Difference between revisions of "New York Stock Exchange" - New World Encyclopedia

(Updated & fixed) |

|||

| Line 1: | Line 1: | ||

| − | {{ | + | [[Category:Politics and social sciences]] |

| + | [[Category:Economics]] | ||

| + | {{cleanup|date=November 2008}} | ||

| + | {{refimprove|date=November 2008}} | ||

{{otheruses4|the stock exchange itself|its parent company|NYSE Euronext}} | {{otheruses4|the stock exchange itself|its parent company|NYSE Euronext}} | ||

| − | {{ | + | {{Infobox Exchange |

|name = New York Stock Exchange | |name = New York Stock Exchange | ||

| − | + | |logo = [[Image:New York Stock Exchange.svg|160px|NYSE Logo]] | |

| − | |logo = [[Image: | + | |image = [[Image:Nyse by spigoo.jpg|300px]] |

| − | |image = [[Image: | + | |type = [[Stock exchange]] |

| − | |type = [[Stock | + | |city = New York City, New York |

| − | |city = New York City | ||

|country = United States | |country = United States | ||

| − | |coor = {{ | + | |coor = {{coord|40|42|24|N|74|00|41|W|region:US-NY_type:landmark}} |

|founded = March 8, 1817 | |founded = March 8, 1817 | ||

|owner = [[NYSE Euronext]] | |owner = [[NYSE Euronext]] | ||

| − | |key_people = | + | |key_people = Duncan Niederauer <small>[[Chief executive officer|(CEO)]]</small> |

| − | |currency = [[United States dollar | + | |currency = [[United States dollar]] |

|listings = 2,773 | |listings = 2,773 | ||

| − | |mcap = [[United States dollar| | + | |mcap = [[United States dollar|US$]]25 trillion <small>(2006)</small> |

| − | |volume = | + | |volume = [[United States dollar|US$]]22 trillion <small>(2006)</small> |

| − | |indexes = [[NYSE Composite | + | |indexes = [[NYSE Composite]]<br/>[[Dow Jones Industrial Average]] |

|homepage = [http://www.nyse.com/ www.nyse.com] | |homepage = [http://www.nyse.com/ www.nyse.com] | ||

|footnotes = | |footnotes = | ||

}} | }} | ||

| − | + | The '''New York Stock Exchange''' ('''NYSE''') is a [[stock exchange]] based in New York City, New York. It is the largest stock exchange in the world by [[United States dollar|dollar]] [[market capitalization|value]] of its listed companies [[Security (finance)|securities]].<ref>[http://www.world-exchanges.org/statistics/ytd-monthly</ref> As of October 2008, the combined capitalization of all domestic New York Stock Exchange listed companies was $10.1 trillion.<ref>http://www.nyxdata.com/nysedata/default.aspx?tabid=115</ref> | |

| − | |||

| − | The '''New York Stock Exchange''' ('''NYSE''') | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | + | The NYSE is operated by [[NYSE Euronext]], which was formed by the NYSE's merger with the fully electronic stock exchange [[Euronext]]. Its [[Trading room|trading floor]] is located at 11 [[Wall Street]] and is composed of four rooms used for the facilitation of trading. A fifth trading room, located at 30 Broad Street, was closed in February 2007. The main building, located at 18 [[Broad Street (Manhattan)|Broad Street]] between the corners of Wall Street and [[Exchange Place]], was designated a [[National Historic Landmark]] in 1978.<ref name="NHL designation">[[National Park Service]], [http://www.cr.nps.gov/nhl/designations/Lists/NY01.pdf National Historic Landmarks Survey, New York], retrieved May 31, 2007.</ref> | |

| − | |||

| − | |||

== History == | == History == | ||

| + | The origin of the NYSE can be traced to May 17, 1792, when the [[Buttonwood Agreement]] was signed by 24 [[stock broker]]s outside of 68 [[Wall Street]] in New York under a [[buttonwood tree]] on Wall Street which earlier was the site of a [[stockade]] fence. On March 8, 1817, the organization drafted a constitution and renamed itself the "New York Stock & Exchange Board." (This name was shortened to its current form in 1863.) [[Anthony Stockholm]] was elected the Exchange's first president. (For other presidents, see [[List of presidents of the New York Stock Exchange]].) | ||

| + | [[Image:Stockexchange.jpg|left|thumb|The floor of the New York Stock Exchange in 1908]] | ||

| + | The first central location of the NYSE was a room rented for $200 a month in 1817 located at 40 Wall Street. The NYSE was destroyed in the [[Great Fire of New York (1835)]]. It moved to a temporary headquarters. In 1863 it changed its name to the New York Stock Exchange (NYSE). In 1865 it moved to 10-12 Broad Street. The Dow Jones Industrial Average (DJIA) was created by Dow Jones & Company, a financial news publisher, in 1896. | ||

{{Infobox_nrhp | name =New York Stock Exchange | {{Infobox_nrhp | name =New York Stock Exchange | ||

| nrhp_type = nhl | | nrhp_type = nhl | ||

| Line 48: | Line 38: | ||

| lat_degrees = 40 | lat_minutes = 42 | lat_seconds = 24.21 | lat_direction = N | | lat_degrees = 40 | lat_minutes = 42 | lat_seconds = 24.21 | lat_direction = N | ||

| long_degrees = 74 | long_minutes = 0 | long_seconds = 41.6 | long_direction = W | | long_degrees = 74 | long_minutes = 0 | long_seconds = 41.6 | long_direction = W | ||

| + | |locmapin = New York | ||

| area = | | area = | ||

| built =1903 | | built =1903 | ||

| architect= [[Trowbridge & Livingston]]; [[George B. Post]] | | architect= [[Trowbridge & Livingston]]; [[George B. Post]] | ||

| architecture= Classical Revival | | architecture= Classical Revival | ||

| − | | designated= June | + | | designated= June 2, 1978<ref name="nhlsum">{{cite web|url=http://tps.cr.nps.gov/nhl/detail.cfm?ResourceId=1776&ResourceType=Building |

| − | | added = June | + | |title=New York Stock Exchange|date=2007-09-17|work=National Historic Landmark summary listing|publisher=National Park Service}}</ref> |

