to counterfeiting and a criminal enterprise. Current government/bank cabals are unrestrained in this behavior. Money creation through fractional reserve banking should be limited to bank loans for productive activities that increase assets and the value of the economy.

Money supply

- See also: Money supply

The money supply is measured in categories called M1, M2, and M3. This varies according to liquidity. M1 is currency and cash deposits that can be withdrawn on demand. M2 is M1 plus time deposits, savings deposits, and some money-market funds that can be withdrawn in a short period of time. M3 is M2 plus large-time deposits and other forms of money. The "other forms of money" is controversial, not agreed upon, and difficult to measure. Some countries describe M4 as "broad money," including M3 and long-term commercial paper, bonds, and other non-liquid notes. M4 is not easily converted for economic transactions and, therefore, not usually considered money.

Fractional reserve banking is M1 when paid in currency to a borrower and M2 and M3 on the bank journal ledger. From an accounting perspective, the money supply is doubled by the cash amount created by the loan. In countries with fractional-reserve banking, commercial bank money usually forms most of the money supply.[24] The acceptance and value of commercial bank money are based on the fact that it can be exchanged freely at a commercial bank for central bank money.[24][25]

The actual increase in the money supply through this process may be lower, as (at each step) banks may choose to hold reserves in excess of the statutory minimum, borrowers may let some funds sit idle. Some members of the public may choose to hold cash. There also may be delays or frictions in the lending process.[26] Government regulations may also limit the money creation process by preventing banks from giving out loans even when the reserve requirements have been fulfilled.[27]

Types of money

There are two types of money created in a fractional-reserve banking system operating with a central bank:[24][25][28]

- Central bank money: money created or adopted by the central bank regardless of its form – precious metals, commodity certificates, banknotes, coins, electronic money loaned to commercial banks, or anything else the central bank chooses as its form of money.

- Commercial bank money: demand deposits in the commercial banking system; also referred to as "checkbook money," "sight deposits," or simply "credit."

Regulatory framework

In banking before the 18th century, a bank deposit was the customer's property held in safekeeping by a bank. Today most legal frameworks allow the deposited funds to become the bank's property. The depositor, in turn, receives an asset called a deposit account (a checking or savings account). That deposit account is a liability on the balance sheet of the bank.[29]

Each bank is legally authorized to issue credit up to a specified multiple of its reserves, so reserves available to satisfy payment of deposit liabilities are less than the total amount the bank is obligated to pay in satisfaction of demand deposits. Normally, fractional-reserve banking functions smoothly, and banks maintain enough of a buffer of reserves to cover depositors' cash withdrawals and other demands for funds. However, during a bank run or a financial crisis in the economy, demands for withdrawal can exceed the bank's reserves, and the bank will be forced to raise additional reserves quickly to avoid default. A bank can raise funds from additional borrowing (e.g., from interbank lending market or the central bank), by selling assets, or by calling in short-term loans. If creditors fear the bank is running out of reserves or is insolvent, they have the incentive to redeem their deposits before other depositors take the remaining reserves. Thus the fear of a bank run can precipitate a crisis. Contemporary regulation of banks and central banks designed to prevent bank runs includes the centralized clearing of payments, central bank lending to member banks, regulatory auditing, and government-administered deposit insurance.

Fractional reserve lending has been difficult to limit and enforce because governments are tempted to enter into cabals with central banks. This started with the Bank of England in 1896 and became a problem when the Federal Reserve bank was created in 1913 in the U.S. Large sums of money became available for these governments to enter into war, expand government bureaucracies, and offer all kinds of subsidies with strings attached to states, institutions, and individuals.

Fractional reserve lending has been difficult to limit and enforce in the commercial sector because new money is created through loans and used by banks to speculate wildly in the stock markets holding depositors' money at risk. This behavior caused the stock market collapse in 1929 and many bank failures (1930-1932), causing the Great Depression. This crisis led to new bank regulations in the 1930s, such as the Glass-Steagall Act (1933) and the creation of the Federal Deposit Insurance Corporation (FDIC) that restricted bank speculation and protected depositors. However, this was repealed under bank lobbying pressure in 1999 and followed immediately by Enron, WorldCom, and other financial scandals and eventually the 2007-2008 bank crisis and bailout. However, instead of reinstating the Glass-Steagall Act, the large banks and accounting firms pressured the government to adopt their legislation, the Sarbanes-Oxley Act (2002) and the Dodd-Frank Act (2010) that enabled big banks to continue speculation while creation complicated regulations small banks could not afford. The political will to restrain all banks equally and create a level playing field for new banks to enter the market did not develop as it did in the 1930s.

Financial institutions that handle mortgage-backed securities (MBS) and secondary paper and do not produce assets, though more regulated, are still allowed to borrow and trade with the central bank and newly created money rather than forced to work with existing money outside of fractional reserve banking. This incentivizes speculation and financial instability. For example, originating banks are incentivized to make risky loans and immediately sell them to mortgage bundlers and make a profit, leaving the bundlers with a junk portfolio.

Instituting laws that require banks only to charge a service fee in handling other people's money, rather than giving ownership of the deposits to the banks, such as once applied to the Bank of Amsterdam and the Bank of Venice,[30] would eliminate the ethical problem of banks misusing other people's money. In such cases, profits derived from fractional reserve lending would go to the depositors, with the banks only receiving a fee for their lending service that the depositors approve. This would make the individuals, not banks, the sovereigns in the economy.

