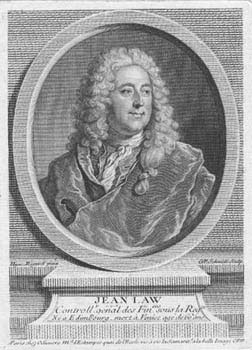

John Law (economist)

John Law (bap. 21 April 1671 - 21 March 1729) was a Scottish economist who believed that money was only a means of exchange that did not constitute wealth in itself, and that national wealth depended on trade. He is said to be the father of finance, responsible for the adoption or use of paper money or bills in the world today.

Law was a gambler and a brilliant mental calculator, and was known to win card games by mentally calculating the odds. An expert in statistics, he was the originator of economic theories, including two major ideas: 'The Scarcity Theory of Value' and 'The Real Bills Doctrine of Money'.

Biography

Law was born into a banking family from Fife; his father had purchased a landed estate at Cramond on the Firth of Forth, and after his death in 1688, Law travelled to London and lost large sums of money in gambling.

On 9 April 1694 John Law fought a duel with Edward Wilson. Wilson had challenged Law over the affections of Elizabeth Villiers. Wilson was killed and Law was tried and found guilty of murder and sentenced to death. His sentenced was commuted to a fine, upon the ground that the offence only amounted to manslaughter. Wilson's brother appealed and had Law imprisoned but he managed to escape to the continent.

Law urged the establishment of a national bank to create and increase instruments of credit, and the issue of paper money backed by land, gold, or silver. The first manifestation of Law's system came when he had returned to his homeland and contributed to the debates leading to the Treaty of Union 1707 with a text entitled Money and Trade Consider'd with a Proposal for Supplying the Nation with Money (1705). After the Union of the Scottish and English parliaments, Law's legal situation obliged him to go into exile again.

He spent ten years moving between France and the Netherlands, dealing in financial speculations, before the problems of the French economy presented the opportunity to put his system into practice.

He had the idea of abolishing minor monopolies and private farming of taxes and creating a bank for national finance and a state company for commerce and ultimately exclude all private revenue. This would create a huge monopoly of finance and trade run by the state, and its profits would pay off the national debt. The French Conseil des Finances, merchants, and financiers objected to this plan.

The wars waged by Louis XIV left the country completely wasted, both economically and financially. And the resultant shortage of precious metals led to a shortage of coins in circulation, which in turn limited the production of new coins. It was in this context that the regent, Philippe d'Orléans, appointed the Scot, John Law of Lauriston (1671-1729), as Controller General of Finances.

In May 1716 the Banque Générale Privée ("General Private Bank"), which developed the use of paper money was set up by Law. It was a private bank, but three quarters of the capital consisted of government bills and government accepted notes. In August 1717, he bought the Mississippi Company, to help the French colony in Louisiana. In 1717 he also brokered the sale of Thomas Pitt's diamond to the regent, Philippe d'Orléans. In the same year Law floated the Mississippi Company as a joint stock trading company called the Compagnie d'Occident which was granted a trade monopoly of the West Indies and North America. The bank became the Banque Royale (Royal Bank) in 1718, meaning the notes were guaranteed by the king. The Company absorbed the Compagnie des Indes Orientales, Compagnie de Chine, and other rival trading companies and became the Compagnie Perpetuelle des Indes on 23 May 1719 with a monopoly of commerce on all the seas. Of course, the system however encouraged speculation in shares in 'The Company of the Indies' (the shares becoming a sort of paper currency) and inflation. In 1720 the bank and company were united and Law was appointed Controller General of Finances to attract capital. Law's pioneering note-issuing bank was extremely successful until it collapsed and caused an economic crisis in France and across Europe.

Law exaggerated the wealth of Louisiana with an effective marketing scheme, which led to wild speculation on the shares of the company in 1719. In February 1720 it was valued for a very high future cash flow at 10,000 livres. Shares rose from 500 livres in 1719 to as much as 15,000 livres in the first half of 1720, but by the summer of 1720, there was a sudden decline in confidence, leading to a 97 per cent decline in market cap by 1721. Predictably, the 'bubble' burst at the end of 1720, when opponents of the financier attempted en masse to convert their notes into specie. By the end of 1720 Philippe II dismissed Law, who then fled from France.

Law subsequently moved between London and Venice where he contracted pneumonia and died a poor man in 1729.

Books

- Millionaire: The Philanderer, Gambler, and Duelist Who Invented Modern Finance by Janet Gleeson (2000). (ISBN 0-684-87295-1)

- Extraordinary Popular Delusions and the Madness of Crowds by Charles Mackay. First published 1841, and still available.

External links

Credits

New World Encyclopedia writers and editors rewrote and completed the Wikipedia article in accordance with New World Encyclopedia standards. This article abides by terms of the Creative Commons CC-by-sa 3.0 License (CC-by-sa), which may be used and disseminated with proper attribution. Credit is due under the terms of this license that can reference both the New World Encyclopedia contributors and the selfless volunteer contributors of the Wikimedia Foundation. To cite this article click here for a list of acceptable citing formats.The history of earlier contributions by wikipedians is accessible to researchers here:

The history of this article since it was imported to New World Encyclopedia:

Note: Some restrictions may apply to use of individual images which are separately licensed.