| + | | added = June 2, 1978<ref name="nris">{{cite web|url=http://www.nr.nps.gov/|title=National Register Information System|date=2007-01-23|work=National Register of Historic Places|publisher=National Park Service}}</ref> | ||

| governing_body = Private | | governing_body = Private | ||

| refnum=78001877 | | refnum=78001877 | ||

}} | }} | ||

| − | |||

| − | |||

| − | |||

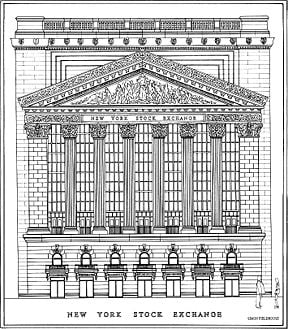

| − | The | + | The volume of stocks traded increased sixfold in the years between 1896 and 1901 and a larger space was required to conduct business in the expanding marketplace.<ref>''[http://www.nyse.com/about/history/1022743347410.html The Building]'' NYSE Group history</ref> Eight New York City architects were invited to participate in a design competition for a new building and the Exchange selected the [[neoclassic design]] from architect [[George B. Post]]. Demolition of the existing building at 10 Broad Street and the adjacent lots started on May 10, 1901. |

| − | The New York Stock Exchange building opened at 18 Broad Street on April 22 1903 at a cost of $4 million. The trading floor was one of the largest volumes of space in the city at the time at 109 x 140 feet (33 x 42.5 m) with a skylight set into a {{convert|72|ft|m|0|sing=on}} high ceiling. The main façade of the building features marble sculpture by [[John Quincy Adams Ward]] in the [[pediment]], above six tall [[Corinthian capital]]s, called “Integrity Protecting the Works of Man.” The building was listed as a [[National Historic Landmark]] and added to the [[List of Registered Historic Places in New York County, New York|National Register of Historic Places]] on June 2, 1978.<ref>[http://tps.cr.nps.gov/nhl/detail.cfm?ResourceID=1776&resourceType=Building National Register Number: 78001877] | + | The New York Stock Exchange building opened at 18 Broad Street on April 22, 1903 at a cost of $4 million. The trading floor was one of the largest volumes of space in the city at the time at 109 x 140 feet (33 x 42.5 m) with a skylight set into a {{convert|72|ft|m|0|sing=on}} high ceiling. The main façade of the building features marble sculpture by [[John Quincy Adams Ward]] in the [[pediment]], above six tall [[Corinthian capital]]s, called “Integrity Protecting the Works of Man.” The building was listed as a [[National Historic Landmark]] and added to the [[List of Registered Historic Places in New York County, New York|National Register of Historic Places]] on June 2, 1978.<ref>[http://tps.cr.nps.gov/nhl/detail.cfm?ResourceID=1776&resourceType=Building National Register Number: 78001877] National Historic Landmark</ref> |

| − | In 1922, a building designed by [[Trowbridge & Livingston]] was added at 11 Broad Street for offices, and a new trading floor called "the garage." Additional trading floor space was added in 1969 and 1988 (the "blue room") with the latest technology for information display and communication. Another trading floor was opened at 30 Broad Street in 2000. With the arrival of the Hybrid Market, a greater proportion of trading was executed electronically and the NYSE decided to close the 30 Broad Street trading room in early 2006. | + | In 1922, a building designed by [[Trowbridge & Livingston]] was added at 11 Broad Street for offices, and a new trading floor called "the garage." Additional trading floor space was added in 1969 and 1988 (the "blue room") with the latest technology for information display and communication. Another trading floor was opened at 30 Broad Street in 2000. With the arrival of the Hybrid Market, a greater proportion of trading was executed electronically and the NYSE decided to close the 30 Broad Street trading room in early 2006. In late 2007 the exchange closed the rooms created by the 1969 and 1988 expansions due to the declining number of traders and employees on the floor, a result of increased electronic trading. |

| − | The 11 Wall Street building was designated a [[National Historic Landmark]] in 1978.<ref name="nhlsum"/> | + | The 11 Wall Street building was designated a [[National Historic Landmark]] in 1978.<ref name="nhlsum"/><ref name="nrhpinv">{{cite web|url=http://pdfhost.focus.nps.gov/docs/NHLS/Text/78001877.pdf |date=March 1977 |author=George R. Adams |title=New York Stock Exchange National Register of Historic Places Inventory-Nomination (1MB PDF)|publisher=National Park Service|accessdate=2008-01-30|format=PDF}}</ref><ref name="nrhpphotos">{{cite web|url=http://pdfhost.focus.nps.gov/docs/NHLS/Photos/78001877.pdf |title=National Register of Historic Places Inventory-Nomination (1MB PDF)|year=1983|publisher=National Park Service|format=PDF}}</ref> |

| − | ==Events== | + | ===Events=== |

| − | + | {{seealso| Black Monday (1987)|October 27, 1997 mini-crash}} | |

| − | + | The exchange was closed shortly after the beginning of [[World War I]] (July 31, 1914), but it partially re-opened on November 28 of that year in order to help the war effort by trading [[Bond (finance)|bonds]], and completely reopened for stock trading in mid-December. | |

| − | The | ||

On September 16, 1920, a [[Wall Street Bombing|bomb exploded on Wall Street]] outside the NYSE building, killing 33 people and injuring more than 400. The perpetrators were never found. The NYSE building and some buildings nearby, such as the [[JPMorgan Chase & Co.|JP Morgan]] building, still have marks on their facades caused by the bombing. | On September 16, 1920, a [[Wall Street Bombing|bomb exploded on Wall Street]] outside the NYSE building, killing 33 people and injuring more than 400. The perpetrators were never found. The NYSE building and some buildings nearby, such as the [[JPMorgan Chase & Co.|JP Morgan]] building, still have marks on their facades caused by the bombing. | ||