Reserve requirements

Reserve requirements are intended to prevent banks from:

- generating too much money by making too many loans against a narrow money deposit base;

- having a shortage of cash when large deposits are withdrawn (although a legal minimum reserve amount is often established as a regulatory requirement, reserves may be made available temporarily in the event of a crisis or bank run).

In some jurisdictions (such as the European Union), the central bank does not require reserves to be held during the day. Reserve requirements are intended to ensure that the banks have sufficient supplies of highly liquid assets so that the system operates in an orderly fashion and maintains public confidence.

In the United States, the central bank dropped reserve requirements on March 26, 2020,[31] allowing the banks to issue an infinite amount of loans and putting the central bank on the hook for all cash withdrawals. This is part of a controversial plan to create a Central Bank Digital Currency (CDBC) that would not require local banks to have large amounts of currency reserves. Nigerians are rejecting a CBDC that has been instituted there as most people have more faith in traditional currency, and some do not have easy access to digital currency. They have protested the system as an infringement on their economic freedom.[32]

In addition to reserve requirements, there are other required financial ratios that affect the amount of loans that a bank can fund. The capital requirement ratio is perhaps the most important of these other required ratios. When there are no mandatory reserve requirements, which are considered by some economists to restrict lending, the capital requirement ratio acts to prevent an infinite amount of bank lending.

Criticism of Fractional Reserve Banking

Austrian School economists such as Jesús Huerta de Soto and Murray Rothbard strongly criticized fractional-reserve banking, calling for it to be outlawed and criminalized. According to them, not only does money creation cause macroeconomic instability (based on the Austrian Business Cycle Theory), but it is a form of embezzlement or financial fraud, legalized only due to the influence of powerful rich bankers on corrupt governments around the world.[33][34] US Politician Ron Paul has also criticized fractional-reserve banking based on Austrian School arguments.[35]

However, this criticism is only partly true. Fractional reserve banking can either be used to expand the economy or, when governments and central banks use it as players, it becomes a corrupt criminal enterprise that redistributes the money supply from producers of economic goods to a criminal cabal. The criticism of a cabal's use of fractional reserve banking is in order, and central banks should be restrained and restructured to only play a role in genuine productive economic activity.

Conclusion

Fractional reserve banking can be a valuable part of a well-governed economic system. It can enable money to be available for loans that is readily available to anyone who wishes to build a home, start a business, build a highway, or engage in any other economic activity that produces assets, goods, and services. It has enabled the tremendous economic growth the world has witnessed in the last 400 years.

However, governments and central banks have hijacked the process of fractional reserve banking for selfish ends and non-productive purposes. This has caused a shift of money and wealth from working people who create economic value to political and banking elites who take much of the fruit of their labor by the tax burden government borrowing imposes. Another form of money creation caused the rise of feudalism in the Middle Ages, the dilution of gold or silver in coins. This new money also entered the economy by distribution from the emperors' mint to bureaucrats, cronies, and warriors. They, in turn, used this unethically produced money to buy up land and businesses from the middle classes—leaving them to become serfs and creating feudalism.[36]Today's banking cabals using fractional reserve lending to governments are causing a rise in what is being called "neo-feudalism."[37]

Laws should prevent the hijacking of fractional reserve banking by:

- Limiting the role of central banks to a clearing house and currency provider for other banks.

- Prohibiting central banks from buying securities or lending money to anyone.

- Limit fractional reserve lending to loans for productive economic activities and prohibit when lending for secondary mortgages or securities.

- Central banks enter new money into the system without charging interest, eliminating debt-financed money. Central banks should only be paid a service fee for offsetting the value of their labor.

These changes should eliminate a dangerous conflict of interest, where those who print money can spend it. It should put an end to the government/bank cabals that are destroying the middle class and creating neo-feudalism

Notes

- ↑ Frederic S. Mishkin, Economics of Money, Banking and Financial Markets, 10th Edition. Prentice Hall 2012

- ↑ Christophers, Brett (2013). Banking Across Boundaries: Placing Finance in Capitalism. New York: John Wiley and Sons. ISBN 978-1-4443-3829-4.

- ↑ calculated by dividing one by the percentage on reserve

- ↑ 4.0 4.1 4.2 (2005) "14", Macroeconomics, 5th, Pearson, 522–532.

- ↑ Compare: (1982) "Commercial Banks", Financial Institutions and Markets: Structure, Growth and Innovations, 4, New Delhi: Tata McGraw-Hill Education, 8–35. ISBN 9780070587991. “[...] while in the earlier years, long-term deposits financed short-term loans, now relatively short-term deposits finance long-term loans.”

- ↑ 6.0 6.1 6.2 6.3 6.4 6.5 Mankiw, N. Gregory (2002). "18", Macroeconomics, 5th, Worth, 482–489.

- ↑ Hubbard and O'Brien. Economics.

- ↑ 8.0 8.1 United States. Congress. House. Banking and Currency Committee. (1964). Money facts; 169 questions and answers on money – a supplement to A Primer on Money, with index, Subcommittee on Domestic Finance ... 1964..

- ↑ Thus, by the 19th century, we find "[i]n ordinary cases of deposits of money with banking corporations, or bankers, the transaction amounts to a mere loan or mutuum, and the bank is to restore, not the same money, but an equivalent sum, whenever it is demanded." Joseph Story, Commentaries on the Law of Bailments (1832, p. 66) and "Money, when paid into a bank, ceases altogether to be the money of the principal (see Parker v. Marchant, 1 Phillips 360); it is then the money of the banker, who is bound to return an equivalent by paying a similar sum to that deposited with him when he is asked for it." Lord Chancellor Cottenham, Foley v Hill (1848) 2 HLC 28.