| − | The [[Wall Street Crash 1929|Black Thursday]] crash of the Exchange on October 24, 1929, and the sell-off panic which started on Black Tuesday, October 29, are often blamed for precipitating the [[Great Depression]]. In an effort to try to restore investor confidence, the Exchange unveiled a fifteen-point program aimed to upgrade protection for the investing public on October 31, 1938. | + | The [[Wall Street Crash 1929|Black Thursday]] crash of the Exchange on October 24, 1929, and the sell-off panic which started on Black Tuesday, October 29, are often blamed for precipitating the [[Great Depression of 1929]]. In an effort to try to restore investor confidence, the Exchange unveiled a fifteen-point program aimed to upgrade protection for the investing public on October 31, 1938. |

| − | On October 1, 1934, the exchange was registered as a national securities exchange with the [[U.S. Securities and Exchange Commission]], with a president and a thirty-three member board. | + | On October 1, 1934, the exchange was registered as a national securities exchange with the [[U.S. Securities and Exchange Commission]], with a president and a thirty-three member board. On February 18, 1971 the non-profit corporation was formed, and the number of board members was reduced to twenty-five. |

| − | + | One of [[Abbie Hoffman]]'s well-known protests took place on August 24, 1967, when he led members of the [[Yippie]] movement to the gallery of the New York Stock Exchange (NYSE). The protesters threw fistfuls of dollars (most of the bills were fake) down to the traders below, some of whom booed, while others began to scramble frantically to grab the money as fast as they could. Hoffman claimed to be pointing out that, metaphorically, that's what NYSE traders "were already doing." "We didn't call the press," wrote Hoffman, "at that time we really had no notion of anything called a media event." The press was quick to respond and by evening the event was reported around the world. Since that incident, the stock exchange has spent $20,000 to enclose the gallery with bulletproof glass. | |

| − | |||

| − | + | On October 19, 1987, the [[Dow Jones Industrial Average]] (DJIA) dropped 508 points, a 22.6% loss in a single day, the second-biggest one-day drop the exchange had experienced, prompting officials at the exchange to invoke for the first time the "[[Trading curb|circuit breaker]]" rule to halt all trading. This was a very controversial move and led to a quick change in the rule; trading now halts for an hour, two hours, or the rest of the day when the DJIA drops 10, 20, or 30 percent, respectively. In the afternoon, the 10% and 20% drops will halt trading for a shorter period of time, but a 30% drop will always close the exchange for the day. The rationale behind the trading halt was to give investors a chance to cool off and reevaluate their positions. Black Monday was followed by Terrible Tuesday, a day in which the Exchange's systems did not perform well and some people had difficulty completing their trades. | |

| − | + | There was a panic similar to many with a fall of 7.2% in value (554.26 points) on October 27, 1997 prompted by falls in Asian markets, from which the NYSE recovered quickly. | |

| − | The NYSE was closed from September 11 until September 17, 2001 as a result of the [[September 11 | + | On January 26, 2000, an altercation during filming of the music video for ''[[Sleep Now in the Fire]]'', which was directed by [[Michael Moore]], caused the doors of the exchange to be closed and the band, [[Rage Against the Machine]], to be escorted from the site by security,<ref name="greenleft">{{cite web | date=March 15, 2000 | title=Rage against Wall Street | work=[[Green Left Weekly]] ''#397''<nowiki></nowiki> | url=http://www.greenleft.org.au/2000/397/24186 | accessdate=2007-10-11}}</ref> after band members attempted to gain entry into the exchange.<ref>{{cite web | last=Basham | first=David | date=January 28, 2000 | title=Rage Against the Machine Shoots New Video With Michael Moore | work=[[MTV News]] | url=http://www.mtv.com/news/articles/1433553/20000128/rage_against_the_machine.jhtml | accessdate=2007-02-17}}</ref> |

| + | Trading on the exchange floor, however, continued uninterrupted.<ref>{{cite web | title="New York Stock Exchange Special Closings," 1885-date | work=[[NYSE Group]] | url=http://www.nyse.com/pdfs/closings.pdf | accessdate=2007-04-07|format=PDF}}</ref> | ||

| + | [[Image:NYSESecurity.JPG|thumb|Security after the September 11 attacks]] | ||

| + | The NYSE was closed from September 11 until September 17, 2001 as a result of the [[September 11 attacks]]. | ||

| − | On September 17, 2003, NYSE chairman and chief executive [[Richard Grasso]] stepped down as a result of controversy concerning the size of his deferred compensation package. | + | On September 17, 2003, NYSE chairman and chief executive [[Richard Grasso]] stepped down as a result of controversy concerning the size of his deferred compensation package. He was replaced as CEO by [[John S. Reed]], the former Chairman of [[Citigroup]]. |

| − | The NYSE announced its plans to acquire Archipelago on April 21, 2005, in a deal intended to reorganize the NYSE as a publicly traded company. NYSE's governing board voted to acquire rival Archipelago on December 6, 2005, and become a for-profit, public company. | + | The NYSE announced its plans to acquire Archipelago on April 21, 2005, in a deal intended to reorganize the NYSE as a publicly traded company. NYSE's governing board voted to acquire rival Archipelago on December 6, 2005, and become a for-profit, public company. It began trading under the name NYSE Group on March 8, 2006. A little over one year later, on April 4, 2007, the NYSE Group completed its merger with Euronext, the European combined stock market, thus forming the [[NYSE Euronext]], the first transatlantic stock exchange. |

| − | Presently, Marsh Carter is Chairman of the New York Stock Exchange, having succeeded [[John S. Reed]] | + | Presently, Marsh Carter is Chairman of the New York Stock Exchange, having succeeded [[John S. Reed]] and the CEO is [[Duncan Niederauer]], having succeeded [[John Thain]]. |

| − | == | + | ===Timeline=== |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

{{proseline}} | {{proseline}} | ||

| − | *1792 - The NYSE acquires its first traded | + | [[Image:NY stock exchange traders floor LC-U9-10548-6.jpg|right|thumb|NYSE's stock exchange traders floor before the introduction of electronic readouts and computer screens]] |

| − | *1817 - The constitution of the New York Stock and Exchange Board is | + | *1792 - The NYSE acquires its first traded securities [http://www.nyse.com/about/history/1022221392987.html] [http://www.nyse.com/about/history/timeline_trading.html] |

| + | *1817 - The constitution of the New York Stock and Exchange Board is adopted [http://www.nyse.com/about/history/timeline_chronology_index.html] | ||

*1867 - The First Stock Ticker [http://www.nyse.com/about/history/timeline_1860_1899_index.html] | *1867 - The First Stock Ticker [http://www.nyse.com/about/history/timeline_1860_1899_index.html] | ||

| − | *1896 - [[Dow Jones Industrial Average]] | + | *1896 - [[Dow Jones Industrial Average]] first published in ''[[The Wall Street Journal]]'' [http://www.nyse.com/about/history/timeline_1860_1899_index.html] |

*1903 - NYSE moves into new quarters at 18 [[Broad Street (Manhattan)|Broad Street]] | *1903 - NYSE moves into new quarters at 18 [[Broad Street (Manhattan)|Broad Street]] | ||

| + | *1906 - Dow exceeds 100 on January 12 | ||

*1907 - [[Panic of 1907]] | *1907 - [[Panic of 1907]] | ||

| − | *1914 - [[World War I]] causes the longest exchange shutdown: four months, two weeks | + | *1914 - [[World War I]] causes the longest exchange shutdown: four months, two weeks; re-opening December 12 brings the largest one-day percentage drop in the DJIA (24.4%) |

*1915 - Market price is given in dollars | *1915 - Market price is given in dollars | ||

| − | *1929 - Central quote system established; [[Wall Street Crash of 1929|Black Thursday]] | + | *1929 - Central quote system established; [[Wall Street Crash of 1929|Black Thursday]], October 24 and Black Tuesday, October 29 signal the end of the [[Roaring Twenties]] bull market |

| − | *1943 - Trading floor is opened to women <ref>[http://www.nyse.com/about/history/timeline_1940_1959_index.html NYSE: Timeline] | + | *1943 - Trading floor is opened to women<ref>''[http://www.nyse.com/about/history/timeline_1940_1959_index.html NYSE: Timeline]"</ref> |

| − | *1949 - Longest [[bull market]] begins | + | [[File:NYSEWallStreet.jpg|right|thumb|The NYSE at [[Christmas]] time (December 2008)]] |

| − | *1954 - | + | *1949 - Longest (eight-year) [[market trends#bull market|bull market]] begins [http://www.nyse.com/about/history/timeline_1940_1959_index.html] |

| − | *1966 - NYSE creates the [[Common Stock Index]]; floor data fully automated | + | *1954 - Dow surpasses its 1929 peak in inflation-adjusted dollars |

| + | *1956 - Dow closes above 500 for the first time on March 12 | ||

| + | *1966 - NYSE creates the [[Common Stock Index]]; floor data fully automated [http://www.nyse.com/about/history/timeline_1960_1979_index.html] | ||

| + | *1967 - Protesters led by [[Abbie Hoffman]] throw mostly fake dollar bills at traders from gallery, leading to the installation of bullet-proof glass | ||

*1970 - [[Securities Investor Protection Corporation]] established | *1970 - [[Securities Investor Protection Corporation]] established | ||

| − | *1971 - NYSE recognized as Not-for-Profit organization | + | *1971 - NYSE recognized as Not-for-Profit organization [http://www.nyse.com/about/history/timeline_1960_1979_index.html] |

| − | *1972 - | + | *1972 - Dow closes above 1,000 for the first time on November 14 |

*1977 - Foreign brokers are admitted to NYSE | *1977 - Foreign brokers are admitted to NYSE | ||

*1979 - [[New York Futures Exchange]] established | *1979 - [[New York Futures Exchange]] established | ||

| − | *1987 - [[Black Monday (1987)|Black Monday]], October 19, sees the largest one-day DJIA percentage drop | + | *1982 - Longest bull market in DJIA history begins |

| − | *1991 - | + | *1987 - [[Black Monday (1987)|Black Monday]], October 19, sees the second-largest one-day DJIA percentage drop (22.6%) in history |

| − | *1996 - Real-time ticker introduced | + | *1991 - Dow exceeds 3,000 |

| − | *1999 - | + | *1995 - Dow exceeds 5,000 |

| − | *2000 - | + | *1996 - Real-time ticker introduced [http://www.nyse.com/about/history/timeline_1980_1999_index.html] |

| + | *1999 - Dow exceeds 10,000 on March 29 | ||

| + | *2000 - Dow peaks at 11,722.98 on January 14; first NYSE global index is launched under the ticker NYIID | ||

*2001 - Trading in fractions (n/16) ends, replaced by decimals (increments of $.01, see [[Decimalisation]]); [[September 11, 2001 attacks]] occur, closing NYSE for 4 sessions | *2001 - Trading in fractions (n/16) ends, replaced by decimals (increments of $.01, see [[Decimalisation]]); [[September 11, 2001 attacks]] occur, closing NYSE for 4 sessions | ||

*2003 - [[NYSE Composite]] Index relaunched and value set equal to 5,000 points | *2003 - [[NYSE Composite]] Index relaunched and value set equal to 5,000 points | ||

| − | *2006 - NYSE and [[ArcaEx]] merge, forming the publicly owned, for-profit NYSE Group, Inc.; in turn, NYSE Group merges with [[Euronext]], creating the first trans-Atlantic stock exchange group; DJIA tops 12,000 on October 19 | + | *2006 - NYSE and [[ArcaEx]] merge, creating [[NYSE Arca]] and forming the publicly owned, for-profit NYSE Group, Inc.; in turn, NYSE Group merges with [[Euronext]], creating the first trans-Atlantic stock exchange group; DJIA tops 12,000 on October 19 |

| − | *2007 - US President [[George W. Bush]] shows up unannounced to the Floor about an hour and a half before | + | *2007 - US President [[George W. Bush]] shows up unannounced to the Floor about an hour and a half before a [[Federal Open Market Committee]] interest-rate decision on January 31.<ref>{{cite news |author=Katy Byron |title=President Bush makes surprise visit to NYSE |url=http://money.cnn.com/2007/01/31/news/newsmakers/markets_bush/index.htm?postversion=2007013115 |work=[[CNN Money]] |publisher=[[Cable News Network]] |date=2007-01-31 |accessdate=2007-02-20}}</ref> NYSE announces its merger with the [[American Stock Exchange]]; NYSE Composite closes above 10,000 on June 1; DJIA exceeds 14,000 on July 19 and closes at a peak of 14,164.53 on October 9. |

| + | *2008 - On September 15, also known as "Ugly Monday" [http://www.goerie.com/apps/pbcs.dll/article?AID=/20080916/NEWS02/809160376/-1/ETN], the DJIA loses more than 500 points amid fears of bank failures, resulting in a permanent prohibition of [[naked short selling]] and a three-week temporary ban on all [[short selling]] of financial stocks; "Dark Monday," September 29 brings the largest daily point drop on the Dow (777.68, almost 7%); the DJIA closes below 10,000 on October 6 for the first time since 2003; October 10 brings record volatility with an intra-day 1,018 point swing; "Manic Monday," October 13 brings the largest one-day Dow point gain ever (936.42) and biggest percentage gain (more than 11%) since 1933; October 15 reverses this with the biggest percentage loss (7.87%) since 1987; "Terrific Tuesday," October 28 rockets the DJIA back over 9,000 with another gain of more than 10%; fresh six-year lows on the NYSE Composite are reached on November 20 near the 7,600 level as [[Citigroup]] plummets below the $5 mark | ||

| + | |||

| + | ==Trading== | ||

| + | [[Image:NYSE opening bell.jpg|right|thumb|U.S. [[Secretary of Commerce]] [[Donald L. Evans]] rings the opening bell at the NYSE on April 23, 2003. Former chairman [[Richard Grasso]] is also in this picture.]] | ||

| + | The New York Stock Exchange (sometimes referred to as "the Big Board") provides a means for buyers and sellers to [[Trader (finance)|trade]] [[Share (finance)|shares]] of [[stock]] in companies registered for public trading. The NYSE is open for trading Monday through Friday between 9:30–16:00 [[North American Eastern Time Zone|ET]], with the exception of holidays declared by the Exchange in advance. | ||

| + | |||

| + | On the trading floor, the NYSE trades in a continuous auction format, where traders can execute stock transactions on behalf of investors. They will gather around the appropriate post where a specialist broker, who is employed by an NYSE member firm (that is, he/she is not an employee of the New York Stock Exchange), acts as an auctioneer in an open outcry auction market environment to bring buyers and sellers together and to manage the actual auction. They do on occasion (approximately 10% of the time) facilitate the trades by committing their own capital and as a matter of course disseminate information to the crowd that helps to bring buyers and sellers together. | ||

| + | |||

| + | As of January 24, 2007, all NYSE stocks can be traded via its electronic [[Hybrid Market]] (except for a small group of very high-priced stocks). Customers can now send orders for immediate electronic execution, or route orders to the floor for trade in the auction market. In the first three months of 2007, in excess of 82% of all order volume was delivered to the floor electronically.<ref>{{Citation | ||

| + | | last = Shell | ||

| + | | first = Adam | ||

| + | | title = Technology squeezes out real, live traders | ||

| + | | newspaper = USA Today | ||

| + | | year = 2007 | ||

| + | | date = 2007-07-12 | ||

| + | | url = http://www.usatoday.com/money/markets/2007-07-11-nyse-traders_N.htm}}</ref> | ||

| + | |||

| + | The right to directly trade shares on the exchange is conferred upon owners of the 1366 "seats." The term comes from the fact that up until the 1870s NYSE members sat in chairs to trade. In 1868, the number of seats was fixed at 533, and this number was increased several times over the years. In 1953, the exchange stopped at 1366 seats. These seats are a sought-after commodity as they confer the ability to directly trade stock on the NYSE. Seat prices have varied widely over the years, generally falling during recessions and rising during economic expansions. The most expensive inflation-adjusted seat was sold in 1929 for $625,000, which, today, would be over six million dollars. In recent times, seats have sold for as high as $4 million in the late 1990s and $1 million in 2001. In 2005, seat prices shot up to $3.25 million as the exchange was set to merge with Archipelago and become a for-profit, publicly traded company. Seat owners received $500,000 cash per seat and 77,000 shares of the newly formed corporation. The NYSE now sells one-year licenses to trade directly on the exchange. | ||

| + | |||

| + | ===NYSE Composite Index=== | ||

| + | In the mid-1960s, the [[NYSE Composite Index]] ({{nyse2|NYA}}) was created, with a base value of 50 points equal to the 1965 yearly close, to reflect the value of all stocks trading at the exchange instead of just the 30 stocks included in the [[Dow Jones Industrial Average]]. To raise the profile of the composite index, in 2003 the NYSE set its new base value of 5,000 points equal to the 2002 yearly close. (Previously, the index had stood just below 500 points, with lifetime highs and lows of 670 points and 33 points, respectively.) | ||

| + | |||

==Notes== | ==Notes== | ||

| − | {{ | + | <references/> |

| + | |||

| + | ==References== | ||

| + | * {{cite book |author=Buck, James E. |title=The New York Stock Exchange: The First 200 Years |publisher=Greenwich Pub. Group |date=1992 |isbn=0944641024}} | ||

| + | * {{cite book |author=Geisst, Charles R. |title=Wall Street: A History - From its Beginnings to the Fall of Enron |publisher=Oxford University Press |date=2004 |isbn=0195170601}} | ||

| + | * {{cite book |author=Kent, Zachary |title=The Story of the New York Stock Exchange |publisher=Scholastic Library Pub. |date=1990 |isbn=0516047485}} | ||

| + | * {{cite book |author=Sloane, Leonard |title=The Anatomy of the Floor |publisher=Doubleday |date=1980 |isbn=0385122497}} | ||

| + | * {{cite book |author=Sobel, Robert |title=N.Y.S.E.: A History of the New York Stock Exchange, 1935-1975 |publisher=Weybright and Talley |date=1975 |isbn=0679401245}} | ||

== External links == | == External links == | ||

| − | |||

*[http://www.nyse.com New York Stock Exchange website] | *[http://www.nyse.com New York Stock Exchange website] | ||

| Line 142: | Line 160: | ||

*[http://arcaex.blogspot.com Archived collection of NYSE Transformation] | *[http://arcaex.blogspot.com Archived collection of NYSE Transformation] | ||

*[http://www.marketwatch.com/News/Story/Story.aspx?guid=%7B1FA12791-0B41-436C-AD86-7E7E61B967F9%7D&siteid=mktw Price of membership and a seat] | *[http://www.marketwatch.com/News/Story/Story.aspx?guid=%7B1FA12791-0B41-436C-AD86-7E7E61B967F9%7D&siteid=mktw Price of membership and a seat] | ||

| + | |||

{{Registered Historic Places}} | {{Registered Historic Places}} | ||

| − | + | ||

| − | + | ||

| − | {{ | + | |

| + | {{Credits|New_York_Stock_Exchange|258911421|}} | ||

Revision as of 23:35, 28 December 2008

Template:Cleanup

- This article is about the stock exchange itself. For its parent company, see NYSE Euronext.

| New York Stock Exchange | |

|---|---|

| NYSE Logo | |

| |

| Type | Stock exchange |

| Location | |

| Coordinates | |

| Owner | NYSE Euronext |

| Key people | Duncan Niederauer (CEO) |

| Currency | United States dollar |

| No. of listings | 2,773 |

| MarketCap | US$25 trillion (2006) |

| Volume | US$22 trillion (2006) |

| Indexes | NYSE Composite Dow Jones Industrial Average |

| Website | www.nyse.com |

The New York Stock Exchange (NYSE) is a stock exchange based in New York City, New York. It is the largest stock exchange in the world by dollar value of its listed companies securities.[1] As of October 2008, the combined capitalization of all domestic New York Stock Exchange listed companies was $10.1 trillion.[2]

The NYSE is operated by NYSE Euronext, which was formed by the NYSE's merger with the fully electronic stock exchange Euronext. Its trading floor is located at 11 Wall Street and is composed of four rooms used for the facilitation of trading. A fifth trading room, located at 30 Broad Street, was closed in February 2007. The main building, located at 18 Broad Street between the corners of Wall Street and Exchange Place, was designated a National Historic Landmark in 1978.[3]

History

The origin of the NYSE can be traced to May 17, 1792, when the Buttonwood Agreement was signed by 24 stock brokers outside of 68 Wall Street in New York under a buttonwood tree on Wall Street which earlier was the site of a stockade fence. On March 8, 1817, the organization drafted a constitution and renamed itself the "New York Stock & Exchange Board." (This name was shortened to its current form in 1863.) Anthony Stockholm was elected the Exchange's first president. (For other presidents, see List of presidents of the New York Stock Exchange.)

The first central location of the NYSE was a room rented for $200 a month in 1817 located at 40 Wall Street. The NYSE was destroyed in the Great Fire of New York (1835). It moved to a temporary headquarters. In 1863 it changed its name to the New York Stock Exchange (NYSE). In 1865 it moved to 10-12 Broad Street. The Dow Jones Industrial Average (DJIA) was created by Dow Jones & Company, a financial news publisher, in 1896.

| New York Stock Exchange | |||

|---|---|---|---|

| (U.S. National Historic Landmark) | |||

| | |||

| Location: | New York, NY | ||

| Coordinates: | coord}}{{#coordinates:40|42|24.21|N|74|0|41.6|W| | name=

}} | |

| Built/Founded: | 1903 | ||

| Architect: | Trowbridge & Livingston; George B. Post | ||

| Architectural style(s): | Classical Revival | ||

| Added to NRHP: | June 2, 1978[4] | ||

| Reference #: | 78001877 | ||

| Governing body: | Private | ||

The volume of stocks traded increased sixfold in the years between 1896 and 1901 and a larger space was required to conduct business in the expanding marketplace.[5] Eight New York City architects were invited to participate in a design competition for a new building and the Exchange selected the neoclassic design from architect George B. Post. Demolition of the existing building at 10 Broad Street and the adjacent lots started on May 10, 1901.

The New York Stock Exchange building opened at 18 Broad Street on April 22, 1903 at a cost of $4 million. The trading floor was one of the largest volumes of space in the city at the time at 109 x 140 feet (33 x 42.5 m) with a skylight set into a 72-foot (22 m) high ceiling. The main façade of the building features marble sculpture by John Quincy Adams Ward in the pediment, above six tall Corinthian capitals, called “Integrity Protecting the Works of Man.” The building was listed as a National Historic Landmark and added to the National Register of Historic Places on June 2, 1978.[6]

In 1922, a building designed by Trowbridge & Livingston was added at 11 Broad Street for offices, and a new trading floor called "the garage." Additional trading floor space was added in 1969 and 1988 (the "blue room") with the latest technology for information display and communication. Another trading floor was opened at 30 Broad Street in 2000. With the arrival of the Hybrid Market, a greater proportion of trading was executed electronically and the NYSE decided to close the 30 Broad Street trading room in early 2006. In late 2007 the exchange closed the rooms created by the 1969 and 1988 expansions due to the declining number of traders and employees on the floor, a result of increased electronic trading.

The 11 Wall Street building was designated a National Historic Landmark in 1978.[7][8][9]

Events

The exchange was closed shortly after the beginning of World War I (July 31, 1914), but it partially re-opened on November 28 of that year in order to help the war effort by trading bonds, and completely reopened for stock trading in mid-December.

On September 16, 1920, a bomb exploded on Wall Street outside the NYSE building, killing 33 people and injuring more than 400. The perpetrators were never found. The NYSE building and some buildings nearby, such as the JP Morgan building, still have marks on their facades caused by the bombing.

The Black Thursday crash of the Exchange on October 24, 1929, and the sell-off panic which started on Black Tuesday, October 29, are often blamed for precipitating the Great Depression of 1929. In an effort to try to restore investor confidence, the Exchange unveiled a fifteen-point program aimed to upgrade protection for the investing public on October 31, 1938.

On October 1, 1934, the exchange was registered as a national securities exchange with the U.S. Securities and Exchange Commission, with a president and a thirty-three member board. On February 18, 1971 the non-profit corporation was formed, and the number of board members was reduced to twenty-five.

One of Abbie Hoffman's well-known protests took place on August 24, 1967, when he led members of the Yippie movement to the gallery of the New York Stock Exchange (NYSE). The protesters threw fistfuls of dollars (most of the bills were fake) down to the traders below, some of whom booed, while others began to scramble frantically to grab the money as fast as they could. Hoffman claimed to be pointing out that, metaphorically, that's what NYSE traders "were already doing." "We didn't call the press," wrote Hoffman, "at that time we really had no notion of anything called a media event." The press was quick to respond and by evening the event was reported around the world. Since that incident, the stock exchange has spent $20,000 to enclose the gallery with bulletproof glass.

On October 19, 1987, the Dow Jones Industrial Average (DJIA) dropped 508 points, a 22.6% loss in a single day, the second-biggest one-day drop the exchange had experienced, prompting officials at the exchange to invoke for the first time the "circuit breaker" rule to halt all trading. This was a very controversial move and led to a quick change in the rule; trading now halts for an hour, two hours, or the rest of the day when the DJIA drops 10, 20, or 30 percent, respectively. In the afternoon, the 10% and 20% drops will halt trading for a shorter period of time, but a 30% drop will always close the exchange for the day. The rationale behind the trading halt was to give investors a chance to cool off and reevaluate their positions. Black Monday was followed by Terrible Tuesday, a day in which the Exchange's systems did not perform well and some people had difficulty completing their trades.

There was a panic similar to many with a fall of 7.2% in value (554.26 points) on October 27, 1997 prompted by falls in Asian markets, from which the NYSE recovered quickly.

On January 26, 2000, an altercation during filming of the music video for Sleep Now in the Fire, which was directed by Michael Moore, caused the doors of the exchange to be closed and the band, Rage Against the Machine, to be escorted from the site by security,[10] after band members attempted to gain entry into the exchange.[11] Trading on the exchange floor, however, continued uninterrupted.[12]

The NYSE was closed from September 11 until September 17, 2001 as a result of the September 11 attacks.

On September 17, 2003, NYSE chairman and chief executive Richard Grasso stepped down as a result of controversy concerning the size of his deferred compensation package. He was replaced as CEO by John S. Reed, the former Chairman of Citigroup.

The NYSE announced its plans to acquire Archipelago on April 21, 2005, in a deal intended to reorganize the NYSE as a publicly traded company. NYSE's governing board voted to acquire rival Archipelago on December 6, 2005, and become a for-profit, public company. It began trading under the name NYSE Group on March 8, 2006. A little over one year later, on April 4, 2007, the NYSE Group completed its merger with Euronext, the European combined stock market, thus forming the NYSE Euronext, the first transatlantic stock exchange.

Presently, Marsh Carter is Chairman of the New York Stock Exchange, having succeeded John S. Reed and the CEO is Duncan Niederauer, having succeeded John Thain.

Timeline

{{#invoke:Message box|ambox}}

- 1792 - The NYSE acquires its first traded securities [1] [2]

- 1817 - The constitution of the New York Stock and Exchange Board is adopted [3]

- 1867 - The First Stock Ticker [4]

- 1896 - Dow Jones Industrial Average first published in The Wall Street Journal [5]

- 1903 - NYSE moves into new quarters at 18 Broad Street

- 1906 - Dow exceeds 100 on January 12

- 1907 - Panic of 1907

- 1914 - World War I causes the longest exchange shutdown: four months, two weeks; re-opening December 12 brings the largest one-day percentage drop in the DJIA (24.4%)

- 1915 - Market price is given in dollars

- 1929 - Central quote system established; Black Thursday, October 24 and Black Tuesday, October 29 signal the end of the Roaring Twenties bull market

- 1943 - Trading floor is opened to women[13]

- 1949 - Longest (eight-year) bull market begins [6]

- 1954 - Dow surpasses its 1929 peak in inflation-adjusted dollars

- 1956 - Dow closes above 500 for the first time on March 12

- 1966 - NYSE creates the Common Stock Index; floor data fully automated [7]

- 1967 - Protesters led by Abbie Hoffman throw mostly fake dollar bills at traders from gallery, leading to the installation of bullet-proof glass

- 1970 - Securities Investor Protection Corporation established

- 1971 - NYSE recognized as Not-for-Profit organization [8]

- 1972 - Dow closes above 1,000 for the first time on November 14

- 1977 - Foreign brokers are admitted to NYSE

- 1979 - New York Futures Exchange established

- 1982 - Longest bull market in DJIA history begins

- 1987 - Black Monday, October 19, sees the second-largest one-day DJIA percentage drop (22.6%) in history

- 1991 - Dow exceeds 3,000

- 1995 - Dow exceeds 5,000

- 1996 - Real-time ticker introduced [9]

- 1999 - Dow exceeds 10,000 on March 29

- 2000 - Dow peaks at 11,722.98 on January 14; first NYSE global index is launched under the ticker NYIID

- 2001 - Trading in fractions (n/16) ends, replaced by decimals (increments of $.01, see Decimalisation); September 11, 2001 attacks occur, closing NYSE for 4 sessions

- 2003 - NYSE Composite Index relaunched and value set equal to 5,000 points

- 2006 - NYSE and ArcaEx merge, creating NYSE Arca and forming the publicly owned, for-profit NYSE Group, Inc.; in turn, NYSE Group merges with Euronext, creating the first trans-Atlantic stock exchange group; DJIA tops 12,000 on October 19

- 2007 - US President George W. Bush shows up unannounced to the Floor about an hour and a half before a Federal Open Market Committee interest-rate decision on January 31.[14] NYSE announces its merger with the American Stock Exchange; NYSE Composite closes above 10,000 on June 1; DJIA exceeds 14,000 on July 19 and closes at a peak of 14,164.53 on October 9.

- 2008 - On September 15, also known as "Ugly Monday" [10], the DJIA loses more than 500 points amid fears of bank failures, resulting in a permanent prohibition of naked short selling and a three-week temporary ban on all short selling of financial stocks; "Dark Monday," September 29 brings the largest daily point drop on the Dow (777.68, almost 7%); the DJIA closes below 10,000 on October 6 for the first time since 2003; October 10 brings record volatility with an intra-day 1,018 point swing; "Manic Monday," October 13 brings the largest one-day Dow point gain ever (936.42) and biggest percentage gain (more than 11%) since 1933; October 15 reverses this with the biggest percentage loss (7.87%) since 1987; "Terrific Tuesday," October 28 rockets the DJIA back over 9,000 with another gain of more than 10%; fresh six-year lows on the NYSE Composite are reached on November 20 near the 7,600 level as Citigroup plummets below the $5 mark

Trading

The New York Stock Exchange (sometimes referred to as "the Big Board") provides a means for buyers and sellers to trade shares of stock in companies registered for public trading. The NYSE is open for trading Monday through Friday between 9:30–16:00 ET, with the exception of holidays declared by the Exchange in advance.

On the trading floor, the NYSE trades in a continuous auction format, where traders can execute stock transactions on behalf of investors. They will gather around the appropriate post where a specialist broker, who is employed by an NYSE member firm (that is, he/she is not an employee of the New York Stock Exchange), acts as an auctioneer in an open outcry auction market environment to bring buyers and sellers together and to manage the actual auction. They do on occasion (approximately 10% of the time) facilitate the trades by committing their own capital and as a matter of course disseminate information to the crowd that helps to bring buyers and sellers together.

As of January 24, 2007, all NYSE stocks can be traded via its electronic Hybrid Market (except for a small group of very high-priced stocks). Customers can now send orders for immediate electronic execution, or route orders to the floor for trade in the auction market. In the first three months of 2007, in excess of 82% of all order volume was delivered to the floor electronically.[15]

The right to directly trade shares on the exchange is conferred upon owners of the 1366 "seats." The term comes from the fact that up until the 1870s NYSE members sat in chairs to trade. In 1868, the number of seats was fixed at 533, and this number was increased several times over the years. In 1953, the exchange stopped at 1366 seats. These seats are a sought-after commodity as they confer the ability to directly trade stock on the NYSE. Seat prices have varied widely over the years, generally falling during recessions and rising during economic expansions. The most expensive inflation-adjusted seat was sold in 1929 for $625,000, which, today, would be over six million dollars. In recent times, seats have sold for as high as $4 million in the late 1990s and $1 million in 2001. In 2005, seat prices shot up to $3.25 million as the exchange was set to merge with Archipelago and become a for-profit, publicly traded company. Seat owners received $500,000 cash per seat and 77,000 shares of the newly formed corporation. The NYSE now sells one-year licenses to trade directly on the exchange.

NYSE Composite Index

In the mid-1960s, the NYSE Composite Index (NYSE: NYA) was created, with a base value of 50 points equal to the 1965 yearly close, to reflect the value of all stocks trading at the exchange instead of just the 30 stocks included in the Dow Jones Industrial Average. To raise the profile of the composite index, in 2003 the NYSE set its new base value of 5,000 points equal to the 2002 yearly close. (Previously, the index had stood just below 500 points, with lifetime highs and lows of 670 points and 33 points, respectively.)

Notes

- ↑ [http://www.world-exchanges.org/statistics/ytd-monthly

- ↑ http://www.nyxdata.com/nysedata/default.aspx?tabid=115

- ↑ National Park Service, National Historic Landmarks Survey, New York, retrieved May 31, 2007.

- ↑ National Register Information System. National Register of Historic Places. National Park Service (2007-01-23).

- ↑ The Building NYSE Group history

- ↑ National Register Number: 78001877 National Historic Landmark

- ↑ Cite error: Invalid

<ref>tag; no text was provided for refs namednhlsum - ↑ George R. Adams (March 1977). New York Stock Exchange National Register of Historic Places Inventory-Nomination (1MB PDF) (PDF). National Park Service. Retrieved 2008-01-30.

- ↑ National Register of Historic Places Inventory-Nomination (1MB PDF) (PDF). National Park Service (1983).

- ↑ Rage against Wall Street. Green Left Weekly #397 (March 15, 2000). Retrieved 2007-10-11.

- ↑ Basham, David (January 28, 2000). Rage Against the Machine Shoots New Video With Michael Moore. MTV News. Retrieved 2007-02-17.

- ↑ "New York Stock Exchange Special Closings," 1885-date (PDF). NYSE Group. Retrieved 2007-04-07.

- ↑ NYSE: Timeline"

- ↑ Katy Byron. "President Bush makes surprise visit to NYSE", CNN Money, Cable News Network, 2007-01-31. Retrieved 2007-02-20.

- ↑ Shell, Adam (2007-07-12), "Technology squeezes out real, live traders", USA Today

ReferencesISBN links support NWE through referral fees

- Buck, James E. (1992). The New York Stock Exchange: The First 200 Years. Greenwich Pub. Group. ISBN 0944641024.

- Geisst, Charles R. (2004). Wall Street: A History - From its Beginnings to the Fall of Enron. Oxford University Press. ISBN 0195170601.

- Kent, Zachary (1990). The Story of the New York Stock Exchange. Scholastic Library Pub.. ISBN 0516047485.

- Sloane, Leonard (1980). The Anatomy of the Floor. Doubleday. ISBN 0385122497.

- Sobel, Robert (1975). N.Y.S.E.: A History of the New York Stock Exchange, 1935-1975. Weybright and Talley. ISBN 0679401245.

External links

- New York Stock Exchange website

- NYSE Valuations

- Archived collection of NYSE Transformation

- Price of membership and a seat

Template:Registered Historic Places

Credits

New World Encyclopedia writers and editors rewrote and completed the Wikipedia article in accordance with New World Encyclopedia standards. This article abides by terms of the Creative Commons CC-by-sa 3.0 License (CC-by-sa), which may be used and disseminated with proper attribution. Credit is due under the terms of this license that can reference both the New World Encyclopedia contributors and the selfless volunteer contributors of the Wikimedia Foundation. To cite this article click here for a list of acceptable citing formats.The history of earlier contributions by wikipedians is accessible to researchers here:

The history of this article since it was imported to New World Encyclopedia:

Note: Some restrictions may apply to use of individual images which are separately licensed.